- 1. India and the World: The Economy in FY2024

- 2. Cooperatives: Tackling Challenges, Building Opportunities

- 3. Investing in a Sustainable Tomorrow

- 4. Towards Inclusive Development

- 5. Financing Rural Infrastructure for Sustainable Development

- 6. Credit Planning and Delivery for Financial Inclusion

- 7. Supervisory Role of NABARD

- 8. Empowering Rural Financial Institutions

- 9. People—Processes and Policies

- 10. Leveraging Finance for Growth

- Success Stories

- Board of Directors as on 31 March 2024 (PDF)

- Principal Officers (PDF)

- Corporate Governance (PDF)

- Annual Accounts 2023–24 (PDF)

- E-Mail Addresses of HODs and Subsidiaries at Mumbai (PDF)

- Regional Offices/Cells/Training Establishments/Subsidiaries (PDF)

- Annual Report 2023-24 (PDF)

- Home

- Board of Directors as on 31 March 2024 (PDF)

- Principal Officers (PDF)

- 1. India and the World: The Economy in FY2024

- 2. Cooperatives: Tackling Challenges, Building Opportunities

- 3. Investing in a Sustainable Tomorrow

- 4. Towards Inclusive Development

- 5. Financing Rural Infrastructure for Sustainable Development

- 6. Credit Planning and Delivery for Financial Inclusion

- 7. Supervisory Role of NABARD

- 8. Empowering Rural Financial Institutions

- 9. People—Processes and Policies

- 10. Leveraging Finance for Growth

- Success Stories

- Corporate Governance (PDF)

- Annual Accounts 2023–24 (PDF)

- E-Mail Addresses of HODs and Subsidiaries at Mumbai (PDF)

- Regional Offices/Cells/Training Establishments/Subsidiaries (PDF)

- Annual Report 2023-24 (PDF)

While promoting rural prosperity is central to NABARD’s vision, its mission emphasises institutional development as one of the key pathways towards realising this vision. NABARD has been mandated to strengthen three sets of rural financial institutions (RFIs), viz., short-term credit cooperatives, long-term credit cooperatives, and regional rural banks (RRBs). Each set has a specific mandate tailored to meet the diverse and escalating credit needs of rural communities. These institutions are crucial for rural financial inclusion given their extensive outreach, local feel and connect, and commitment to grassroots development. Needless to mention, only financially strong RFIs can achieve the avowed objective of rural prosperity through efficient financial services.

It is against this backdrop that NABARD is committed to strengthening these institutions through a range of financial, developmental, and supervisory measures, including policy advocacy and concessional refinance among others. NABARD’s developmental initiatives target all the critical areas required to make the RFIs strong and vibrant—improving governance, technology adoption, business diversification, product innovation, internal control system, capacity building, etc. NABARD also undertakes periodic reviews of RFI performance and their mandated supervision.

8.1 SHORT-TERM RURAL CREDIT COOPERATIVES

A cooperative is a financial entity owned and operated by its members who are both customers and shareholders. Cooperatives are often created by the local community with a sense of collective ownership for deriving mutual socioeconomic benefits. The short-term cooperative credit structure (STCCS) consists of state cooperative banks (StCBs) at the state/apex level, district central cooperative banks (DCCBs) at the district level, and primary agriculture credit societies (PACS) at the village level. The initial role of STCCS of providing short-term crop loans to farmers through PACS has since been widened to cover the non-farm sector; term lending to allied sectors; rural housing; micro-, small-, and medium-sized enterprises (MSMEs); microfinance; etc. Thus, the STCCS, rooted in the principles of equality, democracy, and mutual support, has been serving the rural community, especially farmers, through institutional credit.

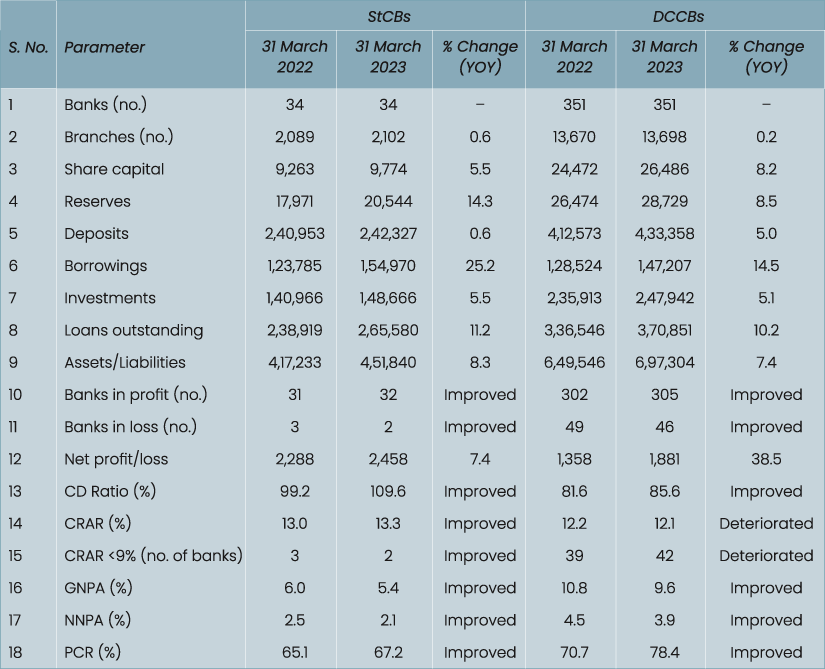

In FY2023, consolidated financial performance of StCBs and DCCBs improved in terms of capital adequacy, asset quality, and profitability. During FY2023, only two StCBs (namely, Arunachal Pradesh and Jammu & Kashmir [J&K]) reported a capital-to-risk (weighted) assets ratio (CRAR) less than the regulatory requirement. As on 31 March 2023, 29 DCCBs had negative CRAR and 38 of the 42 DCCBs with CRAR less than 9% were concentrated in five states/Union Territories (UTs): Madhya Pradesh (15 of 38 DCCBs), Uttar Pradesh (11 of 50 DCCBs), Bihar (5 of 23 DCCBs), Maharashtra (4 of 31 DCCBs), and J&K (3 of 3 DCCBs).

The consolidated net profit of StCBs increased by 7.4% during FY2023. Of the 34 StCBs, 21 reported increased profit in FY2023 over FY2022. The consolidated net profit of DCCBs increased by 38.5% during FY2023. The number of loss-making DCCBs decreased from 49 to 46.

The consolidated share of gross non-performing assets (GNPA) of StCBs and DCCBs has steadily declined over the past 3 years. Of the 34 StCBs, 26 reported lower GNPA (%) than last year. The share of DCCB’s GNPA also declined from 11.5% (31 March 2021) to 9.6% (31 March 2023). The consolidated GNPA of DCCBs declined in 13 of 20 states/UTs during FY2023.

The growth in business was subdued in comparison to that of the scheduled commercial banks (SCBs). During FY2023, StCBs and DCCBs relied more on borrowings for their incremental lending. The financial performance of StCBs and DCCBs is summarised in Appendix Table A8.1.

8.2 LONG-TERM RURAL CREDIT COOPERATIVES

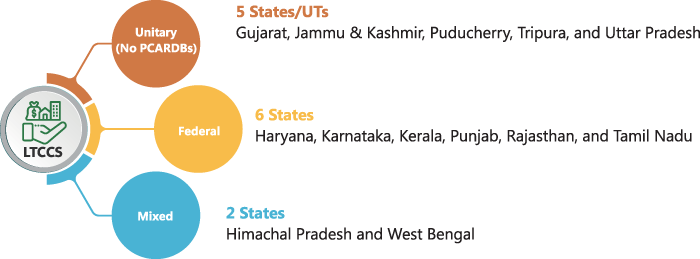

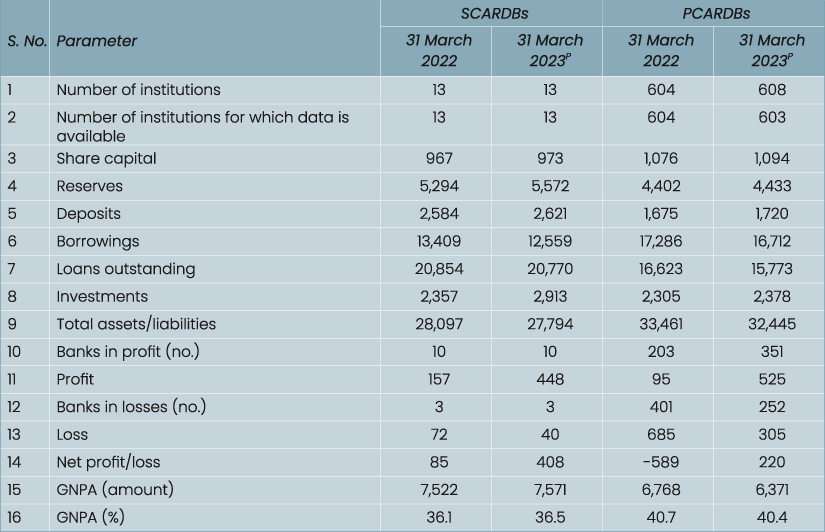

The long-term cooperative credit structure (LTCCS) caters to the long-term credit needs of farmers and contributes to creating capital assets in the agriculture, allied, and off-farm sectors. It consists of state cooperative agriculture and rural development banks (SCARDBs) (at the apex) and primary cooperative agriculture and rural development banks (PCARDBs) (at the district/taluka level in some states) (Figure 8.1). As the agriculture and rural development banks (ARDBs) are not under the purview of the Banking Regulation Act, 1949, they cannot mobilise deposits which are repayable on demand from non-members and the deposits do not enjoy the coverage of Deposit Insurance and Credit Guarantee Corporation.

Figure 8.1: Long-term cooperative structure

LTCCS = Long-Term Cooperative Credit Structure, PCARDB = Primary Cooperative Agriculture and Rural Development Bank, UT = Union Territory.

As on 31 March 2023, deposits of SCARDBs accounted for just 9.4% of the total liabilities, as compared to the 80% share of deposits for RRBs, 54% share for StCBs, and 62% share for DCCBs. In view of the limitations applicable on SCARDBs for mobilising deposits, they are heavily reliant on borrowings to meet their lending requirements. Borrowings accounted for 45.2% of the total liabilities of SCARDBs, as on 31 March 2023 and borrowings from NABARD accounted for 83.6% of the total borrowings. An overview of the financial position of SCARDBs and PCARDBs is provided in Appendix Table A8.2.

8.3 IMPORTANT DEVELOPMENTS IN THE COOPERATIVE SECTOR

8.3.1 Centrally sponsored scheme for the computerisation of PACS

NABARD is implementing the centrally sponsored scheme for the computerisation of about 63,000 functional PACS over a period of 5 years with a total budget outlay of ₹2,516 crore; in FY2024, additional 4,000 PACS have been sanctioned by the Ministry of Cooperation, Government of India (GOI).1

The project is an effort towards providing requisite computer hardware and peripherals together with ERP-based common software2 to enable PACS to capture records of all credit and non-credit operations digitally and seamlessly in an efficient and transparent manner. The project comprises of development of cloud-based common software with cyber security, uploading and building a national-level data repository, training, and other support services. This initiative will pave the way for seamless integration of PACS with the Core Banking Solutions of DCCBs and StCBs. Computerisation will facilitate the realisation of PACS’ true potential by transforming them into multi-service centres (MSCs) to offer an array of products and services, covering the entire gamut of rural livelihood activities.

On 24 February 2024, 18,000 digitised PACS were formally inaugurated by the Prime Minister of India at Bharat Mandapam, New Delhi.

8.3.2 Launch of ARDB computerisation project

The Union Minister of Cooperation launched the project for computerisation of ARDBs on 30 January 2024 in the national conference and workshop organised on ‘Computerisation of Offices of Registrars of Cooperatives of all the States/Union Territories and Agriculture & Rural Development Banks’ at New Delhi. NABARD is the implementing agency for the computerisation of 1,851 units of ARDBs of 11 states and 2 Union Territories. As on 31 March 2024, sanction letters have been issued to 8 states by the Ministry of Cooperation for computerisation of 899 units.

8.3.3 Other developments

- Project on ‘Cooperation amongst Cooperatives’ (details in Section 2.7.1)

- PACS as Common Service Centres (CSCs) for better access to e-services (details in Section 2.6)

- Study on Reforms, Restructuring and Innovations in ARDBs (details in Section 2.6)

- National Conference on Best Practices in Rural Cooperative Banks (details in Section 2.7.3)

- Fintech workshop for rural cooperative banks (RCBs) (details in Section 2.7.4)

8.4 COOPERATIVE DEVELOPMENT FUND

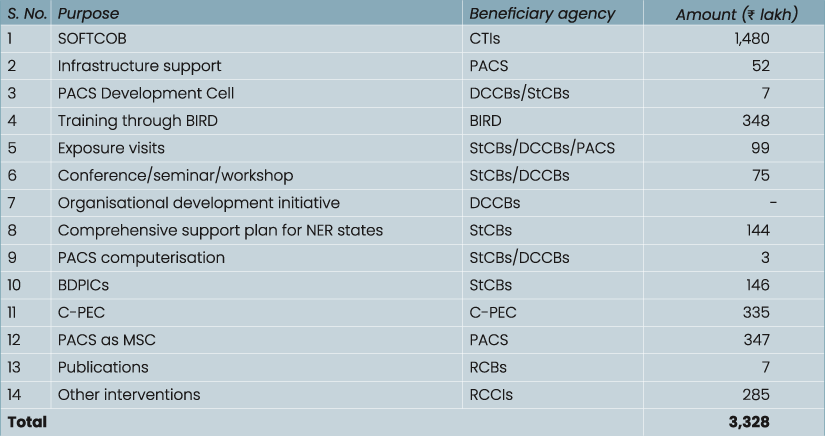

The Cooperative Development Fund (CDF) was established by NABARD in FY1993 with an initial corpus of ₹10 crore, which has been augmented periodically through contribution from NABARD’s annual profit.

Under the scheme, NABARD established the Centre for Professional Excellence in Cooperatives at Bankers Institute of Rural Development (BIRD), Lucknow to improve quality of training systems and formulate policies that foster professionalism and quality human resources of STCCS. The fund is also utilised for programmes conducted by the training establishments of NABARD (BIRD centres at Lucknow, Mangaluru, and Kolkata).

As of 31 March 2024, a cumulative amount of ₹326.9 crore has been disbursed from CDF since inception. The balance of the corpus fund as on 1 April 2024, after replenishment and appropriation, is ₹200 crore. Appendix Table A8.3 presents information on grant support to cooperatives from CDF in FY2024.

Key outcome indicators under CDF as on 31 March 2024 are listed below:

- Major assistance of CDF goes to cooperative training institutions under the Scheme of Financial Assistance for Training of Cooperative Banks Personnel (SOFTCOB). An amount of ₹1,480 lakh was utilised for conducting the training programmes under SOFTCOB during FY2024.

- NABARD introduced a scheme in 2021 to support the setting up of Business Diversification and Product Innovation Cells (BDPICs) in StCBs. There are 21 BDPICs in operation for which ₹13.9 crore has been sanctioned till 31 March 2024.

- Under the scheme for transformation of PACS as multi-service centres, PACS can avail assistance on a reimbursement basis for accompanying measures like project preparation, exposure visits, capacity building of PACS functionaries, documentation, technology adoption, etc.

- Towards the implementation of the centrally sponsored project on the computerisation of PACS, NABARD’s share of ₹252 crore is to be utilised from the CDF for the development and maintenance of National Level PACS Software (₹236.5 crore) and training of stakeholders (₹15.5 crore).

- Comprehensive Support Plan for North-Eastern States (including Sikkim), Andaman & Nicobar Islands, and J&K is available for various capacity-building efforts and infrastructural support. All the states except Assam have been sanctioned grant support of up to ₹100 lakh each. An amount of ₹870.1 lakh has been sanctioned to these StCBs as on 31 March 2024.

8.5 REGIONAL RURAL BANKS

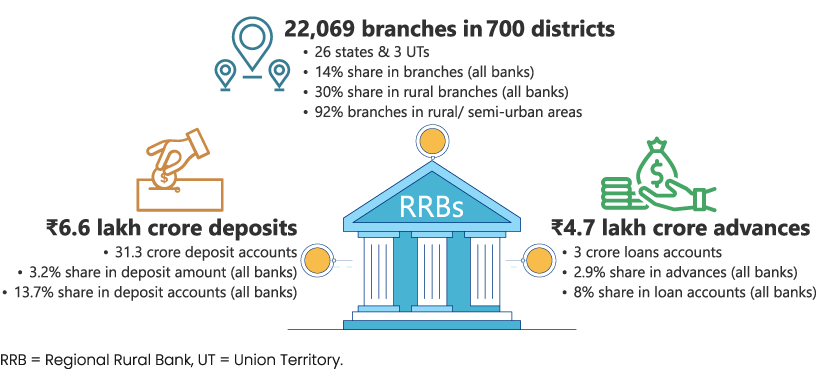

Regional rural banks (RRBs) were established to secure credit flow to small and marginal farmers, agricultural labourers, artisans, and weaker sections of society. As on 31 March 2024, there were 43 RRBs (sponsored by 12 SCBs) with 22,069 branches with operations extending to 31.3 crore deposit accounts and 3 crore loan accounts in 26 states and 3 UTs (Puducherry, Jammu & Kashmir, Ladakh) (Figure 8.2).3

Figure 8.2: Regional rural banks as on 31 March 2024

8.5.1 Unprecedented capital support for RRBs

The government took a landmark decision to sanction ₹10,890 crore of recapitalisation assistance to RRBs during FY2022 and FY2023. This compares exceptionally well with the total capital infusion of ₹8,393 crore by all stakeholders from 1975 till 2021.

In FY2022, an amount of ₹8,168 crore (GOI share: ₹4,084 crore) was sanctioned as recapitalisation assistance to 22 RRBs. These RRBs received the entire amount of recapitalisation assistance sanctioned by 31 March 2023 from all stakeholders.

In the last week of FY2023, an amount of ₹ 2,722 crore (GOI share: ₹ 1,361 crore) was sanctioned as recapitalisation assistance to 22 RRBs.

- As on 31 March 2024, these 22 RRBs have received the entire amount of recapitalisation assistance from sponsor banks and state governments.

- Of the 22 RRBs, 19 have received the entire GOI share amounting to ₹1,097.1 crore.

- Out of the remaining, two in Uttar Pradesh received the proportionate share of the state government in February 2024. Consequently, they received a portion of the GOI share amounting to ₹3 crore against the sanctioned amount of ₹198.6 crore.

- Government of Kerala released their proportionate share in March 2024 and the GOI share is awaited by Kerala Gramin Bank.

The recapitalisation scheme is accompanied by operational and governance reforms under the broad ambit of the Sustainable Viability Plan to transform RRBs. All RRBs had rolled out a 3-year Board-approved viability plan in FY2023 with a well-defined implementation mechanism aimed at credit expansion, business diversification, NPA reduction, cost rationalisation, technology adoption, corporate governance improvement, etc.

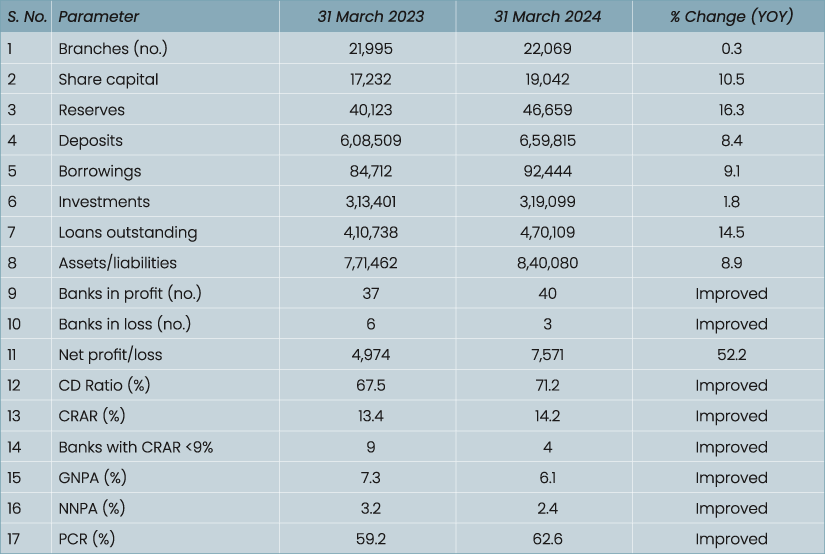

8.5.2 Performance and financial health indicators of RRBs

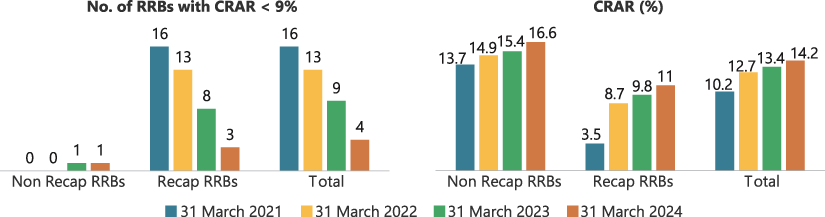

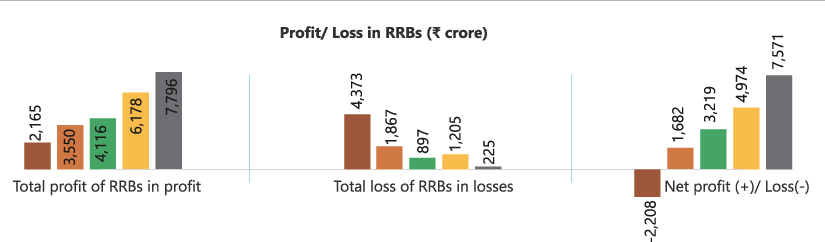

Consequent upon the recapitalisation assistance of RRBs and the roll out of the viability plan, the performance of RRBs at a consolidated level has improved significantly during FY2024 and has reached historic highs on all fronts.

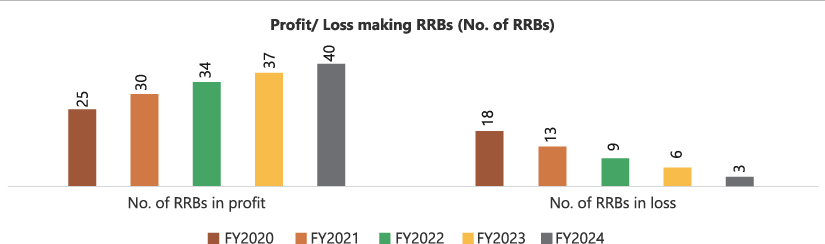

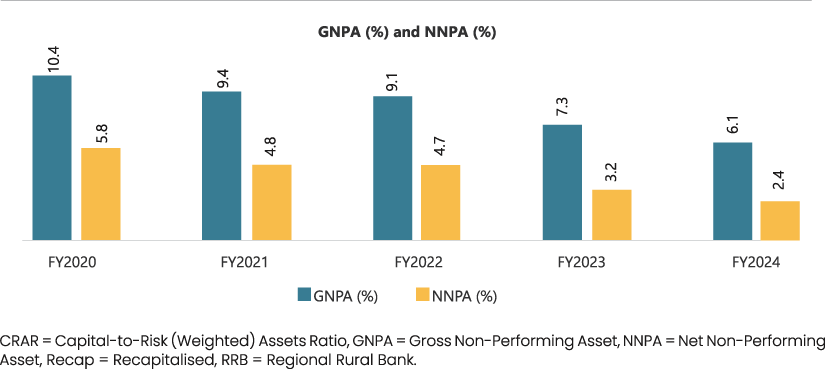

The consolidated net profit was ₹7,571 crore during FY2024 and the consolidated CRAR was at an all-time high of 14.2% as on 31 March 2024. Asset quality measured by GNPA stood at 6.1%, lowest in the last 10 years. Credit expansion led to an increase in consolidated credit to deposit ratio to 71.2%, the highest in 33 years. The pace of technology adoption increased as more RRBs started rolling out digital services to their customers. Share of RRBs in the implementation of flagship financial inclusion schemes of GOI also increased during FY2024.

The number of loss-making RRBs has steadily declined from 18 in FY2020 to 3 in FY2024. Of the 37 RRBs which posted profit in FY2023 (previous year), the net profit of 32 RRBs increased during FY2024. It is notable that in FY2024, four RRBs (of six loss-making RRBs in FY2023) turned profit making after many years of losses, namely Dakshin Bihar Gramin Bank (after 6 years), J&K Gramin Bank (after 4 years), Paschim Banga Gramin Bank (after 4 years) and Assam Gramin Vikash Bank (in losses since FY2019 barring nominal profit in FY2022). However, there are two RRBs, Ellaquai Dehati Bank in J&K and Manipur Rural Bank, which continue to be in losses due to operational difficulties on account of curfew/disturbances.

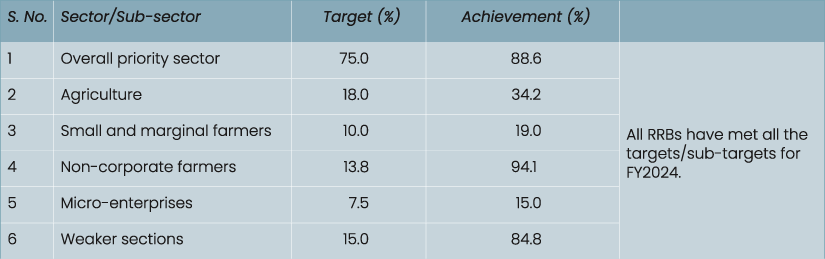

Consolidated GNPA reduced in both absolute and percentage terms. GNPA (%) reduced in 38 of the 43 RRBs during FY2024. All RRBs met all the regulatory targets/sub-targets stipulated by the RBI under Priority Sector Lending (PSL) guidelines during FY2024. The improvement in performance is depicted in Figure 8.3. Key performance indicators are summarised in Appendix Table A8.4. The performance of RRBs in terms of achievement of PSL targets in FY2024 is presented in Appendix Table A8.5.

RRBs play an important role in implementation of the flagship financial inclusion schemes of GOI, viz., Pradhan Mantri Jan Dhan Yojana (PMJDY), Pradhan Mantri Suraksha Bima Yojana, Pradhan Mantri Jeevan Jyoti Bima Yojana, and Atal Pension Yojana. Though RRBs account for only 3% in the total business share of all SCBs, their share in the implementation of these schemes ranges from 16% to 19%. Their share has further increased during FY2024 due to higher growth in enrolments. It may also be pertinent to mention that RRBs have the highest average deposit amount per account in PMJDY accounts amongst all categories of banks (₹4,292 per account in RRBs vis-àvis ₹4,040 per account for other banks).

Figure 8.3: Improvement in performance of RRBs

only 3% in the total business share of all SCBs, their share in the implementation of these schemes ranges from 16% to 19%. Their share has further increased during FY2024 due to higher growth in enrolments. It may also be pertinent to mention that RRBs have the highest average deposit amount per account in PMJDY accounts amongst all categories of banks (₹4,292 per account in RRBs vis-àvis ₹4,040 per account for other banks).

8.5.3 Thrust on technology upgrade in RRBs

The Union Minister of Finance chaired meetings in different regions of the country to review the functioning of RRBs, with a special focus on technology upgrade of the RRBs (Figure 8.4). Emphasis is being laid on:

- rolling out of 14 customer-centric digital services in RRBs, such as, internet banking, mobile banking, unified payment interface (UPI), call centre facility, account aggregator framework, video know-your-customer (KYC), Bharat Bill Payment Service, etc., for improving rural banking service delivery;

- implementation of eight bank-centric digital upgrades in the RRBs like CBS upgrade, loan origination system, NPA management module, HRMS module, etc., for enhancing efficiency in operations.4

Figure 8.4: RRBs offering different digital services (number)

8.5.4 Important developments in the context of RRBs

RRBs as member lending institutions of Credit Guarantee Fund Scheme for Education Loans

To address the issue of the declining loan portfolio of RRBs under priority sector loans to education, the Ministry of Education, vide gazette notification dated 18 April 2023, has included RRBs which are members of Indian Banks’ Association as eligible member lending institutions of the Credit Guarantee Fund Scheme for Education Loans administered by National Credit Guarantee Trustee Company Ltd.

Increase in ceiling of guarantee under Credit Guarantee Fund Trust for Micro and Small Enterprises

The Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), vide notification dated 15 December 2023, has increased the ceiling of guarantee for RRBs from ₹50 lakh to ₹2 crore for all guarantees approved on or after 1 January 2024.

Committee in respect of recruitment, promotion, and outsourcing in RRBs, appointment of the Chair and officers of sponsor banks on deputation to RRBs

The committee was headed by Chairman NABARD, Shaji K.V., with terms of reference to review the recommendations of the Mitra Committee as also the extant guidelines and make suitable recommendations on recruitment, transfer, appointment of chairperson, etc. The report of the committee has been submitted to the Department of Financial Services, GOI on 6 November 2023.

Review of instructions on bulk deposits

The RBI, vide notification dated 26 October 2023, has enhanced the bulk deposit limit for RRBs to ₹1 crore. Previously, single rupee term deposits of ₹15 lakh or more were categorised for RRBs as ‘bulk deposits’.

RRBs in Focus5

The mechanism of ‘RRBs in Focus’ serves as a signal of caution to the RRBs to initiate remedial measures to avoid further deterioration of financials and slippage into the ‘Prompt Corrective Action’ framework. NABARD provides continuous guidance and technical assistance to ‘RRBs in Focus’ in addition to other types of assistance. Based on the audited financial position as on 31 March 2023, there were 15 RRBs classified as ‘RRBs in Focus’ during FY2024 (as opposed to 16 in FY2023). The performance of Madhya Pradesh Gramin Bank (in focus in FY2023) improved and it came out of the ‘in focus’ list in FY2024. Of the 16 RRBs ‘in focus’ during FY2023, CRAR improved in 11, GNPA in all 16, and profitability measured by return on assets improved in 10 RRBs.

Workshops/seminars for capacity building of RRBs

A symposium on ‘Strengthening financial sustainability and operational viability of RRBs’ was organised in coordination with the College of Agricultural Banking, Pune for chairpersons of all RRBs on 11–12 May 2023.

A workshop on ‘Convergence/Awareness of GOI Policies on MSME Lending’ was organised on 4 January 2024. Sessions on GOI Schemes for MSMEs, credit guarantee schemes of CGTMSE, and best practices in MSME lending were handled by distinguished speakers from the Ministry of Micro, Small and Medium Enterprises, GOI, NABARD, CGTMSE, and RRB chairpersons.

A workshop on the topic ‘Leveraging Account Aggregator (AA) Framework for Business Growth’ was organised on 15 March 2024 for chairpersons of RRBs to present strategies for acquiring high-value customers through the AA framework. Experts from the AA industry presented live examples and case scenarios for the benefit of RRBs.

8.6 ROADMAP FOR RFIs

To propel the cooperative sector into a new era of efficiency and modernisation, NABARD will play a proactive role as outlined in the upcoming ‘New Cooperative Policy’ of the GOI. A pivotal step involves the computerisation of all functional PACS, consolidating them under a single software platform.

This initiative aims to centralise PACS data into a single data repository, facilitating streamlined reporting for all stakeholders. Simultaneously, the computerisation of all ARDBs and their branches will be pursued, enhancing their operational effectiveness. NABARD is going to roll out a platform for the implementation of a Cooperative Governance Index (CGI) for RCBs. The CGI will serve as a tool to evaluate and improve the corporate governance standards within these cooperative banks, ensuring transparency and accountability. The pilot phase is going to be implemented in 69 StCBs and DCCBs in FY2025. This will be followed up by roll-out in all StCBs and DCCBs.

NABARD will continue to monitor the viability plans of RRBs closely, ensuring that they meet the targets outlined in their viability plans. It will also facilitate the adoption of technology among the RRBs and RCBs. By promoting the adoption of best-in-class banking-centric and customer-centric digital services, RFIs can enhance their service offerings and meet the evolving needs of their customers in today’s digital age.

Due emphasis is being laid by NABARD on business diversification by the STCCS through the intervention of BDPICs and PACS Development Cells. It is undertaking the process of revising various scheme guidelines under CDF assistance. NABARD would continue to focus on improving the skill base of personnel in both cooperatives and RRBs. It will also focus on strengthening weaker StCBs and DCCBs through turnaround plans and implementable strategies.

NOTES

- For details, please see NABARD (2023), Annual Report, 2022–23, National Bank for Agriculture and Rural Development, Mumbai. Box 8.1, p. 95. https://www.nabard.org/pdf/2023/annual-report-2022-23-full-report.pdf.

- ERP = Enterprise Resources Planning.

- J&K Grameen Bank has four branches in the Union Territory of Ladakh.

- CBS = Core Banking Solutions, HRMS = Human Resource Management System, NPA = Non-Performing Assets.

- RRBs which meet one of three criteria—CRAR < 10%; GNPA >= 10%; Return on Assets (RoA) < 0%—for the last 2 consecutive years are categorised as ‘RRBs in focus’.

APPENDIX TO CHAPTER 8

Table A8.1: Consolidated performance of StCBs and DCCBs (amount in ₹ crore)

CD Ratio = Credit to Deposit Ratio, CRAR = Capital-to-Risk (Weighted) Assets Ratio, DCCB = District Central Cooperative Bank, GNPA = Gross Non-Performing Assets, NNPA = Net Non-Performing Assets, PCR = Provision Coverage Ratio, StCB = State Cooperative Bank, YOY = Year-on-Year.

Notes:

- During FY2023, Malappuram DCCB was merged with Kerala State Cooperative Bank vide Registrar of Cooperatives, Govt. of Kerala proceedings/Order No. CB(5)6394/2020 dated 12 January 2023.

- The matter of merger of Malappuram DCCB with Kerala StCB is with the Supreme Court. The data of Malappuram DCCB is, hence, shown along with DCCBs.

Source: Off-site surveillance returns submitted by banks in Ensure Portal of NABARD.

Table A8.2: Overview of financial position of SCARDBs and PCARDBs (amount in ₹ crore)

GNPA = Gross Non-Performing Assets, PCARDB = Primary Cooperative Agriculture and Rural Development Bank, P = data is provisional, SCARDB = State Cooperative Agriculture and Rural Development Bank.

Source: Data reported by SCARDBs.

Table A8.3: Grant support to cooperatives from CDF in FY2024

BIRD = Bankers Institute of Rural Development, CDF = Cooperative Development Fund, C-PEC = Centre for Professional Excellence in Cooperatives, CTI = Cooperative Training Institute, DCCB = District Central Cooperative Bank, MSC = Multi-Service Centre, NER = North-East Region, PACS = Primary Agricultural Credit Societies, RCB = Rural Cooperative Bank, RCCI = Rural Cooperative Credit Institutions, SOFTCOB = Scheme of Financial Assistance for Training of Cooperative Banks Personnel, StCB = State Cooperative Bank.

Table A8.4: Consolidated performance of RRBs (amount in ₹ crore)

CD Ratio = Credit to Deposit Ratio, CRAR = Capital-to-Risk (Weighted) Assets Ratio, GNPA = Gross Non-Performing Assets,

NNPA = Net Non-Performing Assets, PCR = Provision Coverage Ratio, YOY = Year-on-Year.

Source: Off-site surveillance returns submitted by banks to the Ensure Portal and RRB Darpan Portal of NABARD.

Table A8.5: Achievement of PSL targets by RRBs in FY2024

PSL = Priority Sector Lending, RRB = Regional Rural Bank.

Note: Target and achievement presented as a percentage of adjusted net bank credit (ANBC) for FY2024 are computed on an average basis of achievement for all four quarters as per RBI guidelines. ANBC is as on corresponding date of the previous year.

© 2024 NABARD All Rights Reserved

Designed & Developed by RDX Digital