Some Important Programmes in Livelihoods: Searching for Focus?

43

credit, AP has taken the lion’s share of the

total allocation. The Outcome Budget for

the year 2014–15 has a target of

`

120 billion

of bank credit for SHGs in AP and Kerala,

and only

`

2 billion for all the other states.

Out of a total of

`

4.76 billion provided by

way of interest subvention on SHG bank

loans in 2013–14 and 2014–15,

`

3.69 billion

went to AP.

Southern states have had more than a

fair share of NRLM funds and support as

they were early movers in the SHG move-

ment. In credit, 67 per cent of the groups

that accessed credit in 2014–15 were from

the southern region and had a share of 82

per cent of the total credit amount facilitated.

The Subvention Scheme on credit was intro-

duced in the year 2014 under NRLM. The

subsidy amounts too have been flowing in

to southern states as the programme is slow

to make headway in other states. Of the total

interest subvention amount of

`

4.76 billion

disbursed in 2013–14 and 2014–15,

`

4.40

billion has been received by southern states

(92 per cent). Of the total 1.65million groups

that were eligible for subvention, 80 per cent

(1.33 million SHGs) were in the southern

states. Under MKSP, of the total 3.2 million

women farmers covered, AP (including erst-

while Telangana) accounted for 2.62million

women farmers. The achievement in AP

alone was higher than the targeted coverage

of 2.45 million. In the rest of the states, not

much by way of livelihood initiatives have

been reported. Thus, NRLM—in the first

four years of its existence—has been focussed

on the southern states andmostly on the state

of AP. The distribution of NRLMbenefits has

been highly skewed, which is untenable given

the mission of “organizing and support-

ing the poor to come out of poverty”. As a

national programme and amatter of priority,

it should have also focussed on other states

with preponderant poor population and not

just continued to fund one state or region.

There have been problems in the credit

arrangements made for SHGs under NRLM.

By end of March 2015, there were 2.63 mil-

lion SHG loan accounts with banks with an

outstanding loan amount of

`

342.49 billion.

Roughly, one-third of these accounts were in

default. Approximately,

`

48.45 billion i.e.,

14 per cent of the total credit was defaulted.

In the southern states too, significant

defaults were reported. In a total of 13 states,

the defaults were inmore than 50 per cent of

the accounts and in 10 states, 50 per cent or

more of the loan amounts were in default.

At such high levels of default, banks find

it difficult to continue the credit facilities.

While the “

Panchsutra

” is an inalienable

part of the programme of SHGmobilisation

and support, the disseminated principles

of financial discipline do not seem to have

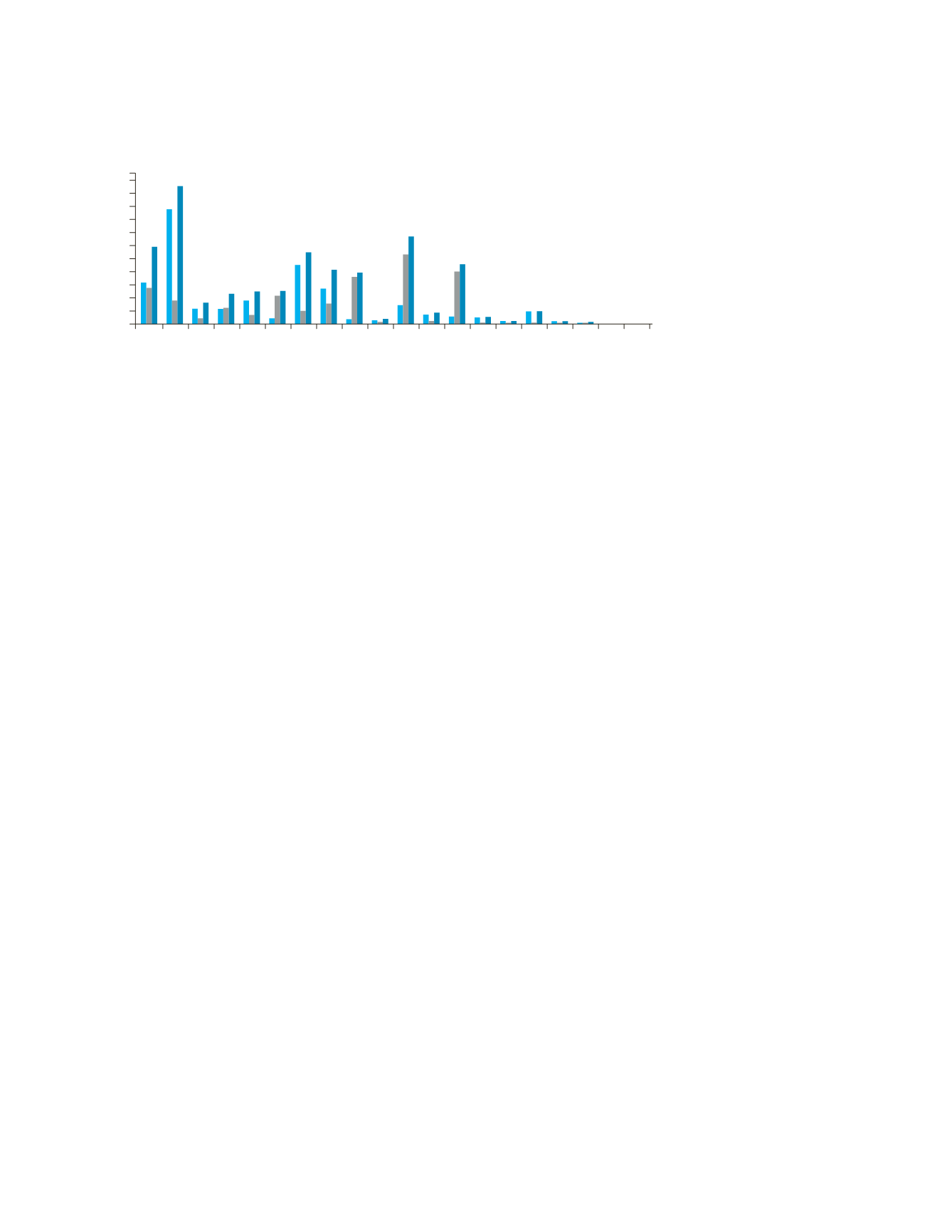

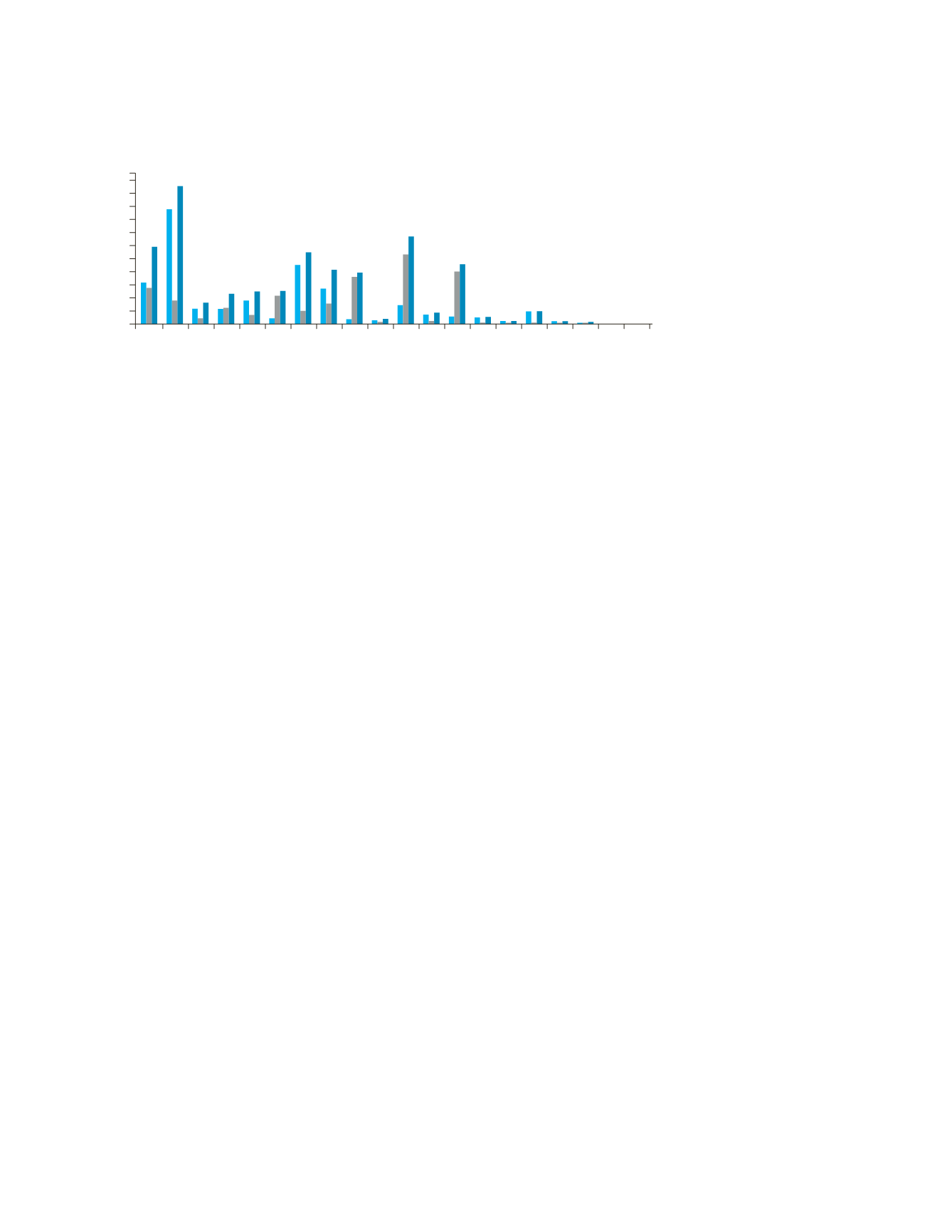

Figure 3.7:

SHGs’-promoted state-wise comparison

Source:

Mid-term Assessment of NRLP–National Mission Management Unit, NRLM; MoRD, GoI, 2015.

110,000

100,000

90,000

80,000

70,000

60,000

50,000

40,000

30,000

20,000

10,000

0

Assam

Bihar

Chhattisgarh

Gujarat

Jharkhand

Karnataka

Madhya Pradesh

Maharashtra

Odisha

Rajasthan

Tamil Nadu

Uttar Pradesh

West Bengal

Haryana

Himachal Pradesh

Jammu and Kashmir

Punjab

Uttarakhand

Arunachal Pradesh

Manipur