188

years thus:

`

8,000 crore,

`

8,000 crore and

`

14,000 crore, respectively. If these

three years data are to be treated as the yardstick , the difference between the

defaults in priority sector credit and the amounts allocated to the RIDF, has

been over 60% each year (or under each tranche).

We do not have such accurate data on the estimated sizes of farm credit

defaults for recent years when, it should be admitted, there have been reductions

in defaults as well as increases in RIDF Corpus allocations. Even so

a priori

indications are that the gap between the two has further widened because of the

higher base of bank credit operations. We have attempted a tentative estimate

of the possible defaults in agricultural credit based on banks’ performance in

priority sector dispensation for three years ending March 2010, March 2011

and March 2012.

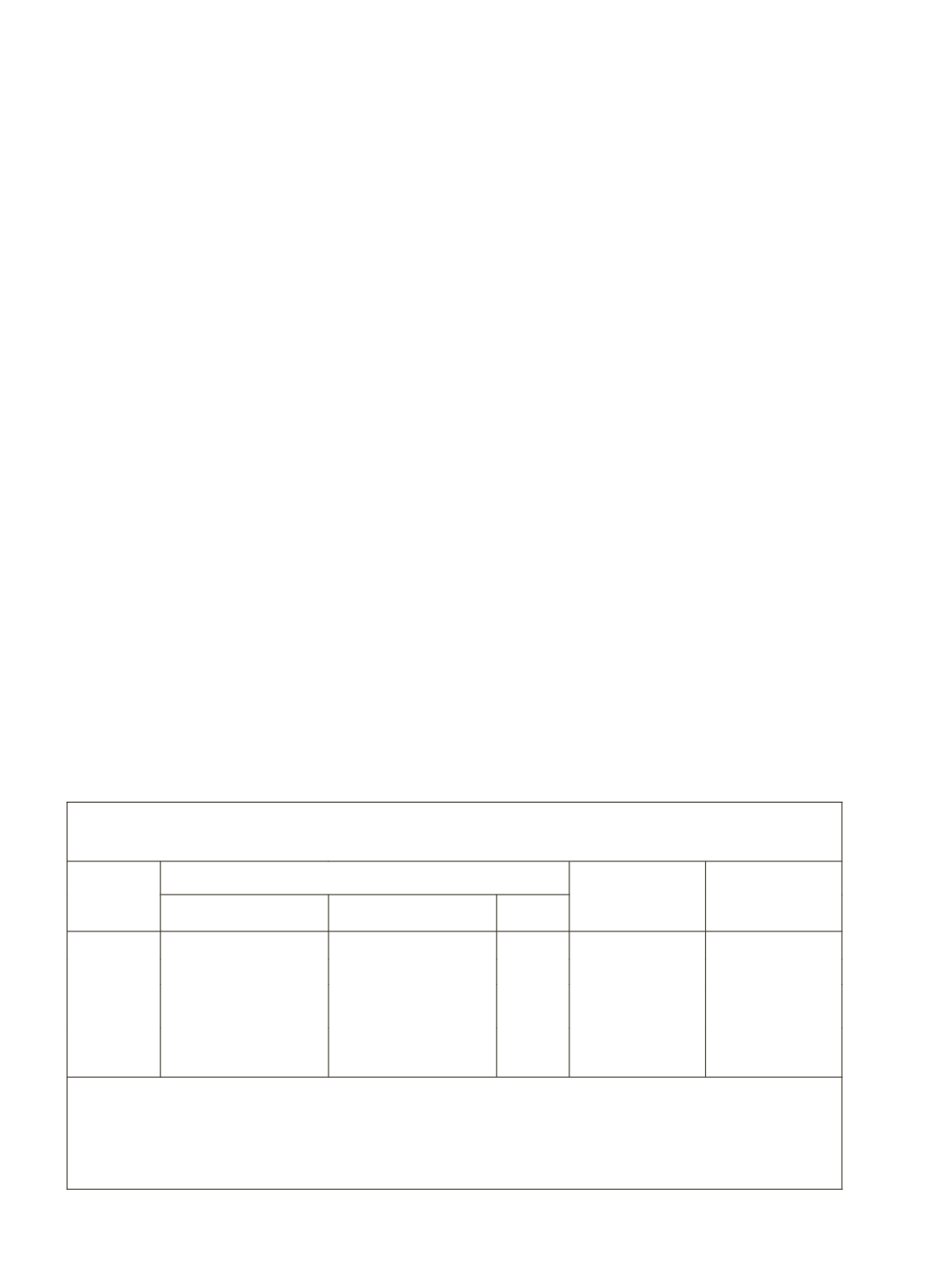

Again, except for two years 2009-10 and 2010-11 for which the

preceeding years’ default data appear suspect, the tentative estimates made

here show that the difference between the defaults in agricultural credit target

and the amounts allocated to RIDF has been about 65% in 2010-11 and 79%

in 2011-12.

The implication of the above differences is that RIDF has turned out

to be an insufficient measure to induce banks to set aside 18% of their net

bank credit to agriculture directly or indirectly through rendering support for

rural infrastructural development. The system appears to adopt a lukewarm

approach to introducing effective instruments of incentives and disincentives for

goading banks to fulfil the credit targets, let alone adopting punitive measures

Table 6.4: Tentative Estimate of Agricultural Credit Default and RIDF

Allocations for Public and Private Sector Banks

Year-End

Amount of Agricultural Credited Defaulted

@

RIDF

Allocations

For Next Year

Difference

Public Sector Bank PrivateSector Bank Total

2008-09

6,805

-

6,805

14000*

2009-10

2,081

-

2,081

16000*

2010-11

37,726

13,498

51,224

18,000

33,224

(64.9)

2011-12

66,640

26,961

93,601

20,000

73,601

(78.6)

@

Derived indirectly from the data on priority sector performance presented in RBI's publication

Report on

Trend and Progress of Banking in India, 2010-11

(p.85) and 2011-12 (p.75)

* Data reported on priority sector targets appear suspect as RIDF allocations made in succeeding years are

considerably higher than the credit target defaults.

(Figures within brackets are percentages of difference over the sizes of credit defaulted)