189

for the purpose. This is not any critical comment on banks’ behaviour, for it

was an explicit part of public policy not to allow banks to earmark more than

1.5% of net bank credit for RIDF as indirect credit under the priority sector

target. But, if the banks default more, there is no punishment of an RIDF

contribution and hence they can easily escape the priority sector obligations.

How much is that, is what one is required to know.

Divergences between Bank’s Actual Deposits into RIDF and Sizes of

Corpuses

What is more,

the processes involved in placing demand on individual

banks for contributing to RIDF based on each bank’s share in the Corpus

assigned by RBI, have left behind sizeable amounts with banks themselves

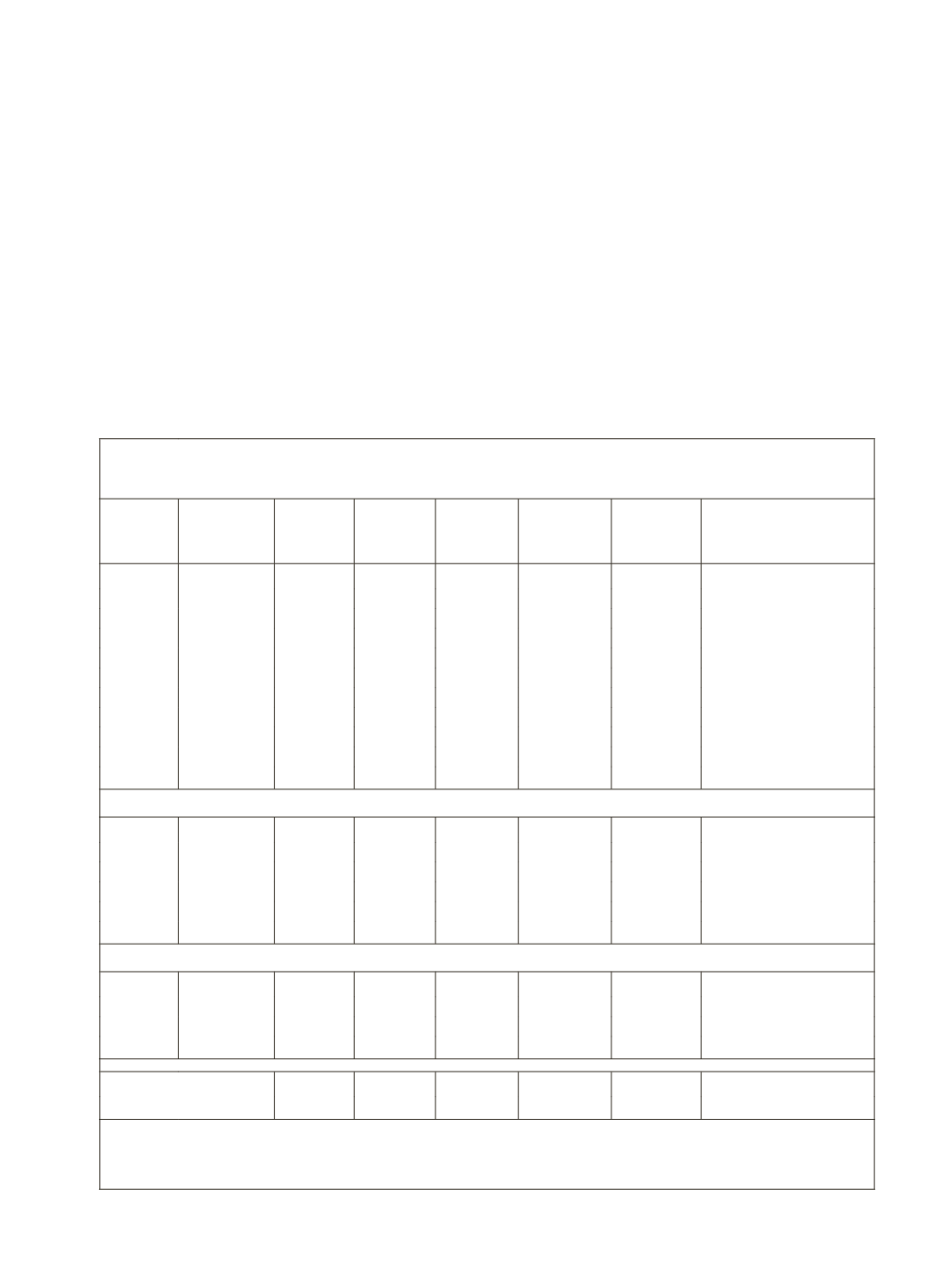

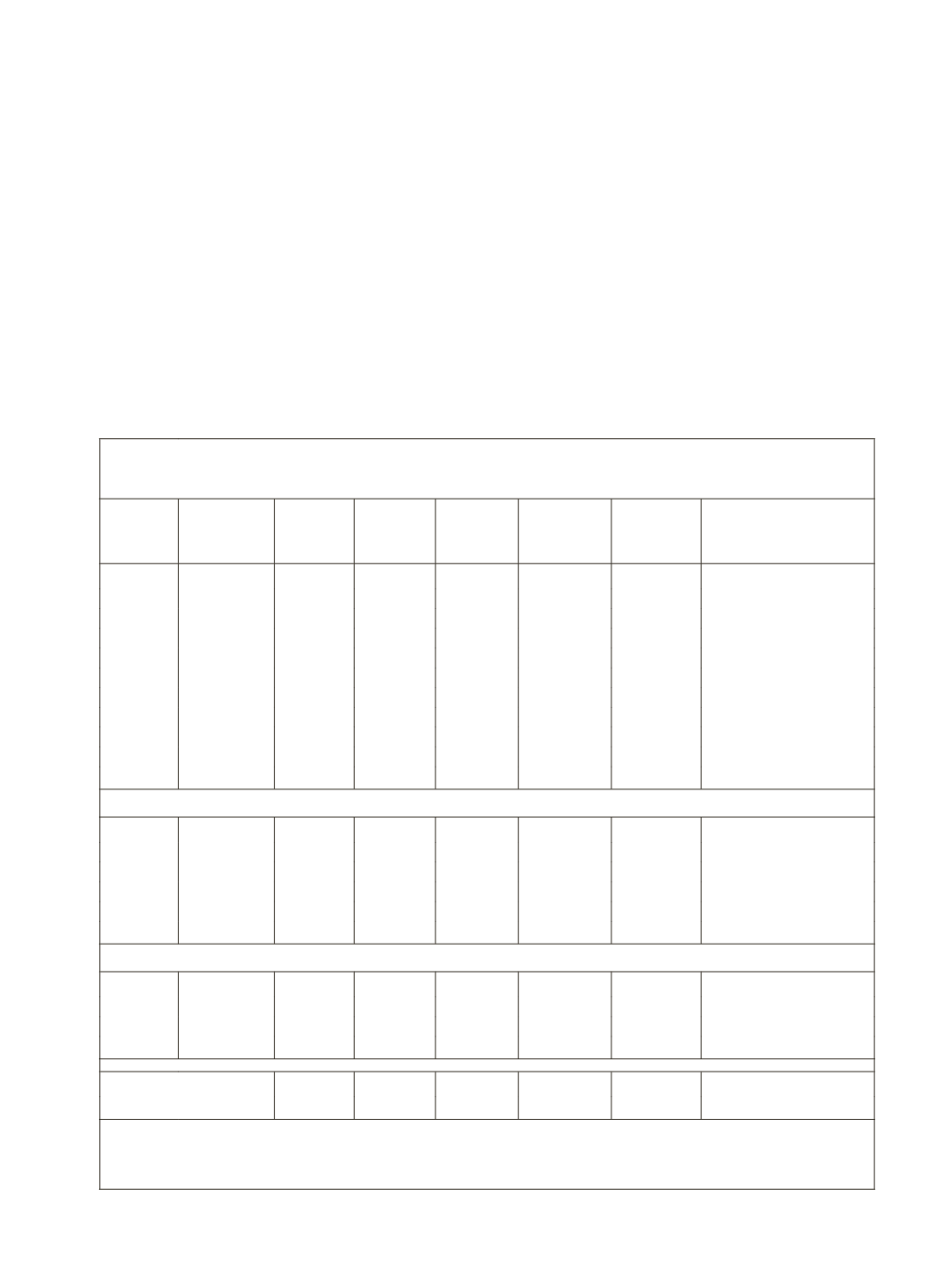

Table 6.5: Tranche-wise Details of RIDF (As at end-March 2010)

(Amount in

`

crore)

Tranche Beginning

of the

Tranche

No. of

Projects

Corpus* Deposits

Received

Loans

Sanctioned

Loans

Disbursed

Ratio of Loans

Disbursed to Loans

Sanctioned (per cent)

I

1995

4,168 2,000 1,587 1,906

1,761

92.4

II

1996

8,193 2,500 2,225 2,636

2,398

91.0

III

1997 14,345 2,500 2,308 2,733

2,454

89.8

IV

1998

6,171 3,000 1,413 2,903

2,482

85.5

V

1999 12,106 3,500 3,052 3,435

3,055

88.9

VI

2000 43,168 4,500 4,081 4,489

4,071

90.7

VII

2001 24,598 5,000 4,074 4,582

4,053

88.5

VIII

2002 20,887 5,500 5,188 5,950

5,149

86.5

IX

2003 19,548 5,500 4,873 5,638

4,916

87.2

X

2004 16,530 8,000 6,420 7,672

6,489

84.6

XI

2005 29,771 8,000 6,421 8,320

6,605

79.4

Closed Tranches I to XI

XII

2006 41,955 10,000 7,775 10,411 7,280

69.9

XIII

2007 36,890 12,000 7,835 12,706 7,601

59.8

XIV

2008 85,465 14,000 6,442 14,708 6,653

45.2

XV

2009 39,015 14,000 4,228 15,630 3,474

22.2

XVI

2010 41,779 16,000

18,315

3731

20.4

Total

4,02,810 1,00,000 67,921 1,03,718 68,440

66.0

Separate Window of Bharat Nirman Programme

XII

2006

-

4,000 3,946 4,000

4,000

100

XIII

2007

-

4,000 3,416 4,000

4,000

100

XIV

2008

-

4,000 3,817 4,000

4,000

100

XV

2009

-

6,500 3,626 6,500

6,500

100

Total

-

18,500 14,805 18,500 18,500

100

Grand Total

4,02,810 1,18,500 82,725 1,22,218 86,940

71.1

-': Nil/Not Available. *: Provided by the Government of India.

Source:

NABARD. [This is a reproduction from RBI (2010):

Report on Trend and Progress of Banking in

India 2009-10

, p.133; even the above footnotes are from the same source].