[ 50 ]

“SHG

S

,

SAVING

FOR

THE

PRESENT

,

SECURING

THE

FUTURE

”

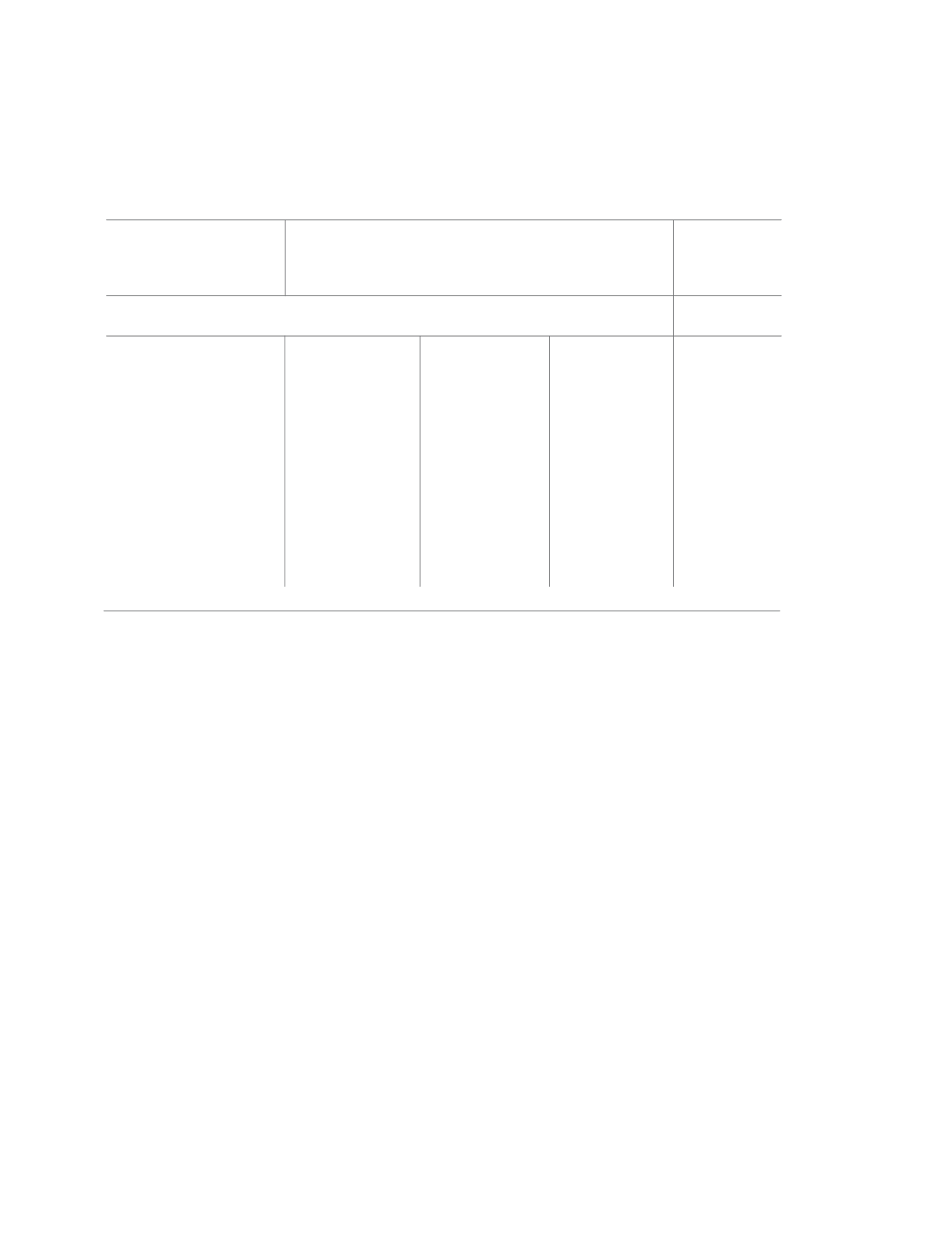

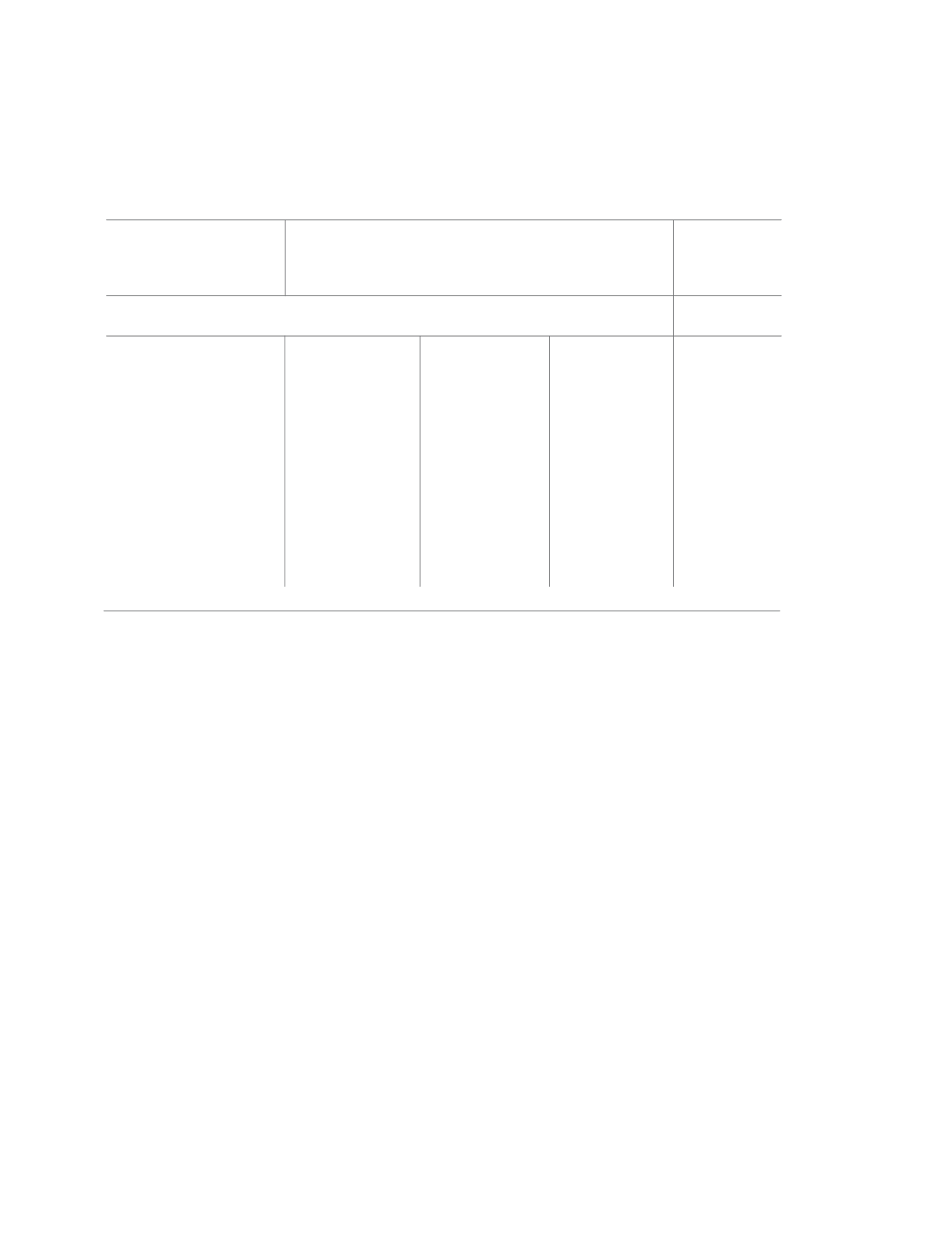

SHARE OF MODERN AGENCIES IN CREDIT OUTSTANDING

Perhaps as a response, during late 1980s and early 1990s, several Non-

Governmental Organisations made forays into microfinance and brought several

innovations to reach the unreached. Group approach through self-help groups

(SHG)

4

was one of the most important channels for reaching the unreached to

provide financial access. With policy support from Reserve Bank of India (RBI)

and NABARD, the Self Help Group-Bank Linkage Programme (SHG-BLP) was

launched during early 1990s, which has completed 25 years as of now. Apart

from SHG Bank Linkage channel, there has been emergence of Microfinance

Institutions (MFIs) on the rural finance scene. Though the share of MFIs and

SHGs in the total credit outstanding for a rural household is not substantial

compared to mainstream institutions, the 25-year journey of SHG-BLP, mostly

covering women, has been phenomenal as will be discussed in the next section.

Undisputedly, the programme has been a movement that empowered women.

The model has been accepted widely as an effective delivery mechanism for

most services. Thus, the influence of the SHG movement has been well beyond

mere providing financial resources to the rural people transcending to rural

health, education, and caring for the environment.

Table 2.

SHARES OF TRADITIONAL AND MODERN

INSTITUTIONAL AGENCIES# IN TOTAL CREDIT

OUTSTANDING, RURAL, 2012

Credit Agency

Formal

Agencies

Informal

Agencies

Traditional

Modern

Others

All India

51.1

4.2

44.0

0.7

38.7

10.8

49.3

1.2

24.0

54.9

4.1

38.5

2.5

52.3

4.7

42.6

0.4

43.5

6.8

49.6

0.1

33.7

8.3

0.1

8.3

7.3

68.3

0.4

West Bengal

Telangana

Tamil Nadu

Odisha

Karnataka

Andhra Pradesh

Source: Compiled from NSS Report No.577: Household Indebtedness in India

Note: # in Table 1.