- 1. India and the World: The Economy in FY2024

- 2. Cooperatives: Tackling Challenges, Building Opportunities

- 3. Investing in a Sustainable Tomorrow

- 4. Towards Inclusive Development

- 5. Financing Rural Infrastructure for Sustainable Development

- 6. Credit Planning and Delivery for Financial Inclusion

- 7. Supervisory Role of NABARD

- 8. Empowering Rural Financial Institutions

- 9. People—Processes and Policies

- 10. Leveraging Finance for Growth

- Success Stories

- Board of Directors as on 31 March 2024 (PDF)

- Principal Officers (PDF)

- Corporate Governance (PDF)

- Annual Accounts 2023–24 (PDF)

- E-Mail Addresses of HODs and Subsidiaries at Mumbai (PDF)

- Regional Offices/Cells/Training Establishments/Subsidiaries (PDF)

- Annual Report 2023-24 (PDF)

- Home

- Board of Directors as on 31 March 2024 (PDF)

- Principal Officers (PDF)

- 1. India and the World: The Economy in FY2024

- 2. Cooperatives: Tackling Challenges, Building Opportunities

- 3. Investing in a Sustainable Tomorrow

- 4. Towards Inclusive Development

- 5. Financing Rural Infrastructure for Sustainable Development

- 6. Credit Planning and Delivery for Financial Inclusion

- 7. Supervisory Role of NABARD

- 8. Empowering Rural Financial Institutions

- 9. People—Processes and Policies

- 10. Leveraging Finance for Growth

- Success Stories

- Corporate Governance (PDF)

- Annual Accounts 2023–24 (PDF)

- E-Mail Addresses of HODs and Subsidiaries at Mumbai (PDF)

- Regional Offices/Cells/Training Establishments/Subsidiaries (PDF)

- Annual Report 2023-24 (PDF)

Cooperatives are people-centric enterprises owned, controlled, and run by and for their members to realise their common economic, social, and cultural needs and aspirations. Cooperatives aggregate the power of people who, on their own, would find it difficult to achieve their goals. Cooperatives are thus, unique entities that reduce individual risk in undertaking economic activities through a culture of shared productivity, decision-making, and creative problem-solving.

‘Cooperation is the ideal strategy for ensuring self-sufficiency of a village; it is the well-spring of an Aatmanirbhar Bharat.’

—Prime Minister Narendra Modi

2.1 PRINCIPLES OF COOPERATIVES

Functioning of cooperatives is driven by higher values of self-help, self-responsibility, democracy, equality, transparency, and social responsibility (Figure 2.1). These characteristics distinguish them from other economic models and make them best suited to play a role in strengthening the rural economy.

Figure 2.1: Seven principles of cooperatives

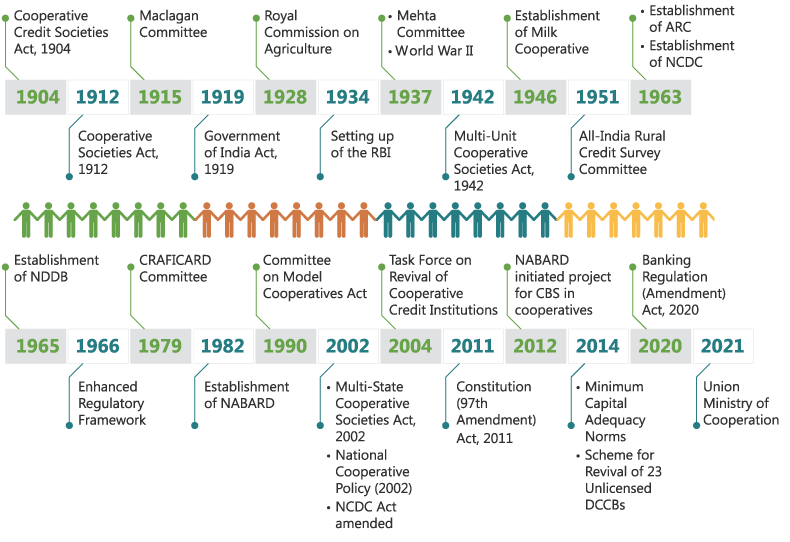

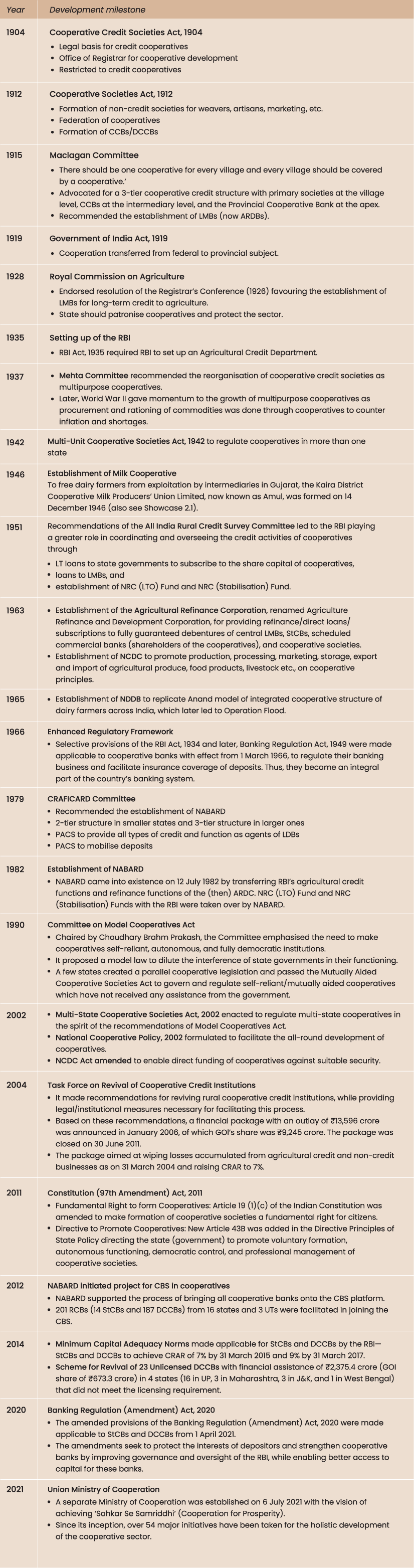

2.2 HISTORY OF THE COOPERATIVE MOVEMENT IN INDIA

The culture of cooperation and the practice of cooperative activities are deeply ingrained in the Indian ethos. It has been 120 years since cooperative institutions received legal recognition in India with the enactment of the Cooperative Credit Societies Act, 1904. The law was passed to facilitate flow of institutional credit to farmers in view of the widespread distress in the agricultural sector in the latter part of the nineteenth century due to recurrent famines. The history of the cooperative movement since then is briefly traced in Figure 2.2 and Appendix Table A2.1.

Figure 2.2: Development milestones for the cooperative movement in India

ARC = Agricultural Refinance Corporation, CBS = Core Banking Solutions, CRAFICARD = Committee to Review Arrangements for Institutional Credit for Agriculture and Rural Development, DCCB = District Central Cooperative Bank, NCDC = National Cooperative Development Corporation, NDDB = National Dairy Development Board, RBI = Reserve Bank of India.

2.3 CONSTITUTIONAL FRAMEWORK OF COOPERATIVES IN INDIA

‘Cooperative societies’ is a state subject under Entry 32 of the State List of Seventh Schedule of the Constitution of India. Cooperative societies functioning within a single state are governed by the Cooperative Societies Act of their respective state/Union Territory (UT). Cooperative societies functioning in more than one state/UT are governed by Multi-State Cooperative Societies Act, 2002 under the purview of Government of India (GOI). Constitution (97th Amendment) Act, 2011 granted citizens the fundamental right to form cooperative societies and included a directive under the Directive Principles of State Policy requiring the state (government) to promote voluntary formation, autonomous functioning, democratic control, and professional management of cooperative societies.

Cooperative banks are basically cooperative societies which are registered under the Cooperative Societies Act of the state concerned or under the Multi-State Cooperative Societies Act, 2002. Central and state laws on cooperative societies generally deal with incorporation, regulation, and winding up of the cooperative societies. When cooperative societies carry on the business of banking, they come under the regulatory purview of the Reserve Bank of India, and they are licensed under the provisions of the Banking Regulation, Act, 1949.

2.4 INDIAN COOPERATIVES IN THE GLOBAL CONTEXT

The Indian cooperative movement is one of the largest in the world with nearly 8 lakh cooperative societies (of the 30 lakh globally)1 and a membership base of over 29 crore people.2 India accounts for nearly 27% of all cooperatives in the world.3 Over 20% of Indian population4 is estimated to be part of the cooperative movement in comparison to the global average of 12%.5 Of the 300 largest cooperatives in the world (by turnover/GDP per capita), 15 are from India with IFFCO at top position, followed by Amul.6 India ranks second in the Asia Pacific region (after Japan) and sixth in the world (after USA, France, Germany, Brazil, and Japan) in terms of number of cooperatives under this category.7 Among the top 300 cooperatives listed by turnover (US$), IFFCO is placed 72nd, Amul 90th, and KRIBHCO 236th.8

2.5 COOPERATIVE SCENARIO IN INDIA9

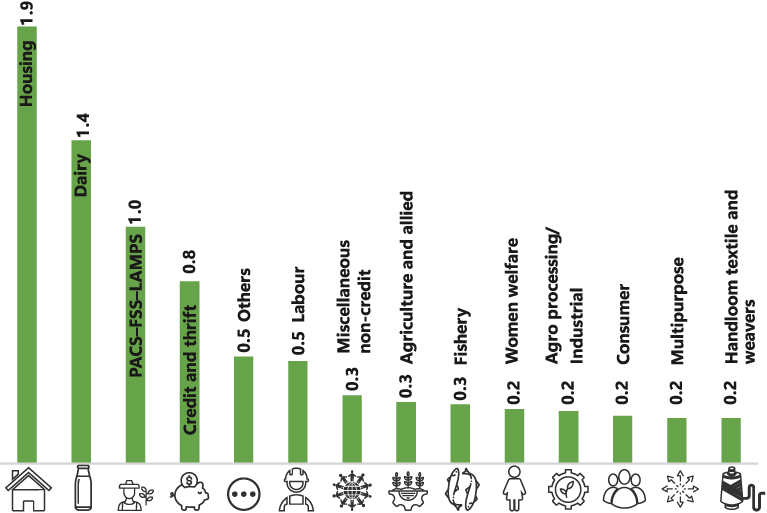

2.5.1 Sectoral distribution

The cooperatives in India cover a wide array of activities, including credit and banking, fertiliser, sugar, dairy, marketing, consumer goods, handloom, handicraft, fisheries, housing, etc. Housing (24%), dairy (17.7%), and PACS–FSS–LAMPS (13%) account for over 54% of all the cooperatives in the country (Figure 2.3, Appendix Table A2.2).10 Also, 48% of the total cooperative members are associated with PACS–FSS–LAMPS. Dairy cooperatives and their federations have been especially successful in India, contributing to equitable growth of their members (Showcase 2.1).

Figure 2.3: Cooperative societies by sector (number in lakh)

FSS = Farmers’ Service Society, LAMPS = Large Area Multipurpose Cooperative Society , PACS = Primary Agricultural Credit Society.

Note: The difference between the PACS and ‘credit and thrift’ societies is that the ‘credit and thrift’ societies are dependent primarily on member savings for meeting the credit needs of their members. The PACS were originally thrift-oriented credit institutions but have matured into channels for disbursing credit by availing refinance with limited emphasis on deposit mobilisation (barring a few states like Kerala). Source: National Cooperative Database, Ministry of Cooperation, Government of India. https://cooperatives.gov.in/en.

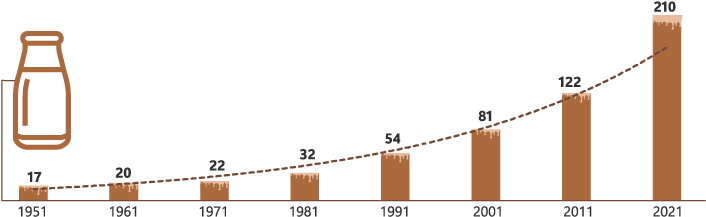

Showcase 2.1: Dairy cooperatives—a successful endeavour

Formation of dairy cooperatives in India was the driving force behind its ‘White Revolution’, transforming it from being a milk-deficient country to the largest milk producer in the world with 24% share in the global milk production.a The dairy sector contributes to over 5% of India’s GDP.b

Before being organised into dairy cooperatives, small-scale milk producers had little bargaining power. The milk marketing system was controlled by contractors and middlemen. As milk is perishable, farmers were compelled to sell their milk for whatever they were offered.

Polson, a private dairy, had monopoly over the supply of milk pasteurised in Anand (Gujarat) to Mumbai. Acknowledging the plight of dairy farmers of Kaira in Gujarat, who were being exploited by middlemen, Sardar Vallabhbhai Patel advised the farmers to form a cooperative society with its own pasteurisation plant and market their milk through the cooperative society. Guided by Sardar Patel, Morarji Desai and Tribhuvan Das Patel helped organise the farmers into primary dairy cooperatives in villages which would, in turn, federate to form a dairy cooperative union with milk processing facilities. This marked the beginning of the Kaira District Co-operative Milk Producers’ Union Limited, Anand (known as Amul today). It was formally registered on 14 December 1946.

Following a visit by Prime Minister Lal Bahadur Shastri to Anand, Gujarat in 1964, the National Dairy Development Board (NDDB) was created in 1965 with a mandate to support the creation of dairy cooperatives along the ‘Anand Pattern’ across India. The ‘Anand Pattern’ was essentially a cooperative structure comprising village-level dairy cooperative societies which promote district-level unions, which, in turn, promote the state-level marketing federation. Starting in 1970, NDDB replicated ‘Anand Pattern’ cooperatives through the Operation Flood programme all over the country.

Figure S2.1.1: Milk production in India (million tonnes)c

aPIB (2023), ‘India ranks first in milk production in the world contributing 24% of global milk production’, Press Information Bureau, press release by Ministry of Fisheries, Animal Husbandry & Dairying, Government of India, 7 February. https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1897084.

b PIB (2024), ‘World Milk Day (June 01)’, Press Information Bureau, press release by Ministry of Fisheries, Animal Husbandry & Dairying, Government of India, 31 May. https://pib.gov.in/PressNoteDetails. aspx?NoteId=151889&ModuleId=3.

c PIB (2022), ‘Milk Production in India’, Press Information Bureau, press release by Ministry of Fisheries, Animal Husbandry & Dairying, Government of India, 7 September. https://pib.gov.in/FeaturesDeatils. aspx?NoteId=151137.

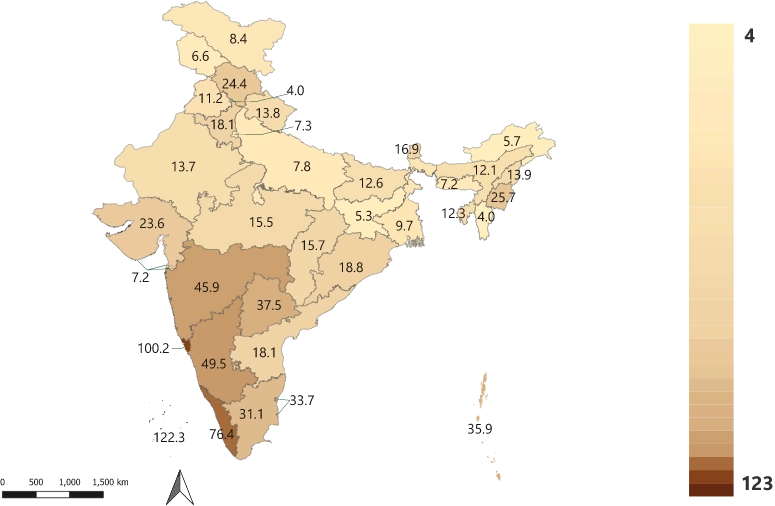

2.5.2 Regional distribution

Though India has a very large number of cooperatives, the spread of the cooperative movement has not been uniform across states. Maharashtra alone accounts for over a fourth of the total cooperatives in the country. The top 5 states with the largest number of cooperatives accounting for over 57% of the cooperatives in the country are Maharashtra, Gujarat, Telangana, Madhya Pradesh, and Karnataka (Appendix Table A2.3).

Figure 2.4: Cooperative membership as a percentage of population by state (2023)

Sources:

- No. of cooperatives and membership data sourced from National Cooperative Database 2023, Ministry of Cooperation, Government of India. https://cooperatives.gov.in/en.

- Estimated population data sourced from Unique Identification Authority of India.

Among the big states, cooperative membership as a percentage of estimated total population is much higher in the states in the southern and western regions than the eastern and north-eastern. Cooperative membership as a percentage of total population was highest in Kerala (77%) followed by Karnataka (50%), and lowest in Mizoram (4%). There are still 18,497 gram panchayats not covered by a PACS in India and the government has launched a central plan to establish a cooperative society in each of these.11

2.6 NABARD’S MANDATE OF SUPPORTING RURAL COOPERATIVES

Development of rural institutions is one of the core mandates of NABARD and a part of its corporate mission statement. NABARD’s role in the development of cooperative sector can be broadly summarised under the domains of refinance support, developmental support, policy support, and supervisory role (Figure 2.5).

Figure 2.5: NABARD’s mandate of supporting the development of rural cooperatives

Refinance support

Augmenting resources of RCBs Facilitating capital formation in agriculture

Developmental support

Training and capacity building Providing infrastructure support

Policy support

Supporting policy research and action at the central and federal levels

Supervision of RCBs

Conducting statutory inspection

Ensuring compliance to statutory/regulatory provisions

RCB = Rural Cooperative Bank.

- Refinance support: NABARD extends refinance to rural cooperative banks (RCBs) for supplementing their resources for short-term and long-term lending for agriculture, allied activities, and rural non-farm sector. Of the total ground level credit disbursed by rural credit cooperatives, the share of resources mobilised from NABARD is over 55% (also see sections 6.2-6.5 of this report).

- Developmental support: NABARD provides developmental support through its Cooperative Development Fund set up in FY1993 (also see Section 8.4 of this report). It also promotes financial inclusion in rural areas through its Financial Inclusion Fund (also see Section 6.6 of this report).

- Policy and implementation support:

- Centrally sponsored scheme for computerisation of the PACS (also see Section 8.3.1 of this report)

- Centrally sponsored scheme for computerisation of agriculture and rural development banks (ARDBs) (also see Section 8.3.2 of this report)

- Study on Reforms, Restructuring and Innovations in ARDBs: NABARD Consultancy Services (a NABARD subsidiary) conducted this study and submitted the draft report to the Ministry of Cooperation, GOI for consideration and feedback.

- National Policy on Cooperation: NABARD provided inputs for the formulation of the draft policy to the Committee for the National Policy of Cooperation. The committee is mandated with drafting the new National Cooperation Policy document to provide an enabling framework to realise the vision of ‘Sahakar se Samriddhi’, strengthen the cooperative movement in the country, and promote the cooperative-based economic development model.

- PACS as common service centres (CSCs): A memorandum of understanding has been signed between Ministry of Cooperation, Ministry of Electronics and Information Technology, NABARD, and CSC e-Governance Services India Limited for providing more than 300 e-services, such as banking, insurance, Aadhaar enrolment/updating, health services, PAN card and rail/bus/air ticket, etc., through the PACS. So far, 35,379 PACS have started providing CSC services to rural citizens, which may result in higher income for these PACS.

- Supervisory support: NABARD conducts periodic inspections of supervised entities including regional rural banks, and state and district central cooperative banks (statutorily) and state cooperative ARDBs (voluntarily).

2.7 NABARD INITIATIVES IN DEVELOPING THE COOPERATIVE SECTOR

2.7.1 Cooperation amongst Cooperatives

‘Cooperation amongst Cooperatives’ is one of the fundamental principles of the cooperative movement and it helps in achieving synergies by bringing together different types of cooperative institutions to strengthen the movement and in increasing their share in the contribution to the economy. A pilot project to promote ‘Cooperation amongst Cooperatives’ was launched by the Union Minister for Cooperation on NABARD Foundation Day (12 July 2023) in Banaskantha and Panchmahal DCCBs of Gujarat to promote financial transactions of primary dairy cooperative societies with cooperative banks and to strengthen the cooperative sector to increase its self reliance (also see Showcase 6.1 of this report). After the success of the pilot project, the campaign on ‘Cooperation amongst Cooperatives’ was launched in all districts of Gujarat by the Chief Minister of Gujarat on 15 January 2024.

2.7.2 CBS upgrade in rural cooperative banks

NABARD encouraged and supported the process of bringing the RCBs onto the Core Banking Solutions (CBS) platform.

Figure 2.6: NABARD-initiated project for CBS in cooperatives

New technologies adopted

BHIM UPI, PFMS, CKYCR, AePS, Green PIN, BBPS, Positive Pay System

AePS = Aadhar Enabled Payment System, BBPS = Bharat Bill Payment System, BHIM UPI = Bharat Interface for Money Unified Payments Interface, CBS = Core Banking Solutions, CKYCR = Central ‘Know Your Customer’ Records Registry, DCCB = District Central Cooperative Bank, PFMS = Public Financial Management System, RCB = Rural Cooperative Bank, StCB = State Cooperative Bank, UT = Union Territory.

NABARD, in August 2022, kicked off the ‘National Level Study on Core Banking Solutions in Rural Cooperative Banks’. The report indicated a list of ‘Must-Have’ and ‘Good-to-Have’ modules which NABARD has been pursuing with the CBS vendors to ensure their availability in the CBS system. NABARD, in its endeavour to enable the RCBs to have access to latest technologies in the banking sector, is working to facilitate common platforms for various initiatives like Centralised Account Aggregator platform, Cyber Insurance, Common MIS Server, Centralised Payment System, etc., for the RCBs.

2.7.3 National Conference on Best Practices in Rural Cooperative Banks

A two-day ‘National Conference on Best Practices in Rural Cooperative Banks’ was organised at Lucknow on 16–17 October 2023, attended by about 200 participants. Others watched the live stream of the proceedings on YouTube. The workshop deliberated on the best practices of RCBs in areas of governance, business diversification, human resource management, technology adoption and the way forward in these areas.

2.7.4 Promoting fintech engagement of rural credit cooperatives

India is increasingly moving towards digital banking, and fintech companies are largely driving this change. To promote the fintech engagement of the RCBs so that they may offer digitally-enabled banking solutions to the rural populace, NABARD organised a two-day fintech workshop for the RCBs on 11–12 March 2024 at Lucknow. The objective of the workshop was to create awareness amongst the RCBs on fintech/agritech applications, enable an understanding of the technology needs of the RCBs, and foster collaboration between the RCBs and fintech/agritech companies. Also, NABARD, in collaboration with NABVENTURES, conducted a panel discussion on the topic ‘Collaboration amongst FinTechs and RFIs’ at the Global Fintech Festival 2023 on 7 September 2023.

2.8 WAY FORWARD

The growth disparities between the rural and urban economies are a matter of concern and may exacerbate income inequality in the country. The agriculture and allied sector comprising of livestock, forestry, and fisheries is the bedrock of the rural economy and one of the largest providers of rural employment.

The cooperatives provide a third alternative, with free-market organisations at the one end (which provide goods and services through exchanges in the market) and the state-owned organisations at the other (which provides goods and services through state control). The all-inclusive cooperative model provides a successful and sustainable economic alternative for equitable growth in the Amrit Kaal.

While promoting the cooperative sector as the backbone of the new Indian economy, it is important to address the present weaknesses. Lack of technology adoption has been one of the major reasons which contributed to the decline in market share of cooperatives. The computerisation of the PACS and ARDBs is expected to digitise the operations of grassroot-level organisations and improve transparency and efficiency in their operations.

NABARD is working towards developing a Cooperative Governance Index (CGI) for rural cooperative banks to assess and improve governance standards.

Members’ education and awareness of cooperative principles, management, rights, and duties should be given due emphasis by policy planners and implementers.

To build a future cadre of trained cooperators, curricula of schools and colleges, as well as specialised management courses should have modules devoted to the study of cooperatives.

It should be the endeavour of all stakeholders to see that the RCBs increase their share in agriculture credit from the current 11% to at least 20% by 2030 and 40% by FY2047.

NOTES

- ICA (2023), World Cooperative Monitor (WCM) Report 2023, International Cooperative Alliance. https://monitor.coop/sites/default/files/2024-01/wcm_2023_3101.pdf.

- National Cooperative Database, Ministry of Cooperation, Government of India. https://cooperatives.gov.in/en.

- International Cooperative Alliance https://ica.coop/en/cooperatives/facts-and-figures.

- https://uidai.gov.in/images/StateWiseAge_AadhaarSat_Rep_31032023_Projected-2023-Final.pdf.

- International Cooperative Alliance https://ica.coop/en/cooperatives/facts-and-figures.

- IFFCO = Indian Farmers Fertiliser Cooperative Limited, Amul = Gujarat Cooperative Milk Marketing Federation Ltd.

- ICA (2023), Note 1.

- KRIBHCO = Krishak Bharati Cooperative.

- Unless mentioned otherwise, all data quoted in this section is sourced from the National Cooperative Database 2023, Ministry of Cooperation, Government of India. https://cooperatives.gov.in/en.

- PACS = Primary Agricultural Credit Society, FSS = Farmers’ Service Society, LAMPS = Large Area Multipurpose Cooperative Society.

- PIB (2023), Functioning of PACS, Press Information Bureau, press release by Ministry of Cooperation, Government of India, 12 December. https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1985494#:~:text=New 20Multipurpose%20PACS%2F%20Dairy%2F%20 Fishery,NCDC%20and%20other%20National%20level.

APPENDIX TO CHAPTER 2

Table A2.1: Development milestones for the cooperative movement in India

ARC = Agricultural Refinance Corporation, ARDB = Agriculture and Rural Development Bank, CBS = Core Banking Solutions, CCB = Central Cooperative Bank, CRAFICARD = Committee to Review Arrangements for Institutional Credit for Agriculture and Rural Development, CRAR = Capital to Risk (Weighted) Assets Ratio, DCCB = District Central Cooperative Bank, GOI = Government of India, J&K = Jammu and Kashmir, LDB = Land Development Banks, LMB = Land Mortgage Bank, LT = Long Term, NRC (LTO) Fund = National Rural Credit (Long-Term Operations) Fund, NCDC = National Cooperative Development Corporation, NDDB = National Dairy Development Board, PACS = Primary Agricultural Credit Societies, RBI = Reserve Bank of India, RCB = Rural Cooperative Bank, StCB = State Cooperative Bank, UP = Uttar Pradesh, UT = Union Territory

Table A2.2: Cooperative society membership by sector (2023)

FSS = Farmers’ Service Society, LAMPS = Large Area Multipurpose Cooperative Society, PACS = Primary Agricultural Credit Society. Note: The difference between the PACS and ‘credit and thrift’ societies is that the ‘credit and thrift’ societies are dependent primarily on member savings for meeting the credit needs of their members. The PACS were originally thrift-oriented credit institutions but have matured into channels for disbursing credit by availing refinance with limited emphasis on deposit mobilisation (barring a few states like Kerala). Source: National Cooperative Database, Ministry of Cooperation, Government of India. https://cooperatives.gov.in/en.

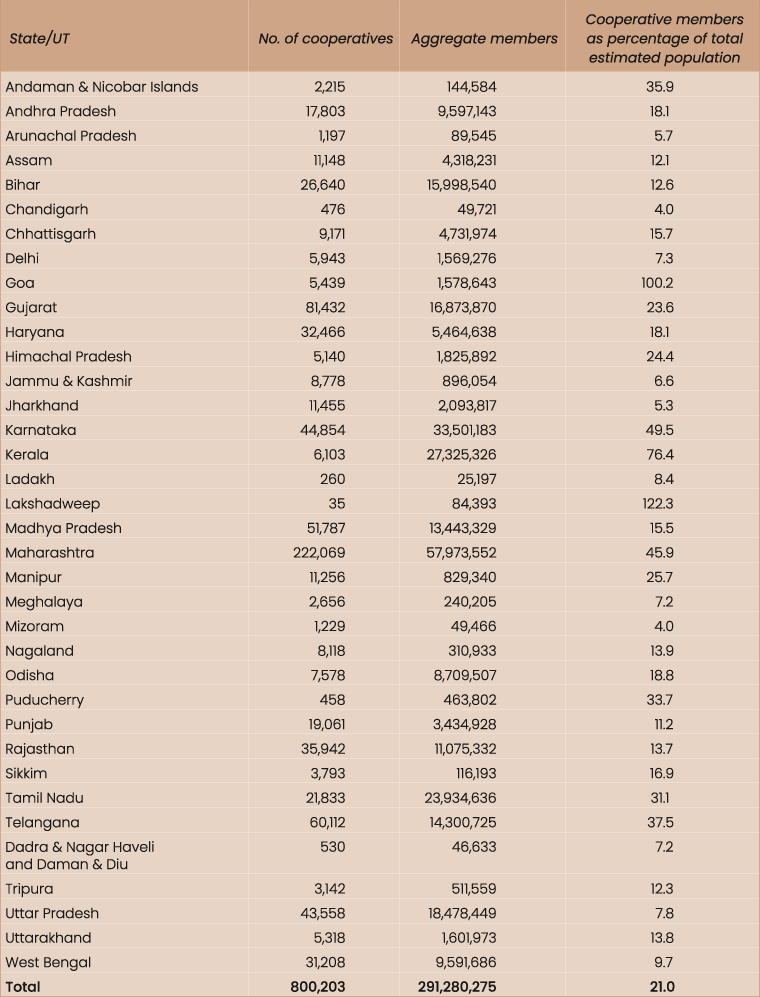

Table A2.3: Cooperative society membership by state (2023)

Note: Data on aggregate members may include membership of an individual in multiple societies.

Source:- No. of cooperatives and membership data sourced from National Cooperative Database 2023, Ministry of Cooperation, Government of India. https://cooperatives.gov.in/en.

- Estimated population data sourced from Unique Identification Authority of India.

© 2024 NABARD All Rights Reserved

Designed & Developed by RDX Digital