186

project-specific loans are redeemed by the state governments, the same are

repaid to banks.

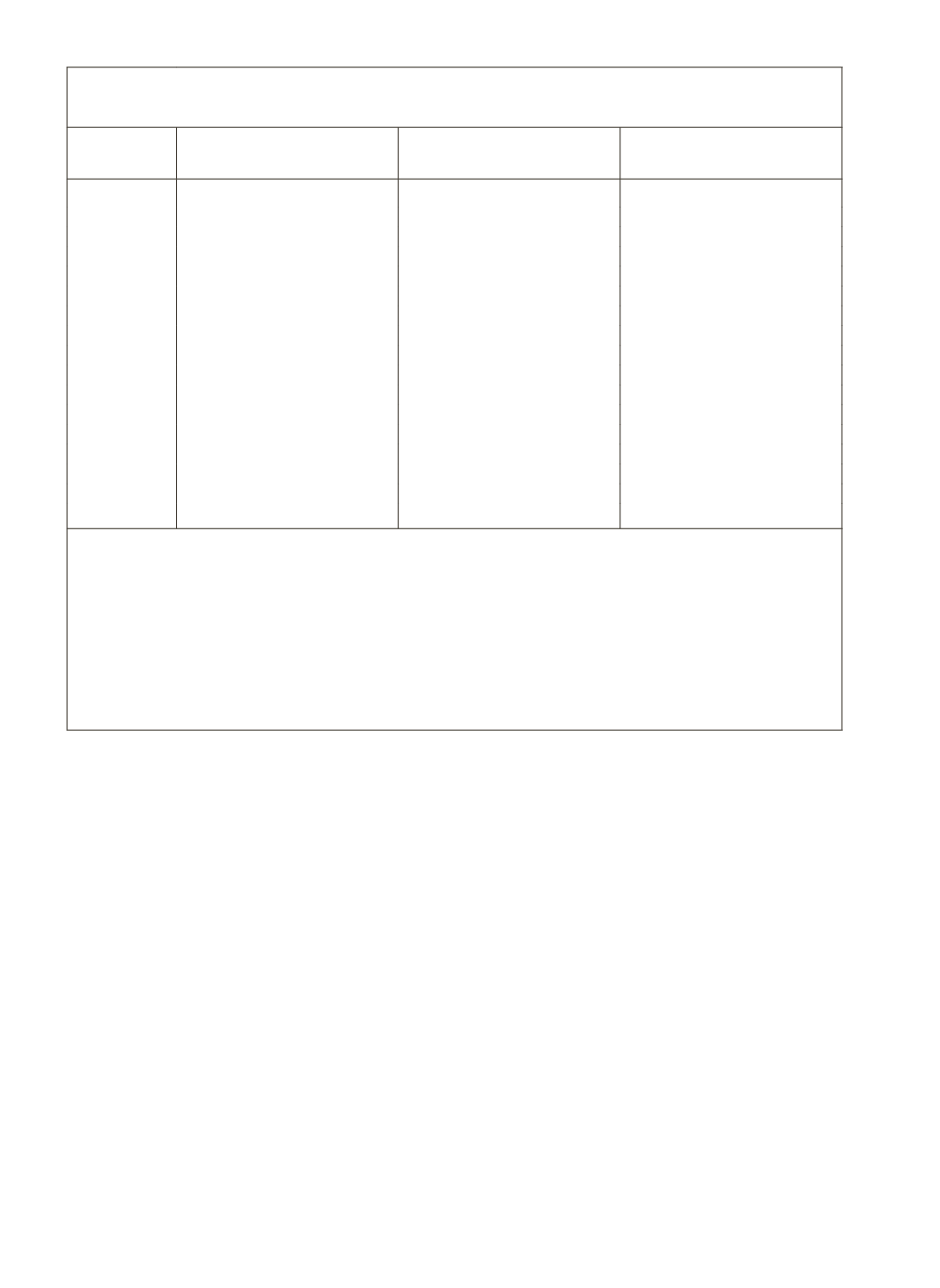

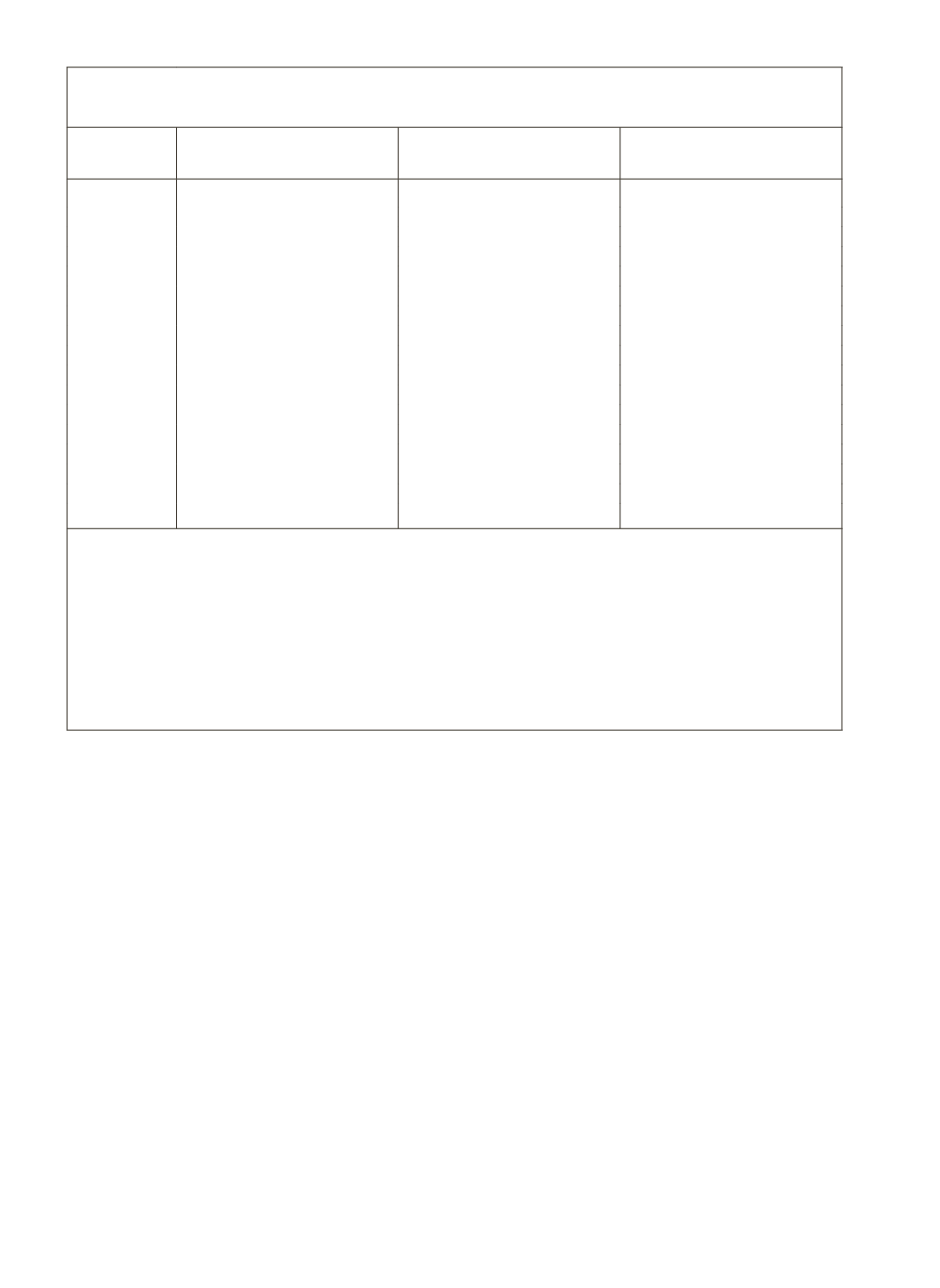

The end results of the above fund operations – deposits received,

repayment made, and the resultant outstandings each year – is depicted in

Table 6.2. Amounts of deposits shown against individual yeas in this table

pertain to different tranches of RIDF in operations in the respective years; so

are repayments. Deposits outstandings broadly represent loans outstandings

against state governments. There has occurred a steady increase in annual

deposits by banks implying that NABARD has been steadily expanding demands

on them for rural infrastructure loans for state governments; they have touched

`

75,107 crore as at the end of March 2012.

An Unexplained and Hidden Gap

The process explained above in the operations of RIDF leave behind

two major gaps in the information system. First, the so-called RIDF Corpus

Table 6.2: RIDF Deposits: Annual Receipts, Repayments and Outstandings

(Rupees Crore)

Year

Deposit Received

from Banks

Repayments Made

to Banks

Deposit Outstandings

(year-end)

1995-96

350

-

350

1996-97

1042

-

1,392

1997-98

1007

-

2399

1998-99

1338

129

3,608

1999-2000

2,306

395

5,426

2000-01

2,654

475

7,251

2001-02

3,591

1.117

9,725

2002-03

3,857

1,423

12,159

2003-04

2,159

2,229

12,089

2004-05

4,353

7273@

9,169

2005-06

6,092

1,287

13,974

2006-07

6,966

786

20,155

2007-08

11,808

1,370

30,593

2008-09

18,805

2,375

47,023

2009-10

16,399

3,553

59,869

2010-11

13,056

5,047

67,878

2011-12

15,241

8,012

75,107

@

An unusually high size of repayment during 2004-05 was due to prepayment of past high interest rate

borrowings by state governments; NABARD in turn repaid to banks

`

7,273 crore on deposits made under

tranches RIDF II to IX up to March 31, 2005. It may be recalled that the interest rates on RIDF loans to

state governments were gradually reduced from 13% under RIDF I to 11.5% under RIDF IV, 10.5% under

RIDF VII and was fixed at 2% above the bank rate (8.5% at the prevailing bank rate) under tranches VIII

and IX. Considering the declining trend in interest rates, the lending rates in respect of undisbursed

amounts of RIDF tranches IV to IX were restructured with effect from 1 November 2003 with the approval

of the RBI. Accordingly, the lending rates for loans disbursed under tranches IV to VII were fixed at 7% and

6.5% for RIDF VIII and IX , respectively (NABARD

Annual Report 2003-04

. p.74).

Source:

Culled out from individual annual reports of NABAED for respective years.