180

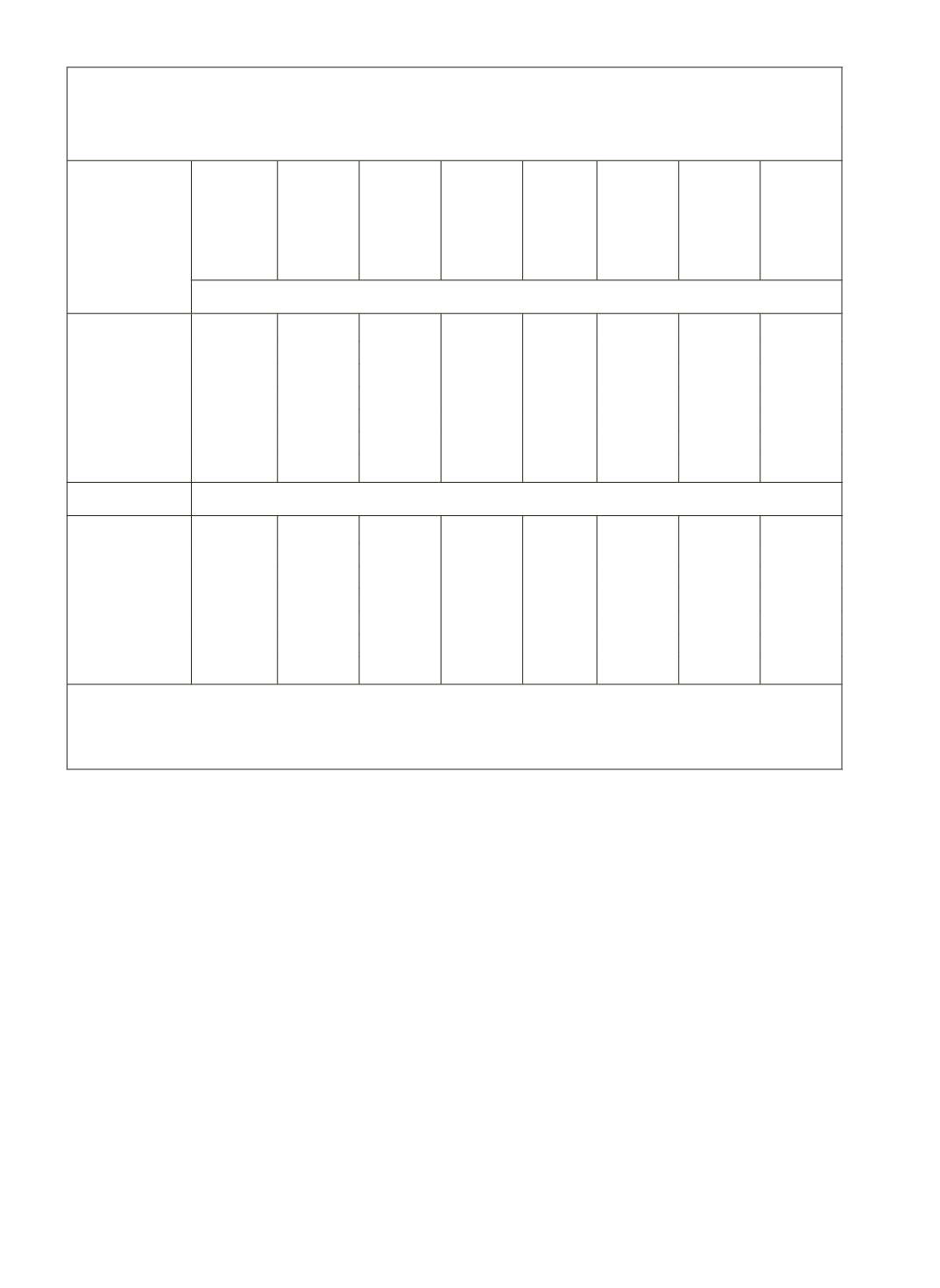

Table 5.26: State-wise/Broad Sector-wise Ground Level Credit (GLC)

Disbursements under Priority Sector

(Amount in rupees, lakh)

Name of the

States/UTs

Primary

Sector

(Agriculture

and

Allied

Activities)#

Percentage

to

Total

Secondary

Sector

(NFS) $

Percentage

to

Total

Service

Sector

(OPS) $

Percentage

to

Total

Total

Priority

Sector

Percentage

to

Total

2001-02

Northern Region 1481532

26.4

379230

23.3

419509

18.3

2280271

23.9

NE Region

11645

0.2

10245

0.6

33317

1.4

55207

0.6

Eastern Region 329231

5.9

65850

4.0

276521

12.0

671602

7.0

Central Region

846144

15.1

220983

13.6

340441

14.8

1407568

14.8

Western Region 966829

17.2

127713

7.8

210968

9.2

1305510

13.7

Southern Region 1974869

35.2

824183

50.6

1017296

44.3

3816348

40.0

Total

5610250

100.0

1628204

100.0

2298052

100.0

9536506

100.0

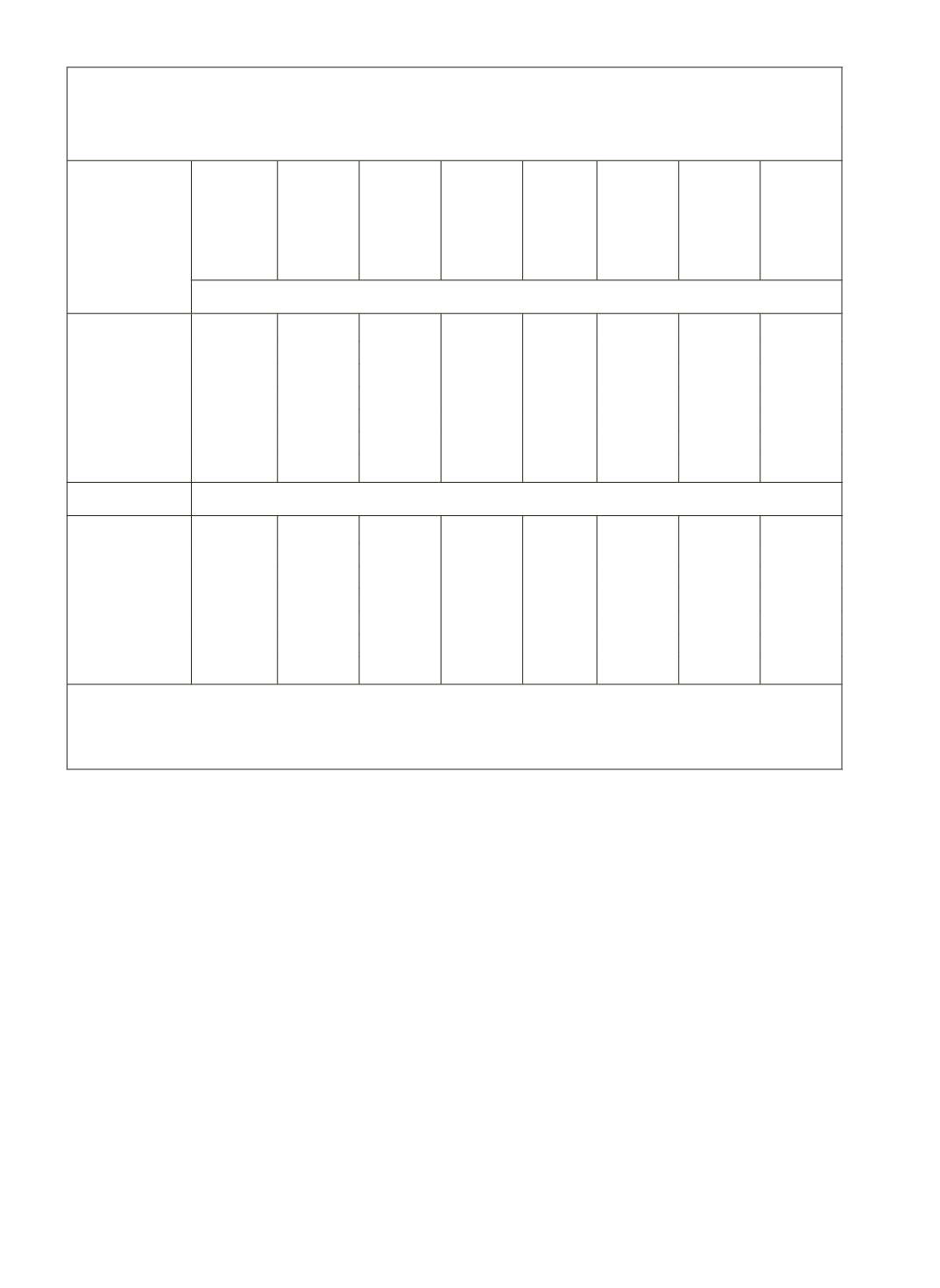

2003-04

Northern Region 2181869

28.7

510483

24.4

755258

18.0

3447610

24.8

NE Region

29994

0.4

19070

0.9

65506

1.6

114570

0.8

Eastern Region 504740

6.6

104284

5.0

590699

14.1

1199723

8.6

Central Region 1248734

16.4

275432

13.2

510474

12.2

2034640

14.7

Western Region 1012247

13.3

137444

6.6

298303

7.1

1447994

10.4

Southern Region 2613740

34.4

1042010

49.9

1978785

47.1

5634535

40.6

Total

7591324

100.0

2088723

100.0

4199025

100.0

13879072

100.0

# Under Agriculture and Allied Activities CBs figures are taken from RPCD,RBI

$ NABARD Regional Offices/Sub-Offices * State wise data not available

Note:

Figures in

Italics

indicates percentage to total

Source:

NABARD Regional Offices/Sub-Offices

Scarcity of resources with NABARD

It must be added in parenthesis that NABARD’s refinances are growing

in a niggardly fashion because the institution is faced with a serious constraint.

Apart from the stoppage of contribution to the National Rural Credit (Long-Term

Operations) Fund, there are three other developments which have constricted

NABARD’s ability to expand its promotional activities through refinance and

other methods. First, NABARD has been made to approach the market at

market rates of interest. Today about 40% of its working funds are at market

rates of interest as against 19% at the end of March 2003. Second, NABARD’s

profits are being charged to income-tax. Finally, RBI has dispensed with the

practice of giving general line of credit (GLC). The annual line was

`

6,600

crore a few years ago and the entire amount has been recalled by the RBI as on

January 31, 2007.