60

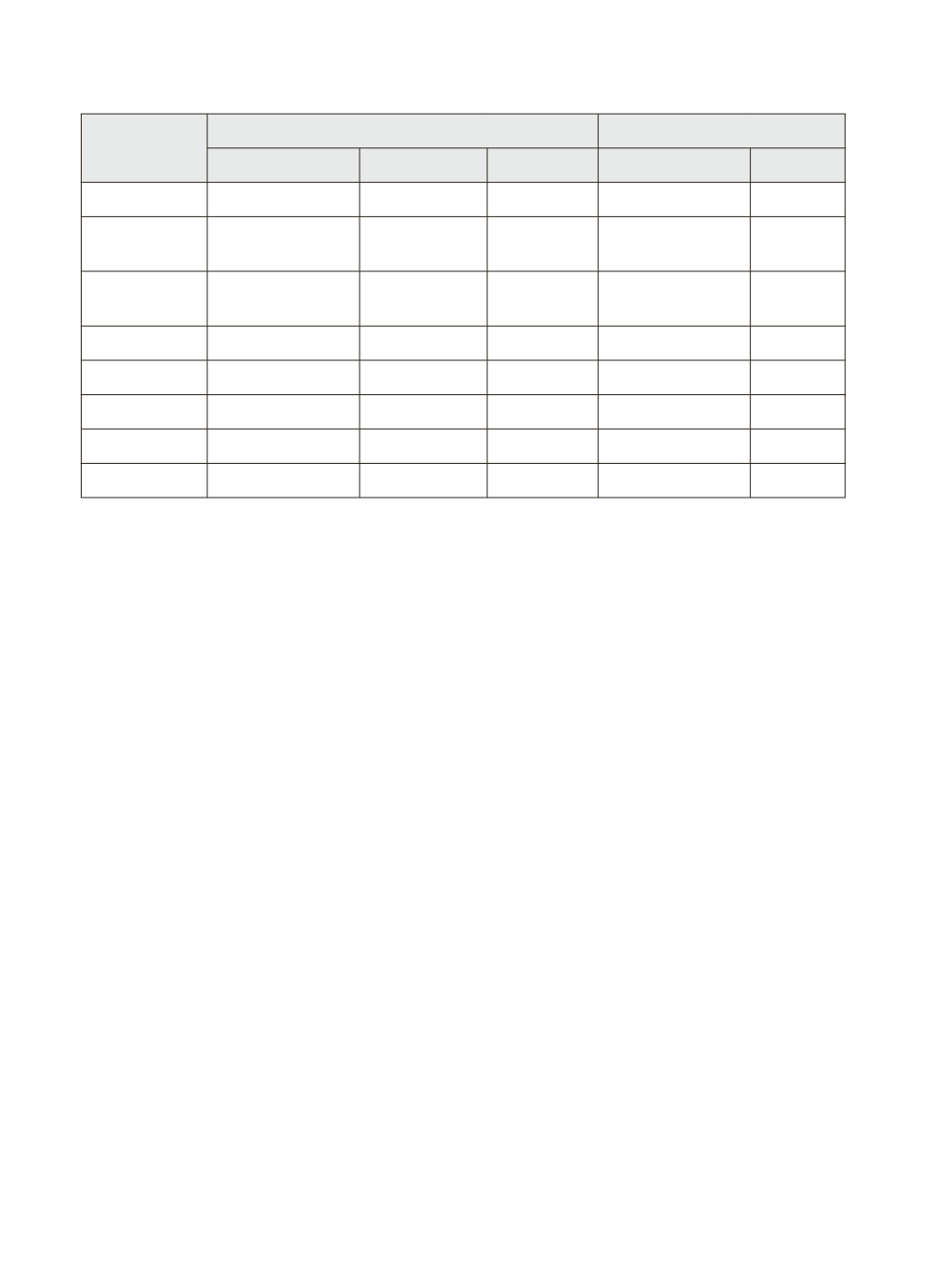

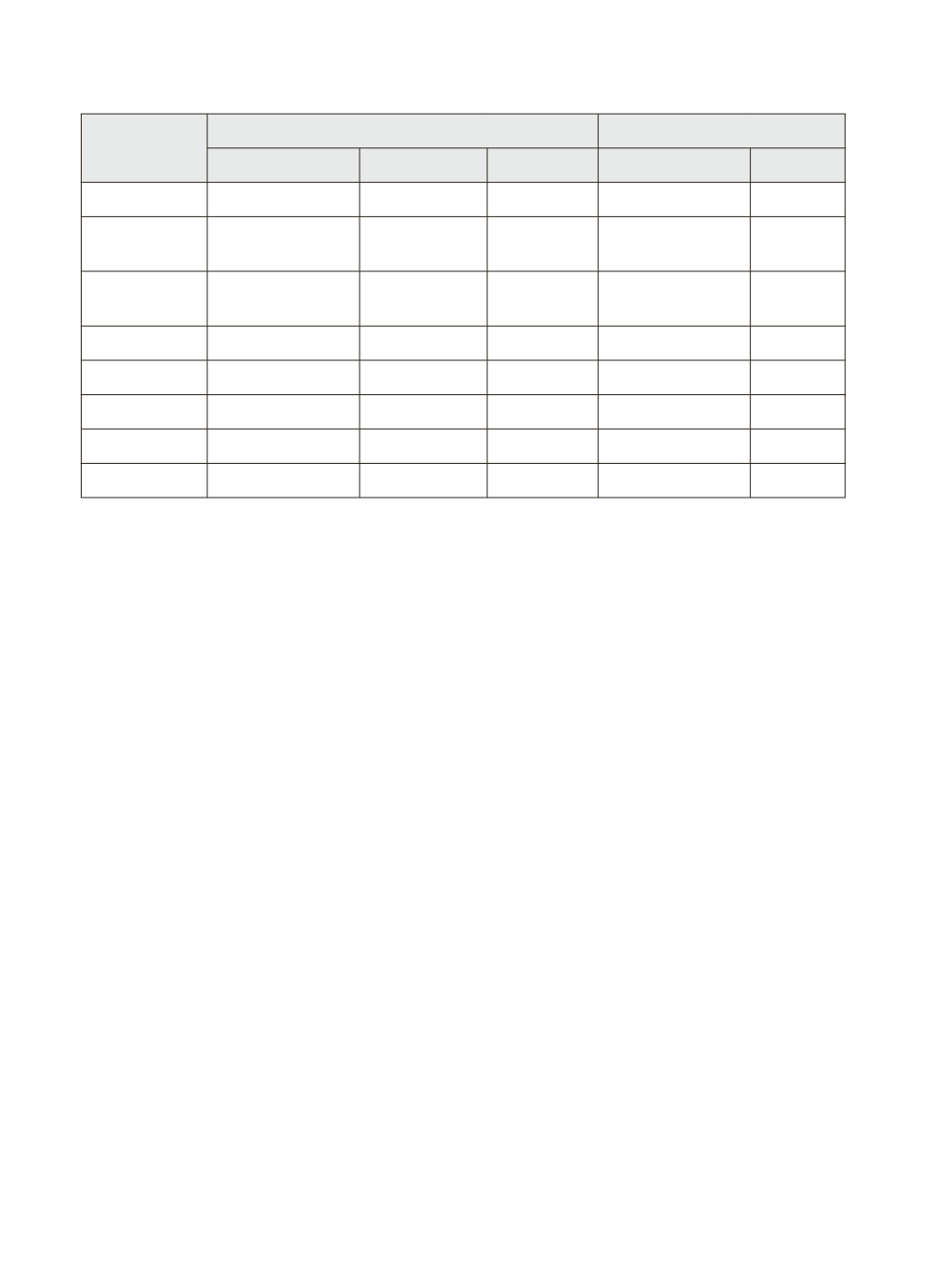

Table 4.2: Bank-Wise RuPay KCC Transactions (Apr 2015-Mar 2016)

Bank Type

Channels

Total Transactions

NFS

POS

E-com Total (No.)

% in total

SBI Associates

`

13,95,39,800

`

71,62,405

`

5,11,630

`

14,72,13,835

2.03

Private Sector

Banks

`

7,26,46,750

`

20,48,207

`

7,46,94,957

1.03

Public Sector

Banks

`

4,27,56,21,950

`

4,71,34,025

`

27,47,250

`

4,32,55,03,225

59.70

DCCB

`

27,13,22,300

`

1,04,421

`

27,14,26,721

3.75

RRB

`

2,37,55,20,200

`

52,97,173

`

10,680

`

2,38,08,28,053

32.86

SCB

`

4,62,38,400

`

4,62,38,400

0.64

Grand Total

`

7,18,08,89,400

`

6,17,46,231

`

32,69,560

`

7,24,59,05,190

100.00

Channel share

99.10%

0.85% 0.05% 100.00%

Source: NPCI, Mumbai

4.16 An analysis of scale of uses & market share of three card payment systems

indicated that National Financial Switch (NFS)/ ATMs dominated the KCC

transactions accounting for as high as 99.1 per cent followed by Point of Sale

(POS) devices at 0.85 percent and the RuPay PaySecure (E-Commerce operations

launched on 21 June 2013) was having a very negligible share of 0.05 per cent.

With RuPay PaySecure, anyone having RuPay cards can make online payments

to fulfill various need-based services such as reservations, booking, ticketing,

shopping, utility bill payments in a secured manner.

4.17 The pattern of KCC transactions across various banks on NFS and POS channels

was compared over two periods (Apr 14-Sept 14 and Sept 15 –Feb 16) to see

whether any definite trend is there in transactions made through these two

channels. It may be observed from Table 4.3 & 4.4 that there was not much

difference in average ticket size per transaction through NFS or POS devise,

as no definite trend in average amount transacted across various banks was

observed. The average amount transacted in case of RRBs and cooperatives was

less as compared to that in case of other banks. However, these amounts were

under-estimated since the denominator (number of transactions) included both

financial and non-financial transactions. As compared to transactions through

NFS and POS channels, the transactions through E-Com (Table 4.5) channel was

observed to be very less.