- 1. India and the World: The Economy in FY2024

- 2. Cooperatives: Tackling Challenges, Building Opportunities

- 3. Investing in a Sustainable Tomorrow

- 4. Towards Inclusive Development

- 5. Financing Rural Infrastructure for Sustainable Development

- 6. Credit Planning and Delivery for Financial Inclusion

- 7. Supervisory Role of NABARD

- 8. Empowering Rural Financial Institutions

- 9. People—Processes and Policies

- 10. Leveraging Finance for Growth

- Success Stories

- Board of Directors as on 31 March 2024 (PDF)

- Principal Officers (PDF)

- Corporate Governance (PDF)

- Annual Accounts 2023–24 (PDF)

- E-Mail Addresses of HODs and Subsidiaries at Mumbai (PDF)

- Regional Offices/Cells/Training Establishments/Subsidiaries (PDF)

- Annual Report 2023-24 (PDF)

- Home

- Board of Directors as on 31 March 2024 (PDF)

- Principal Officers (PDF)

- 1. India and the World: The Economy in FY2024

- 2. Cooperatives: Tackling Challenges, Building Opportunities

- 3. Investing in a Sustainable Tomorrow

- 4. Towards Inclusive Development

- 5. Financing Rural Infrastructure for Sustainable Development

- 6. Credit Planning and Delivery for Financial Inclusion

- 7. Supervisory Role of NABARD

- 8. Empowering Rural Financial Institutions

- 9. People—Processes and Policies

- 10. Leveraging Finance for Growth

- Success Stories

- Corporate Governance (PDF)

- Annual Accounts 2023–24 (PDF)

- E-Mail Addresses of HODs and Subsidiaries at Mumbai (PDF)

- Regional Offices/Cells/Training Establishments/Subsidiaries (PDF)

- Annual Report 2023-24 (PDF)

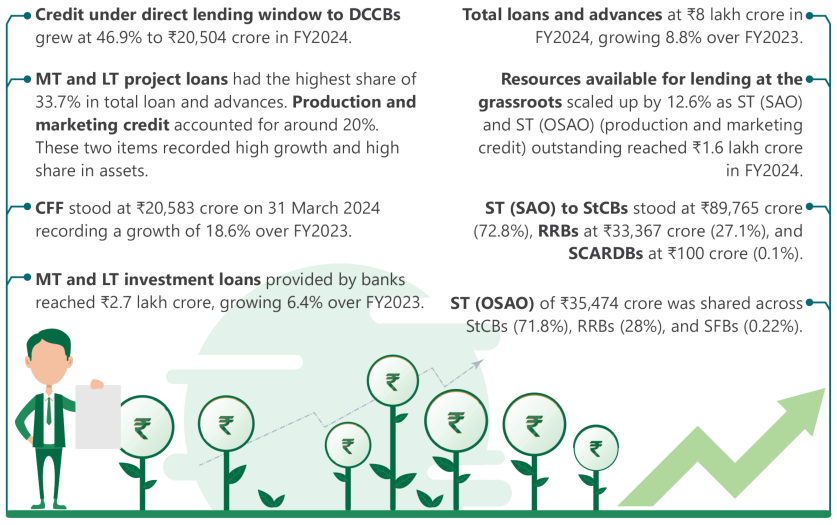

As on 31 March 2024, NABARD reported a balance sheet size exceeding ₹9 lakh crore, marking a growth rate of 13.6% over FY2023, the high point of the year being the maiden issuance of social bonds pioneering environmental, social, and governance (ESG) investing in India (Showcase 10.1).

Showcase 10.1: Maiden issue of social bond by NABARD

‘NABARD predates the concept of ESG investing and has, since inception, been focussed on sustainable development of the rural sector in India. Now, it’s on us to bring the Indian markets to the rural masses of India.’

- Chairman, NABARD, Shaji K.V.

NABARD spearheaded the cause of ESG investment in the country by issuing India’s first rupee-denominated social bond this year. The listing ceremony was conducted at the historic Market Hall of the Bombay Stock Exchange on 29 September 2023. The ₹1,000 crore bond issue made NABARD one of the largest issuers in the Indian domestic market. Such was the enthusiasm that the offer received ₹8,560 crore in bids, of which ₹1,040.5 crore worth were accepted. This AAA rated bond was externally certified by KPMG under the social bond guidelines of the International Capital Markets Association.

Listing ceremony of social bond

The funds raised through this offering will be used to refinance drinking water projects under GOI’s Jal Jeevan Mission, financed under NIDA in Telangana.

ESG = Environmental, Social, Governance; GOI = Government of India; NIDA = NABARD Infrastructure Development Assistance.

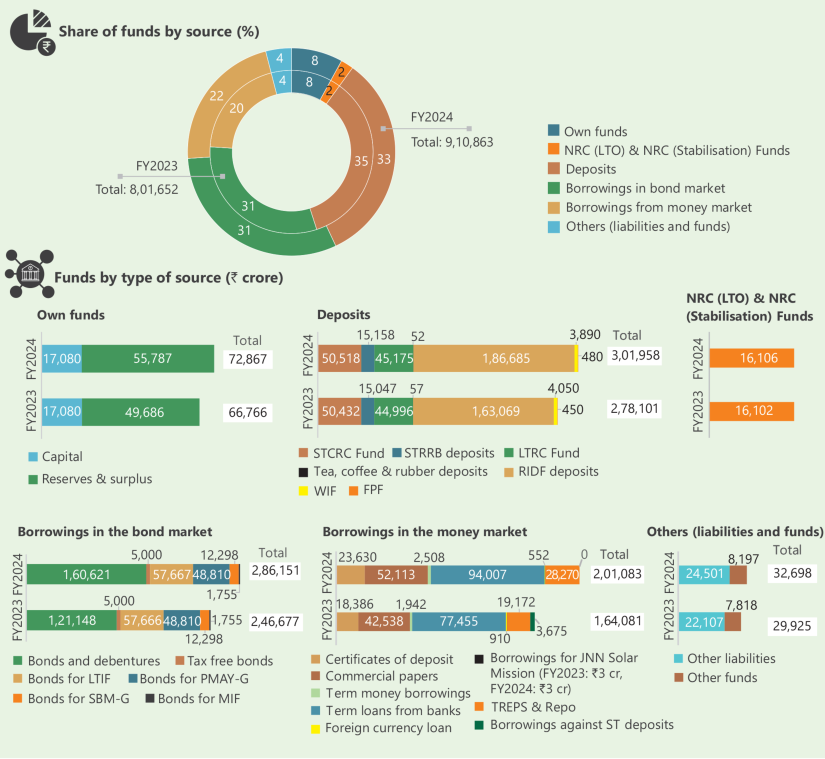

10.1 SOURCES OF FUNDS

10.1.1 Capital, reserves, and NRC funds

NABARD’s balance sheet size has increased by 85.7%, from ₹4.9 lakh crore (FY2019) to ₹9.1 lakh crore (FY2024), at a compound annual growth rate (CAGR) of 13.2%. Our paid-up capital on 31 March 2024 stood at ₹17,080 crore, against an authorised share capital of ₹30,000 crore (Figure 10.1). At the close of FY2024, own funds (capital, reserves, and surplus) stood at ₹72,867 crore. NABARD contributed ₹1 crore each to the National Rural Credit (NRC) Long-Term Operation (LTO) Fund and the NRC (Stabilisation) Fund.

10.1.2 Deposits

NABARD augmented various funds for different purposes over time by tapping into the priority sector lending shortfall of commercial banks. On 31 March 2024, the aggregate outstanding under such funds was more than ₹3 lakh crore, which is 33.2% of the total liabilities, including Short-Term Cooperative Rural Credit Fund, Short-Term Regional Rural Bank deposits, Long-Term Rural Credit Fund, and Rural Infrastructure Development Fund (RIDF) (Figure 10.1).

Figure 10.1: Sources of funds

cr = crore, FPF = Food Processing Fund, JNN Solar Mission = Jawaharlal Nehru National Solar Mission, LTIF = Long-Term Irrigation Fund, LTO = Long-Term Operations, LTRC = Long-Term Rural Credit, MIF = Micro-Irrigation Fund, NRC = National Rural Credit, PMAY–G = Pradhan Mantri Awaas Yojana–Gramin, RIDF = Rural Infrastructure Development Fund, SBM–G = Swachh Bharat Mission–Grameen, ST = Short-Term, STCRC = Short-Term Cooperative Rural Credit, STRRB = Short-Term Regional Rural Bank, TREPS = Tri-party Repo Dealing & Settlement, WIF = Warehouse Infrastructure Fund.

The Government of India (GOI) allocated ₹40,475 crore for RIDF in FY2024. Through the financial year, NABARD mobilised ₹49,730 crore and repaid ₹25,598 crore in various tranches under RIDF deposits.

NABARD also mobilised ₹100 crore and repaid ₹70 crore under Food Processing Fund (FPF) deposits during the FY2024. The outstanding deposits at the end of FY2024 was ₹3,890 crore under Warehouse Infrastructure Fund (WIF) and ₹480 crore under FPF.

10.1.3 Borrowings as on 31 March 2024

Total mobilised corpus stood at ₹3.5 lakh crore and the total outstanding borrowings of NABARD were ₹4.9 lakh crore. Commercial papers, term loans, and non-convertible debentures formed 94% of the total borrowing portfolio of NABARD.

Borrowings in the bond market

- During FY2024, bonds of ₹65,393 crore were issued and ₹25,920 crore were redeemed. The outstanding under bonds and debentures increased by 32.6% over FY2023.

- During FY2024, no mobilisation took place under the Extra-Budgetary Resources scheme of the GOI. As a result, outstandings against bonds raised for GOI schemes remained the same as last year.

Borrowings in the money market

During the year, NABARD issued commercial papers to raise ₹1.3 lakh crore. Term loans worth ₹82,450 crore were borrowed from commercial banks through the financial year.

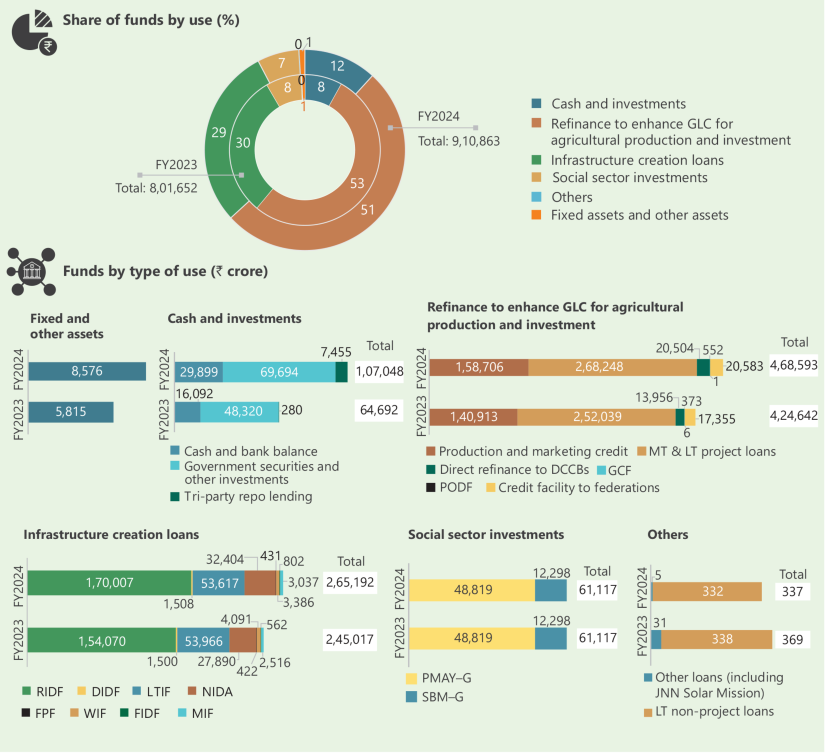

10.2 USES OF FUNDS

NABARD raised funds during FY2024 to finance its development agenda that included shoring up ground level credit (GLC) for rural production and investment, infrastructure creation, social sector development, cash and investment management, and creation of fixed assets (Figure 10.2).

NABARD provides loans and advances to rural financial institutions for increasing GLC to farmers for financing of their short-term seasonal agricultural operations as also for investing in capital formation for carrying out various farming activities.

Refinance is also available for purposes like working capital loans for weavers and artisans, marketing support under various lines of credit, and for conversion of short-term loans into medium-term loans in case of natural calamities.

In addition, NABARD provides loans for infrastructure creation, social sector development, warehousing activities, food processing, etc., to various entities, including state governments and state-owned corporations.

NABARD lends directly to state governments under NRC (LTO) for contributing to the share capital of cooperative credit institutions. These funds are utilised for cash and investment management and creation of fixed assets for running business operations.

Figure 10.2: Uses of funds

DCCB = District Central Cooperative Bank, DIDF = Dairy Processing and Infrastructure Development Fund, FIDF = Fisheries and Aquaculture Infrastructure Development Fund, FPF = Food Processing Fund, GCF = Green Climate Fund, GLC = Ground Level Credit, JNN Solar Mission = Jawaharlal Nehru National Solar Mission, LT = Long-Term, LTIF = Long-Term Irrigation Fund, MIF = Micro-Irrigation Fund, MT = Medium-Term, NIDA = NABARD Infrastructure Development Assistance, PMAY–G = Pradhan Mantri Awaas Yojana–Gramin, PODF = Producers’ Organisation Development Fund, RIDF = Rural Infrastructure Development Fund, SBM–G = Swachh Bharat Mission–Grameen, WIF = Warehouse Infrastructure Fund.

Note: MT & LT project loans include the amount subscribed to special development debentures of state cooperative agriculture and rural development banks, which are in the nature of deemed advances.

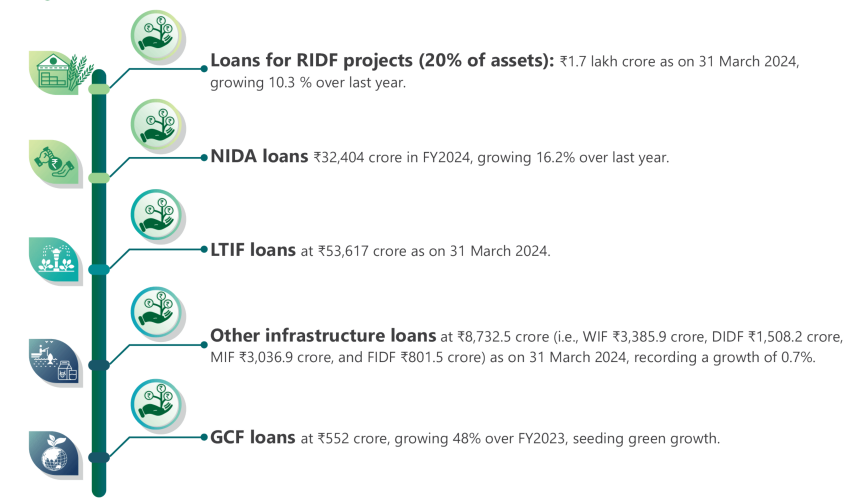

Highlights of deployment of funds and year-on-year growth, as on 31 March 2024, against various loans and advances extended by NABARD are given in Figure 10.3.

Figure 10.3: Shoring up GLC through refinance: Status as on 31 March 2024

CFF = Credit Facility to Federations, DCCB = District Central Cooperative Bank, GLC = Ground-Level Credit, LT = Long-Term, MT = Medium-Term, RRB = Regional Rural Bank, SCARDB = State Cooperative Agriculture and Rural Development Bank, SFB = Small Finance Bank, StCB = State Cooperative Bank, ST (OSAO) = Short-Term Other Seasonal Agricultural Operations, ST (SAO) = Short-Term Seasonal Agricultural Operations. Note: The amounts shown are outstanding figures.

Figure 10.4: Social sector investments as on 31 March 2024

NRIDA = National Rural Infrastructure Development Agency, PMAY–G = Pradhan Mantri Awaas Yojana–Gramin,

SBM–G = Swachh Bharat Mission–Grameen.

Note: The amounts shown are outstanding figures.

Figure 10.5: Infrastructure finance as on 31 March 2024

DIDF = Dairy Processing and Infrastructure Development Fund, FIDF = Fisheries and Aquaculture Infrastructure Development Fund, GCF = Green Climate Fund, LTIF = Long-Term Irrigation Fund, MIF = Micro-Irrigation Fund, NIDA = NABARD Infrastructure Development Assistance, RIDF = Rural Infrastructure Development Fund, WIF = Warehouse Infrastructure Fund.

Note: The amounts shown are outstanding figures.

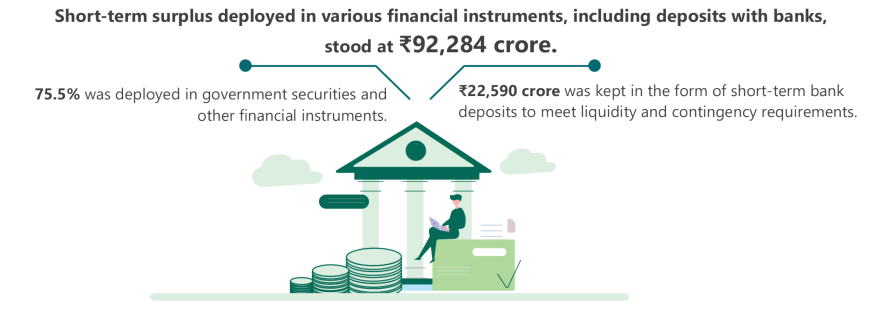

Figure 10.6: Investment of surplus funds as on 31 March 2024

Note: The amounts shown are outstanding figures.

10.3 INCOME AND EXPENDITURE

NABARD earned ₹48,847 crore income during FY2024, i.e., a 24% hike over FY2023 (Figure 10.7). Profit before tax in FY2024 was ₹8,068 crore (against ₹6,555 crore in FY2023) and profit after tax was ₹6,103 crore (against ₹5,360 crore in FY 2023). The net surplus has been appropriated by transferring to various funds maintained in NABARD such as the R&D Fund, Reserve Funds, NRC (LTO) Fund, and NRC (Stabilisation) Fund, etc.

Figure 10.7: Income analysis

10.4 NABARD’S INVESTMENTS IN THE AGRICULTURE AND RURAL ECOSYSTEM

NABARD collaborates with strategic partners through equity investments to support the development of the agriculture and rural ecosystem, including enhancing the credit flow.

10.4.1 Investment in NABARD subsidiaries

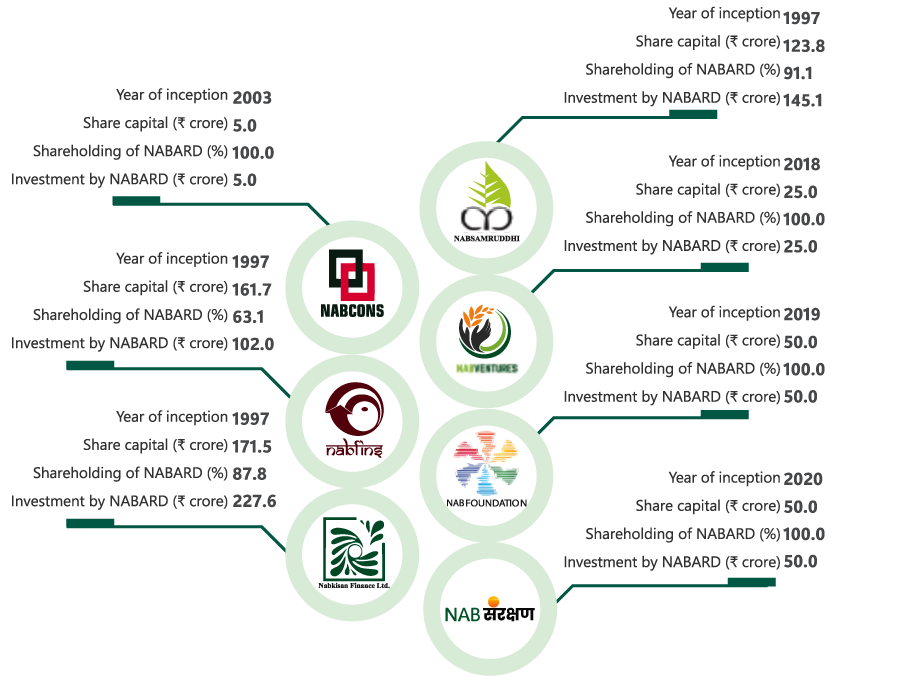

NABARD has seven subsidiaries established to further its mandate (see Annexe to Chapter 10). The subsidiaries contribute significantly in supporting NABARD’s objectives and expanding the impact in rural and agricultural development through financing micro-, small-, and medium-sized enterprises, farmer producers’ organisations, self-help groups, and joint-liability groups. They do so by extending micro-credit facility, providing credit guarantee, investing in rural start-ups, providing consultancy, and innovating in rural development and allied areas.

The total investment in the share capital of the seven subsidiaries stood at ₹604.7 crore as on 31 March 2024 (Figure 10.8). NABARD received a dividend of ₹7.5 crore from NABKISAN Finance Limited, ₹2.3 crore from NABSAMRUDDHI Finance Limited, ₹10.2 crore from NABFINS Limited, and ₹0.1 crore from NABARD Consultancy Services Private Limited in FY2024.

Figure 10.8: Shareholding in subsidiaries of NABARD (₹ crore)

Note: NABKISAN and NABSAMRUDDHI figures include premium.

10.4.2 Strategic investments and returns

NABARD has strategically invested in equity of companies involved in agriculture and rural development sectors. These investments aim to support institutions that contribute to agricultural and rural development, whether through direct interventions or indirectly by mitigating agriculture risks, facilitating market access, providing essential digital services, upgrading skills, and improving credit accessibility through specialised institutional mechanisms.

Till 31 March 2024, NABARD had invested ₹1,106.2 crore in ten companies operating in the agriculture and rural development space. During FY2024, NABARD received a dividend of ₹23.7 crore from four companies, namely, Small Industries Development Bank of India (20%, ₹10.6 crore), Agriculture Insurance Company of India Limited (20%, ₹12 crore), Multi Commodity Exchange of India Limited (191%, ₹0.7 crore), and Common Service Centres e-Governance Services India Limited (6%, ₹0.3 crore).

Table 10.1: Strategic investments and returns

* Figures include premium.

Note: Components may not add up to total due to rounding off.

10.4.3 Investing in alternate investment funds

NABARD is contributing to Alternate Investment Funds (Securities and Exchange Board of India-registered) to encourage entrepreneurship in existing or new activities for catering to agriculture and rural development, to facilitate development of income-generating sustainable units for replication by rural entrepreneurs, and to promote technological innovations and technology dissemination in agricultural and rural sectors.

As on 31 March 2024, the total commitment by NABARD stood at ₹729 crore in 31 funds vis-à-vis a commitment of ₹634 crore in 25 funds as on 31 March 2023. During FY 2024, NABARD has committed ₹95 crore to 6 funds. An amount of ₹503.3 crore has been disbursed. The funds drew a total of ₹103.2 crore and refunded a capital of ₹15.1 crore during the year with a capital gain of ₹7.1 crore and other income, including a dividend of ₹5.7 crore.

10.4.4 Other initiatives

- A seminar on ‘Harnessing Opportunities: NABARD transforming Agri-Landscape’ was organised on 6 March 2024 at Mumbai to provide a common platform for venture capitalists, industry experts, chief executive officers (CEOs) of incubation centres, agri-start-up founders, and incubatees to discuss the challenges and issues faced by agri-start-ups.

- In order to develop synergies between NABARD operations and functioning of portfolio companies, NABARD, together with NABVENTURES, organised a meet of these companies.

- Towards effective corporate governance in subsidiaries, NABARD organised a workshop on Capacity Building of Nominee Directors/Managing Directors/CEOs of its subsidiaries on 31 July 2023 at National Bank Staff College, Lucknow.

10.5 STRATEGIC INVESTMENT AND MOBILISATION FOR IMPACT AND GROWTH

NABARD has been focusing on financing development activities and maintaining a well-diversified, expanding, and well-performing asset base. Towards sustainable development of rural areas, NABARD has issued social bonds to be used to refinance drinking water project financing. This diversification is a sign of NABARD’s deepening commitment to social and other developmental projects with the aim of transforming India into a developed country by 2047. In the coming years, NABARD expects to further leverage forward-looking investment opportunities in agri-exports, value chain financing, renewable energy, and climate change adaptation, amongst others.

ANNEXE TO CHAPTER 10 PERFORMANCE OF NABARD SUBSIDIARIES IN FY2024

NABFINS

NABFINS Limited (NABFINS) has achieved notable performance metrics in FY2024, with a disbursement of ₹2,723 crore, reflecting a robust growth rate of 48% as compared to FY2023. As of 31 March 2024, the balance sheet size was ₹3,112.4 crore and loan outstanding was ₹3,050 crore. The Profit Before Tax (PBT) stands at ₹191.6 crore for FY2024. The company boasts an active borrower base exceeding 11 lakh. The gross non-performing assets (GNPA) of NABFINS stood at 2.1% at the end of 31 March 2024.

The company expanded its outreach by opening 75 new direct lending branches during FY2024, bringing the total to 402. The geographical footprint of NABFINS expanded significantly with the commencement of operations in Uttar Pradesh, Goa, and Tripura, thereby extending its presence to 19 states.

Since inception, NABFINS has extended its services to more than 28 lakh households with micro credit flow of over ₹13,966 crore at the lowest rate of interest among non-banking financial company–microfinance institutions (NBFC–MFIs). The company operates through two different business models, viz., business and development correspondent model and direct lending model. Additionally, to support other institutions’ effort to reach microfinance borrowers, the company also extends bulk loans under the institutional lending model. Currently, the company has 401 branches and 109 active business correspondent partners.

Major initiatives in FY2024

Initiatives during FY2024 included

- opening three all-women branches in Kerala, Karnataka, Tamil Nadu;

- a pilot project to provide digital healthcare services to borrowers; and

- five projects for skill development of women borrowers with support from NABARD.

Recognition

- NABFINS received the Data Excellence Award for data efficacy from CRIF High Mark, a leading credit information company.

- Government of Tamil Nadu extended its appreciation to NABFINS for corporate social responsibility (CSR)-related initiatives in Namakkal district, Tamil Nadu. As a part of CSR commitments, the company has sanctioned 11 projects worth ₹1.2 crore covering eight states across the nation.

Showcase A10.1: From vision to venture: NABFINS-backed entrepreneurs propel growth

Sulochna Sao, from Chhattisgarh, has embarked on a remarkable entrepreneurial journey in the snack manufacturing sector. With NABFINS support channelled through the joint liability group (JLG) she was a member of, Sulochana steered her enterprise to noteworthy success. Through her unwavering commitment and industriousness, she has not only expanded her enterprise but also fostered local employment opportunities and stimulated economic growth.

Sulochana Sao, a member of JLG from Raigarh, Chhattisgarh

NABKISAN

NABKISAN Finance Limited (NABKISAN), recorded a balance sheet size of ₹2,804.5 crore (under IGAAP),1 with a year-on-year increase of above 30%. The gross loan book outstanding of ₹2,585.7 crore showed a year-on-year growth of about 35%, while the total sanctions and disbursements exceeded the targets set by the Board, reaching ₹1,779 crore and ₹1,732 crore, respectively. As on 31 March 2024, NABKISAN has sanctioned 3,004 loans to farmer producers’ organisations (FPOs) to the tune of ₹779.9 crore. Cumulatively, 1.5 million farmers across 20 states and 3 Union Territories (UTs) have been impacted through NABKISAN.

NABKISAN remains the leading NBFC lender to FPOs under the Government of India’s (GOI’s) Agri Infrastructure Financing (AIF) scheme. During the year, NABKISAN sanctioned 24 loans under AIF worth ₹4.9 crore, including the first drone project to one farmer producers’ company (FPC). With this, NABKISAN has cumulatively sanctioned 102 FPC loans under AIF amounting to ₹15.2 crore. During the year, NABKISAN supported three socially relevant CSR projects worth ₹93 lakh.

As the implementation partner for three FPC financing schemes of the Government of Tamil Nadu, NABKISAN provided financial assistance to the tune of ₹15.5 crore to 143 FPCs during the year. NABKISAN has also signed a memorandum of understanding (MoU) with the World Bank-assisted ‘Tamil Nadu Rural Transformation Project,’ Government of Tamil Nadu, for enabling credit linkage to FPOs promoted and supported under the project. In addition to this, as the implementation partner for the Odisha Credit Guarantee Scheme for FPOs, NABKISAN has extended credit guarantee coverage to 114 FPOs amounting to ₹9.2 crore.

To improve technology orientation of the agriculture sector, NABKISAN has signed an MoU with Villgro Innovations Foundation to provide funding for start-ups incubated by them where Villgro shall provide de-risking capital up to 15%–25% of the loan value. In this context, NABKISAN has sanctioned two loans to agri start-ups to the tune of ₹2 crore. NABKISAN is an Eligible Lending Institution (ELI) under GOI’s Credit Guarantee Scheme for FPO Financing managed by NABSanrakshan. Under the scheme, 619 FPCs were granted credit guarantees during the year amounting to ₹123.4 crore.

NABSAMRUDDHI

NABSAMRUDDHI Finance Limited (NSFL) witnessed record-breaking financial performance during FY2024 with a 60% year-on-year (YoY) growth in the balance sheet to ₹1,855 crore and assets under management to ₹1,804 crore, and a 39% YoY growth in profits after taxes to ₹49 crore, exceeding targets by 18%. The asset quality of the company improved, with GNPA as a percentage of loan outstanding reducing from 0.5% (as on 31 March 2023) to 0.14% (as on 31 March 2024) through collections and expansion in the loan book. The company managed its second successive year of ‘nil’ delinquencies. Disbursement towards focus segments was around 35% of total disbursement during the year. Cumulatively, around ₹350 crore of water, sanitation, and hygiene (WASH) loans were disbursed through 32 partners. Sanction during FY2024 amounted to ₹191 crore, chalking a YOY growth of 100%. NSFL has been able to reach out to more than 3 lakh ultimate beneficiaries in 25 states and 2 UTs cumulatively through NBFCs, NBFC-MFIs, and other institutional clients.

Major initiatives in FY2024

Major initiatives of NSFL during FY2024 are as follows:

- NSFL organised a WASH Summit jointly with Water.org in September 2023 to bring together experts from the WASH and financial sectors to discuss the guidelines, opportunities, and challenges as well as environmental, social, and governance aspects of climate-ready WASH lending.

- Further, NSFL co-sponsored the Sa-Dhan National Conference on Inclusive Growth, held on 8 and 9 November 2023, and instituted a WASH finance panel session, which was the first of its kind. During the event, NSFL’s pioneering Climate Ready WASH funding programme was launched by Chairman, NABARD, Shaji K.V. The pilot programme is supported by special concessional refinance from NABARD and technical support from knowledge partners such as Sa-dhan, Water.org, and FINISH Mondial, among others.

- NSFL signed an MoU for collaborating with FINISH Mondial through Trust of People for promoting climate-resilient WASH lending.

- With grant support from NABARD, NSFL, in collaboration with Trust of People, has launched a Climate Ready WASH Awareness Campaign under its pilot programme for rural borrowers of MFIs in climate vulnerable districts spread over 7 states, starting from 22 March 2024.

- Further, an MoU was also signed with Climate Policy Initiative on World Water Day to take forward climate financing.

- During the year, NSFL supported three CSR projects amounting to ₹69.02 lakh for WASH segment and education and skill development.

Recognition

NSFL has emerged as an ecosystem builder in WASH funding, being the

- largest wholesale debt provider for Sustainable Development Goal 6 among home-grown NBFCs,

- largest wholesale debt funder for last-mile WASH,

- pioneer in climate ready WASH funding, and

- only home-grown wholesale debt provider covering all sectors (microfinance, micro-, small-,and medium-sized enterprises [MSMEs], and affordable/rural housing) and the entire risk rating spectra (including unrated NBFCs, non-profits, and trusts) under WASH.

In recognition, NSFL was awarded the Sa-Dhan Water.org ‘Water and Sanitation Financing Award, 2023’ under the capital providers category for the second time in a row.

Showcase A10.2: Micro loans, macro change

Karmina Bibi, like many others in her community, previously lacked access to proper water, sanitation, and hygiene (WASH) facilities, leading to health risks and discomfort. When NABSAMRUDDHI gave a concessional loan to Grameen Shakti Microfinance, the first unrated entity in its WASH portfolio, the latter provided a loan to Karmina for building a new toilet. The toilet not only improved her family’s hygiene practices but also enhanced their overall well-being and dignity.

Karmina Bibi, next to her newly constructed toilet

NABCONS

In FY2024, NABARD Consultancy Services Private Limited (NABCONS) witnessed an increase of 63% in its revenues over the previous year, reaching ₹231.8 crore.

As the preferred consulting partner for both central and state governments, NABCONS actively contributes to flagship programmes, such as Jal Jeevan Mission and Atal Bhujal Yojana.

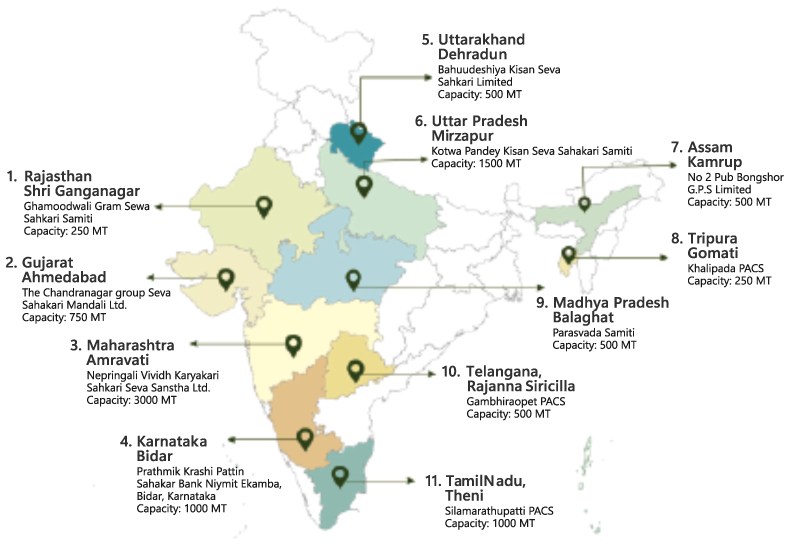

In FY2024, NABCONS expanded its product offering by providing services under the engineering, procurement, and construction domains. NABCONS was awarded the project of construction of warehouses/silos/processing centres/common hiring centres at multiple primary agriculture cooperative societies under GOI’s World’s Largest Grain Storage Plan in Cooperative Sector. NABCONS successfully completed the construction of 11 warehouses in 11 states as a part of GOI’s vision of Sahakar se Samridhi (Cooperation for Prosperity) (Box A10.1).

Other major NABCONS assignments in FY2024 included:

- Carbon credit framework for the small holder farmers in Goa and Karnataka

- Project management consultants under Jal Jeevan Mission in Maharashtra and Karnataka

- Third Party Inspection Agency under Jal Jeevan Mission in Maharashtra, Rajasthan, and Madhya Pradesh

- Preparation of detailed project reports (DPRs) under Jal Jeevan Mission in 5 states, namely, Rajasthan, West Bengal, Karnataka, Assam, and Odisha

- Preparation of DPR under Atal Mission for Rejuvenation and Urban Transformation 2.0 in West Bengal

Box A10.1: NABCONS pilots the construction of warehouses under WLGSP

The World’s Largest Grain Storage Plan (WLGSP) in the Cooperative Sector is an ambitious initiative launched by the Ministry of Cooperation, Government of India in May 2023. The goal of the plan is to address the shortage of grain storage facilities in the country and strengthen India’s food security. Under the plan, storage capacity of 700 lakh metric tonnes would be created over the next 5 years at an estimated cost of ₹1.25 lakh crore. By establishing storage facilities at the level of primary agricultural credit societies (PACS), the government aims for a decentralised storage network.

To ensure time-bound and uniform implementation of the plan in a professional manner, Ministry of Cooperation entrusted NABCONS with constructing 11 warehouses/processing centres/custom hiring centres at 11 primary agriculture cooperative societies in 11 states, along with undertaking feasibility studies on site, preparation of detailed project reports, and providing project management consultancy. For implementation of the pilot, NABCONS collaborated with NABARD, National Cooperative Development Corporation, Food Corporation of India, Central Warehousing Corporation, and National Buildings Construction Corporation.

With an expert team of in-house consultants and specialised partner agencies, NABCONS successfully completed the construction of 11 warehouses within the stipulated timeline and entered the engineering, procurement, and construction sector with this pioneering step. On 24 February 2024, the Prime Minister of India inaugurated these warehouses at Bharat Mandapam in New Delhi and dedicated these warehouses to the farmers of the country (Figure BA10.1).

Figure BA10.1: PACS warehouses by state under WLGSP (capacity in metric tonne)

- Project design and management consultants for various infrastructure projects under Sanitation Water and Community Health (SWACH) project, Rajasthan

- Preparation of a strategic investment plan under the Raising and Accelerating MSME Productivity scheme in Uttar Pradesh

- Setting up a project management unit for monitoring, coordination, and assisting in implementation of Agri-Rural and Gangey Gram Rural Tourism Projects in Uttar Pradesh

- Establishment of an integrated agriculture data hub and digital farmer services platform for agriculture in Kerala under the Digital Agriculture Mission 2021–25 of the GOI

- End-to-end study of operations of the Warehousing Authority of India to review pain points in the growth of eNWR-based pledge financing2

- Survey and investigation of Shahdara drain for rejuvenation and conservation under Namami Gangey Mission using soil biotechnology and nature-based treatment

- Monitoring and evaluation of works under Himachal Pradesh State Compensatory Afforestation Fund Management and Planning Authority which were carried out during FY2017–FY2021

- Social impact assessment study of CSR programmes/activities completed in FY2021 undertaken by Satluj Jal Vidyut Nigam

NABVENTURES

NABVENTURES Fund-I (“the Fund”) is the maiden flagship fund of NABVENTURES Limited with a pooled corpus of ₹598 crore. NABARD, as an anchor investor, has committed ₹228 crore to the Fund, while NABVENTURES, as sponsor, has committed ₹25 crore. It is a sector-focused fund that invests in agri-tech, food-tech, agri/rural fintech, and rural tech businesses at an early to mid-stage. It drives transformation in these industries by providing strategic and operational insights, patient capital, and access to NABARD’s extensive network. For FY2024, the Fund has made fresh investment commitments of ₹62 crore. The Fund focused on supporting its portfolio start-ups through follow-on investments.

The cumulative drawdown commitments called since inception until 31 March 2024 amount to ₹365.7 crore, representing 61% of the total corpus of ₹598 crore. The cumulative investment sanctioned since inception until 31 March 2024 amount to ₹320 crore, representing 60% of the deployable corpus.

The investee companies have delivered the following outcomes to the agri and rural ecosystem:

- Jai Kisan has facilitated loans worth ₹3,000 crore in the food and agri-business value chain across 11 states.

- Krishitantra enabled rapid soil testing for over 1 lakh farmers, and the company is an approved partner for the digital soil health card scheme of the GOI.

- Vilcart linked 90,000+ rural kirana stores in 23,000 villages across 67 districts in four states through a technology platform.

- Unnati connected 17.2 lakh farmers through a network of 83,569 outlets in 181 districts for farm inputs and output aggregation.

- An app developed by Satyukt provides customised crop advisory for 80-plus crops covering an area of 4 lakh acres through 200 partners based on real-time satellite and weather forecasts; with technology used in 19 countries, including India.

- Digitalisation for Rural Empowerment in Agriculture Marketplace: The project aims at promoting digital transactions at mandis among farmers, traders, and intermediaries to streamline trading operations and make them hassle-free. This also helps promote financial literacy among these stakeholders.

- Click Rameswaram: The project is an attempt to improve the livelihood of local artisans, SHGs, and youth through the digital promotion of tourism. The project envisages geotagging of more than 1,000 points of interest in the area, creating QR codes and placing them in prominent locations, and creating a digital coffee table book for hosting on various websites.

- Productivity enhancement through improvement in animal healthcare and fodder quality: The project aims to create awareness in the local community regarding animal healthcare practices and disease prevention, livestock management, etc.

- Construction of school toilets: As a part of WASH initiative, a toilet block is being constructed at GHP School, Birur, Chikkamagaluru with CSR funds from NABFINS. This sanitation facility will not only provide clean and safe environment for the students and staff, but also help reduce the dropout rate of girl students.

- Empowering the transgender community through entrepreneurial support: The project aims at creating livelihood opportunities for the transgender community in Tirupur, Tamil Nadu. As part of the project, NABVENTURES is supporting a group of transgender persons to start a mobile bakery unit-cum-cafeteria.

- Strengthening educational facilities in Zilla Parishad School: The project aims to enhance the educational facilities at Z.P. Higher Primary School in Palghar, Maharashtra, catering to the needs of the tribal community. The school lacks basic infrastructure such as electricity, clean drinking water, proper sanitation, and digital learning resources. With the support of NABSanrakshan’s CSR initiative, the project will address these issues and create a conducive learning environment for the 135 students from poor tribal families.

- Yatri Eco-Sanitation and Hygiene in Dhanushkodi, Tamil Nadu: The project, jointly funded by NABKISAN, NABFINS, and NABFOUNDATION, is an attempt to create clean and environmentally sustainable sanitation facilities in the eco-fragile zone of Dhanushkodi. The project aims at creating livelihood opportunities for the SHGs through portable sanitation on a ‘pay and use’ basis. The project also includes a mobile cafeteria which will bring in additional income for the SHG members.

- Restoring Irrigation Tanks for Augmenting Surface Water and to sustain climate resilience through people institutions (ReASSURE): The aim of the project is to build social capital for promoting community ownership towards water commons and rehabilitating irrigation tank cascades and strengthening tank-based livelihood through promotion of water users’ associations. The project also involves restoration of five irrigation tanks.

- Kuposhan Se Bachav: The project aims at fighting malnutrition in the backward region of Jashpur in Chhattisgarh. It encompasses medical health and awareness camps; distribution of calcium, vitamin, iron, and other essential medicines; promotion of kitchen gardens; and distribution of plants bearing nutrition-rich fruits and vegetables.

- School Soil Health Programme: A GOI programme aimed at creating awareness and inculcating interest in agriculture at a very young age, the project aims at installing Mini Soil Health Labs in 1,000 government schools across the country. Students will be trained on how to test soil on prescribed parameters. Farmers can get their soil tested in these labs as well

- Ujjwal Bhavishya Ki Or: This project envisages the renovation of two government schools in Allahabad with the construction of toilets, hand wash area, repair of classrooms, electric fittings, kitchen area, midday meal hall, supply of water coolers, benches and fans in classrooms, etc. The project is fully funded by the Indian Oil Adani Gas Pvt. Ltd under their CSR obligations.

- IGAAP = Indian Generally Accepted Accounting Principles.

- NWR = Negotiable Warehouse Receipts.

NABSANRAKSHAN

NABSanrakshan Trustee Private Limited (NABSanrakshan), the youngest subsidiary of NABARD, was incorporated in November 2020 as a trustee company to manage credit guarantee funds to promote the flow of finance to desired sectors, thereby contributing towards sustainable and equitable agriculture and rural development. Currently, NABSanrakshan is managing two credit guarantee fund trusts: Credit Guarantee Fund Trust for Farmer Producers’ Organisations (FPO Trust) and Credit Guarantee Fund Trust for Animal Husbandry and Dairying (AHD Trust).

In FY2024, the company focused on creating awareness of the scheme by conducting numerous capacity-building workshops at banks and regional offices, and onboarding ELIs thereby increasing the coverage of credit guarantee schemes.

With the continuous support of GOI and NABARD, as on 31 March 2024, 94 ELIs, have been registered under the FPO Trust and 55 ELIs have been registered under the AHD Trust.

As on 31 March 2024, a cumulative of 1,876 credit guarantees have been issued, providing a coverage of ₹337 crore for total loan amount of ₹401.4 crore availed by 1,479 FPOs having 13.7 lakh farmers across 23 states, resulting in a 138% growth in terms of guarantees issued. All the new credit guarantees have been issued through the Credit Guarantee Portal, resulting in seamless processing, thereby reducing turnaround time. The Credit Guarantee Scheme Guidelines under the FPO Trust have now been extended to include NBFCs (BBB and above).

Under the AHD Trust, five credit guarantees have been issued covering a total loan size of ₹88.6 crore and guarantee cover of ₹22.2 crore, cumulatively. Traction under the AHD Trust was low because the Animal Husbandry Infrastructure Development Fund (AHIDF) was under implementation only till FY2023. Recently, the AHIDF Scheme has been extended till FY2026 and has also subsumed Dairy Processing Infrastructure Development Fund. Under the revised scheme, ELIs have been expanded to include National Cooperative Development Corporation, NABARD, and National Dairy Development Board. Credit guarantee benefits will now be extended to dairy cooperatives in addition to MSMEs.

NABSanrakshan has been given in-principle approval to manage and implement the Partial Credit Guarantee Scheme for rubber, coffee, and cardamom plantations under the Kerala Climate Resilient Agri Value Chain Modernization Project with NABSanrakshan as the Trustee and Government of Kerala as the Settlor. This will be the first state credit guarantee fund under the management of NABSanrakshan.

Government of India has approved extension of Fisheries Infrastructure Development Fund to FY2026, wherein credit guarantee facility to the projects of entrepreneurs, individual farmers, and cooperatives from the existing credit guarantee fund of the Infrastructure Development Fund of the Department of Animal Husbandry and Dairying will also be provided through NABSanrakshan.

NABFOUNDATION

NABFOUNDATION, as a catalyst for development, ventured into areas like livelihood generation, sustainable agriculture and rural development, natural resource management, gender sensitisation, skill and capacity development, drinking water, health, education, sanitation, tourism, financial inclusion through digitisation, etc. During the year, NABFOUNDATION received sanction for 31 projects with a total financial outlay of ₹18.3 crore from NABARD, subsidiaries of NABARD, and other corporates.

The projects under implementation have directly benefited more than 1,000 rural families including 32 self-help groups (SHGs), 80 producer companies, 35 artisans, and more than 500 tribal families across 116 districts, including 18 aspirational districts, states in the north-east, and Union Territory of Ladakh.

New projects taken up during the year are as follows:

In addition, projects like drinking water supply in tribal villages, information and communication technology lab for children with disabilities, school infrastructure development and ‘My Pad | My Right’ projects were taken up during FY2024.

NOTES

© 2024 NABARD All Rights Reserved

Designed & Developed by RDX Digital