- 1. India and the World: The Economy in FY2024

- 2. Cooperatives: Tackling Challenges, Building Opportunities

- 3. Investing in a Sustainable Tomorrow

- 4. Towards Inclusive Development

- 5. Financing Rural Infrastructure for Sustainable Development

- 6. Credit Planning and Delivery for Financial Inclusion

- 7. Supervisory Role of NABARD

- 8. Empowering Rural Financial Institutions

- 9. People—Processes and Policies

- 10. Leveraging Finance for Growth

- Success Stories

- Board of Directors as on 31 March 2024 (PDF)

- Principal Officers (PDF)

- Corporate Governance (PDF)

- Annual Accounts 2023–24 (PDF)

- E-Mail Addresses of HODs and Subsidiaries at Mumbai (PDF)

- Regional Offices/Cells/Training Establishments/Subsidiaries (PDF)

- Annual Report 2023-24 (PDF)

- Home

- Board of Directors as on 31 March 2024 (PDF)

- Principal Officers (PDF)

- 1. India and the World: The Economy in FY2024

- 2. Cooperatives: Tackling Challenges, Building Opportunities

- 3. Investing in a Sustainable Tomorrow

- 4. Towards Inclusive Development

- 5. Financing Rural Infrastructure for Sustainable Development

- 6. Credit Planning and Delivery for Financial Inclusion

- 7. Supervisory Role of NABARD

- 8. Empowering Rural Financial Institutions

- 9. People—Processes and Policies

- 10. Leveraging Finance for Growth

- Success Stories

- Corporate Governance (PDF)

- Annual Accounts 2023–24 (PDF)

- E-Mail Addresses of HODs and Subsidiaries at Mumbai (PDF)

- Regional Offices/Cells/Training Establishments/Subsidiaries (PDF)

- Annual Report 2023-24 (PDF)

Financial systems thrive on stability and public confidence. Effective supervision is imperative for safeguarding the financial health of institutions, protecting depositors’ interests, and ensuring the orderly functioning of the system. As India’s apex institution in the rural financial landscape, NABARD shoulders a significant supervisory responsibility that extends beyond mere oversight to embody a commitment to support financial inclusion and business expansion roles of rural financial institutions (RFIs). It also acts as a guiding force, assisting banks that are not in compliance with regulatory norms to make rectifications and navigate their way back to financial health and sustainability.

7.1 SUPERVISED ENTITIES OF NABARD

Regional rural banks (RRBs) and rural cooperative banks (RCBs) are the two important RFIs that play a vital role in providing financial services in rural India. The RRBs and RCBs are regulated by the Reserve Bank of India (RBI) and supervised by NABARD under Section 35(6) of the Banking Regulation (BR) Act, 1949 and BR Act, 1949 (As Applicable to Cooperative Societies or AACS), respectively. NABARD conducts periodic inspections of supervised entities (SEs), including state and district central cooperative banks (statutorily) and state cooperative agriculture and rural development banks (SCARDBs), apex weavers’ societies, marketing federations, etc., on a voluntary basis (Figures 7.1–7.2 and Appendix Figures A7.1–A7.3).

Figure 7.1: Structure of rural financial institutions

DCCB = District Central Cooperative Bank, LTCCS = Long-Term Cooperative Credit Structure, PACS = Primary Agricultural Credit Society, PCARDB = Primary Cooperative Agriculture and Rural Development Bank, RFI = Rural Financial Institution, RRB = Regional Rural Bank, SCARDB = State Cooperative Agriculture and Rural Development Bank, SE = Supervised Entity, StCB = State Cooperative Bank, STCCS = Short-Term Cooperative Credit Structure, UT = Union Territory

Notes:

- Number of SEs as on 31 March 2024.

- PACS, PCARDBs, and SCARDBs do not figure among statutorily supervised entities.

- Number of PACS as on 31 March 2023. (Source: National Cooperative Database)

- The 34 StCBs include

- 24 which are Scheduled StCBs in the Second Schedule of the Reserve Bank of India Act, 1934 and

- Daman & Diu StCB (license received in March 2024).

- The 352 DCCBs include Tamil Nadu Industrial Cooperative Bank Ltd (TAICO). Malappuram DCCB has since been merged with Kerala StCB but the matter is subjudice.

- There are variations in the cooperative credit structure across states. Not all STCCS have three tiers, some states have two-tier structure as well.

- Of the 13 functional SCARDBs

- 5 are unitary (that is, lending directly), namely, Gujarat, Jammu & Kashmir, Puducherry, Tripura, and Uttar Pradesh;

- 6 are federal (that is, lending through PCARDBs), namely, Haryana, Karnataka, Kerala, Punjab, Rajasthan, and Tamil Nadu; and

- 2 are mixed in nature (that is, lending through both PCARDBs as well as directly), namely, Himachal Pradesh and West Bengal.

- LTCCS

- The provisions of BR Act, 1949, are not applicable to these institutions.

- They do not have access to low-cost deposits.

- They depend heavily on borrowed funds for lending.

- RRBs

- The 43 RRBs are sponsored by 12 scheduled commercial banks.

- The UTs RRBs are operational in include Puducherry, Jammu & Kashmir, and Ladakh.

- 92% of the RRB branches are located in rural/semi-urban areas.

- There are no RRBs in the states of Goa and Sikkim.

Figure 7.2: Supervision by NABARD in FY2024

DCCB = District Central Cooperative Bank, RRB = Regional Rural Bank, SCARDB = State Cooperative Agriculture and Rural Development Bank, StCB = State Cooperative Bank.

Notes:

- DCCBs include Tamil Nadu Industrial Cooperative Bank Ltd.

- Supervision undertaken in FY2024 with respect to status of supervised entities as on 31 March 2023.

7.2 SUPERVISORY ECOSYSTEM: MAJOR DEVELOPMENTS IN FY2024

7.2.1 Roll-out of Enhanced CAMELSC approach

The Enhanced CAMELSC (E-CAMELSC) is an interim supervisory approach adopted by NABARD as a step towards transitioning to a risk-based supervision framework. (Box 7.1).1

Box 7.1: Enhanced CAMELSC

The Enhanced CAMELSC (E-CAMELSC) model evaluates the performance of SEs based on qualitative and quantitative indicators to establish a robust risk management system for institutional resilience. The E-CAMELSC rating model was rolled out from 1 April 2023 for 194 SEs, including RRBs (43), scheduled StCBs (24), and select non-scheduled StCBs (7) and DCCBs (120). For FY2025, 142 banks will be inspected under E-CAMELSC.

A new supervisory rating model has been developed for rating a bank’s performance based on the E-CAMELSC parameters. Detailed guidance notes have been issued in this context for both SEs as well as NABARD inspecting officers, along with a capacity building and training programmes on the theory and practice of E-CAMELSC-based inspections.

CAMELSC = Capital Adequacy, Asset Quality, Management, Earnings, Liquidity, Systems, and Compliance; DCCB = District Central Cooperative Bank; RRB = Regional Rural Bank; SE = Supervised Entity; StCB = State Cooperative Bank.

7.2.2 Launch of SuperSoft 2.0

NABARD has digitalised the supervisory process by introducing the ‘SuperSoft’ application which was launched on 12 July 2022. Since then, statutory inspections of all SEs are being undertaken through SuperSoft, minimising manual intervention and enhancing compliance monitoring.

Amid rapid transformation of the supervisory landscape, with a focus on implementing the E-CAMELSC model, SuperSoft has now been upgraded to Version 2.0, incorporating additional supervisory processes and optimising existing features to enrich user experience (Figure 7.3).

Figure 7.3: Advantages of SuperSoft 2.0

7.2.3 FATF mutual evaluation

India is a member of Financial Action Task Force (FATF), a global body framing the Anti-Money Laundering (AML)/Counter Financing of Terrorism (CFT) standards. These standards also guide the Know Your Customer (KYC)/AML/CFT framework in the banking sector. Accordingly, the SEs of NABARD implement the KYC/AML/CFT directions issued by Government of India (GOI) and RBI from time to time.

The FATF conducts periodic mutual evaluations in the form of in-depth country reports, analysing the implementation and effectiveness of measures to combat money laundering and terrorism financing. India underwent its second mutual evaluation by the FATF in November 2023 (Box 7.2).

Box 7.2: Agenda of interaction with the FATF Mutual Evaluation Assessment Team in New Delhi

- Size of the SEs of NABARD in the Indian financial system

- Licensing, registration, or other controls

- Due diligence of personnel for appointments at senior level in the SEs

- Understanding of the supervisors and SEs regarding AML/CTF risks in the financial sector.

- Mitigating the AML/CFT risks, taking remedial action, and understanding the impact of those actions on compliance by SEs

- Capacity building of SEs: promotion of understanding of AML/CFT obligations and risks by RRBs and RCBs

AML = Anti-Money Laundering, CFT = Counter Financing of Terrorism, RCB = Rural Cooperative Bank, RRB = Regional Rural Bank, SE = Supervised Entity.

In view of the growing importance of the KYC/AML/CFT framework, NABARD has strengthened its interaction with Financial Intelligence Unit–India (FIU-IND), Central Registry of Securitisation Asset Reconstruction and Security Interest (CERSAI), the RBI, and the FATF vertical of the Department of Revenue, GOI.

FIU-IND conducts regular meetings with financial sector regulators, including NABARD as the supervisor of RRBs and RCBs, to strengthen KYC/AML/CFT implementation in the financial system. NABARD participated in two such meetings during the year in which the agenda included the registration of SEs on the FINNet 2.0 portal, sharing of information with FIU-IND, adoption of AML software by SEs, red flag indicators, etc.

7.3 OTHER SUPERVISORY INITIATIVES

7.3.1 Fraud monitoring and review

To make the fraud monitoring and review more effective and result oriented, several improvements were initiated:

- Unified fraud reporting system was implemented across all SEs, and 481 instances of fraud were reported by RRBs and RCBs, amounting to ₹384 crore in FY2024, of which ₹38 crore has been recovered.

- The Central Fraud Monitoring Cell (CFMC) at NABARD scrutinised the modus operandi of frauds that occurred in RRBs and RCBs, undertook root cause analysis, and suggested mitigating measures to prevent future frauds. In case of ‘ingenious’ frauds (employing new or innovative methods), NABARD issued ‘cautionary advice’ to RRBs and RCBs.

The CFMC revised the format for the half-yearly review of regional offices (ROs) to include new parameters for more stringent fraud monitoring. Further, based on the modus operandi reported in frauds during the FY2024, a checklist was developed and shared with ROs to verify and comment on them in the inspection report.

7.3.2 Credit monitoring arrangement

NABARD examines credit monitoring arrangement (CMA) violations by RCBs under individual, unit-wise, and sector categories and reviews the actions initiated by SEs to bring down CMA exposure. An escalation matrix maps the magnitude of CMA violations and prescribes requisite supervisory action. Persistent violations of CMA norms for 3 years running indicates non-compliance with Section 22(3)(b) of the BR Act, 1949 (AACS).

7.3.3 Guidelines on stress testing

It was strongly felt that NABARD’s SEs need to carry out ‘stress tests’ as a risk management tool against shocks. The banks were accordingly advised to ensure that their formal stress-testing frameworks were operational from 31 March 2024 as per prescribed guidelines. The frameworks were designed to enable the SEs to properly identify the triggers, document the remedial actions, and adopt and apply the guiding principles for activation as relevant.

7.3.4 Supervisory Action Framework–Self Initiative for Turn Around

The Supervisory Action Framework–Self Initiative for Turn Around (SAF–SITA) for RCBs was introduced in consultation with the RBI. To initiate such self-corrective action, trigger points on parameters such as capital adequacy measured by the capital to risk-weighted asset ratio, asset quality measured by the percentage of net and gross non-performing assets (NPAs), and profitability measured in terms of consecutive losses have been introduced. Depending on the nature of the deficiency, self-corrective action includes measures for augmenting capital, close monitoring and recovery of NPAs, improving profitability, mobilising low-cost deposits, etc. The SAF–SITA was made effective from 1 April 2024.

7.3.5 Senior supervisory manager for supervised entities

For select SEs with asset sizes greater than ₹25,000 crore, NABARD is in the process of appointing senior supervisory managers to constantly engage with them on credit, market, operational, and management risks.

7.3.6 Capacity building

Bank supervision is a highly specialised domain and inspecting officers should be trained to ‘see through the fog in times of crisis’ and ‘smell the distress well in advance.’ To this end, several capacity-building initiatives were undertaken during FY2024.

- For officers in supervisory roles in ROs, zonal workshops at Jaipur, Pune, Ranchi, and Hyderabad deliberated on the most recent policy initiatives and circulars of NABARD. The workshops included sessions by officers from the RBI’s Enforcement Department (EFD) as well as officers from the RBI’s central and regional offices who shared their observations on NABARD inspection reports.

- The College of Supervisors (CoS) set up by the RBI reinforces the supervisory skills of not just its own personnel, but also of the officers from other financial supervisory institutions, including NABARD. During FY2024, 38 officers from the NABARD Head Office and 43 from its ROs participated in 36 training programmes at the CoS. The programmes covered risks related to credit, market, liquidity, information technology and cyber risks, bank governance, leadership, financial technology, supervisory technology, financial stability, accounting standards, stress testing, econometrics and data analysis, etc.

- One-day workshops on KYC, AML, and CFT were conducted at Bankers Institute of Rural Development (BIRD), Lucknow and BIRD, Mangaluru for the principal officers of RCBs and RRBs. Officers from FIU-IND, CERSAI, RBI, and a private sector AML software service provider handled the sessions along with NABARD.

To disseminate the latest information in the realm of bank supervision, 12 issues of the Inquisitive—a monthly newsletter on topics ranging from KYC/AML/CFT to the role of the FATF in cyber security framework—were published.

7.4 INFORMATION TECHNOLOGY AND CYBER SECURITY INITIATIVES

To enhance the monitoring of cyber security preparedness of SEs, the Cyber Security and Information Technology Examination (CSITE) Cell, set up in NABARD in 2018, has taken several steps during FY2024.

- Operationalising information technology/information system (IT/IS) examination: The 88th Board of Supervision approved the operationalisation of IT examinations of RRBs and RCBs, based on their digital depth and interconnectedness to the payment system. Accordingly, during FY2024, 18 Level III and IV SEs, including 4 RRBs, 13 StCBs, and 1 DCCB, were taken up for IT examination. The objective of the IT/IS examination is to assess the cyber security framework of the SEs and includes the scrutiny of

- IT/IS and cyber security policies,

- framework for adequacies,

- functioning of committees,

- implementation of prescribed cyber security controls based on their level, and

- compliance with advisories and alerts sent by the RBI, National Critical Information Infrastructure Protection Centre, the Indian Computer Emergency Response Team (CERT-In), and Institute for Development & Research in Banking Technology.

- Celebration of Cyber Security Awareness Month: The CSITE Cell celebrated Cyber Security Awareness Month in October 2023. The following activities were conducted during the month:

- Webinar for top management of SEs (including chairpersons, chief executive officers, and managing directors)

- Webinar for the faculty of Cooperative Training Institutions

- Workshop for the Chief Information Security Officers (CISOs) of the SEs

- Dissemination of digital content on cyber security

- Theme-based guide to stay safe online for SEs

- 31 Days Tip on enhancing cyber security posture for SEs

- Online quiz on cyber security for NABARD employees

- During FY2024, the CSITE Cell has

- issued 221 advisories and 10 alerts;

- guided SEs on 14 cyber security incidents;

- conducted 18 cyber security awareness sessions for SEs and ROs;

- revised the Vulnerability Index on Cyber Security based on new circulars issued by CERT-In, RBI, and NABARD and the industry best practice; and

- organised a team visit to the International Trade Fair and Conference on Banking Technology, Equipment and Services to update their knowledge about the emerging global technology environment.

7.5 WAY FORWARD

The supervisory processes that NABARD aims to implement in FY2025 are as follows:

- SuperSoft 2.0 phases: SuperSoft 2.0 will be launched in different phases during FY2025, focusing on milestones such as revising formats, implementing rating modules, introducing mobile application, and conducting IT examinations.

- Project review: A comprehensive review of the inspection guidance note issued in 2020,consolidation of supervision-related circulars, and a revision of SuperSoft checklist will be undertaken.

- KYC/AML enhancement: NABARD plans to introduce dedicated examination of KYC/AML mechanisms in SEs to assess efficacy and modification of KYC returns for better risk-based monitoring.

- Fraud monitoring: Standardisation and digitalisation of quick study/portfolio inspection reports of fraud monitoring in the Supersoft application with options to update the progress made by the bank.

- Cyber security measures: NABARD aims to implement the following measures in FY2025 to strengthen cyber security:

- An IT examination of 24 SEs (2 per month)

- Development of IT examination checklist (module) in the SuperSoft application and conduct IT/IS examination on SuperSoft

- Workshop for CISOs on effective cyber security compliance

- Revision of cyber security circulars to incorporate necessary changes and updates

- Three workshops on cyber security examination for the inspecting officers at ROs across the country

- Revision of incident reporting return and migration to ENSURE 2.0

- Monitoring system for communications from the EFD, RBI: NABARD can leverage DIGI-DAK to track the turnaround time of communications from the EFD, RBI.

- A new feature will be developed through which all pending EFD cases at ROs in DIGI-DAK can be viewed, along with a filter to track the pending queries.

- Through DIGI-DAK, system-generated reminders will be sent to the relevant ROs for pending EFD cases.

- A new feature will be introduced to enable escalation reminders to be sent directly to the EFD cases in DIGI-DAK.

- The Department of Supervision (DoS) 08 dashboard: DoS 08 was developed by NABARD for enabling users to view the status of complaints. The dashboard would provide the following information:

- Total complaints pending, received, closed, and disposed by year

- Number of complaints received by month/complaint type

- Top 10 ROs receiving/pending highest number of complaints

- Complaint duration

- State-wise number of complaints

NOTE

1. CAMELSC = Capital Adequacy, Asset Quality, Management, Earnings, Liquidity, Systems, and Compliance.

APPENDIX TO CHAPTER 7

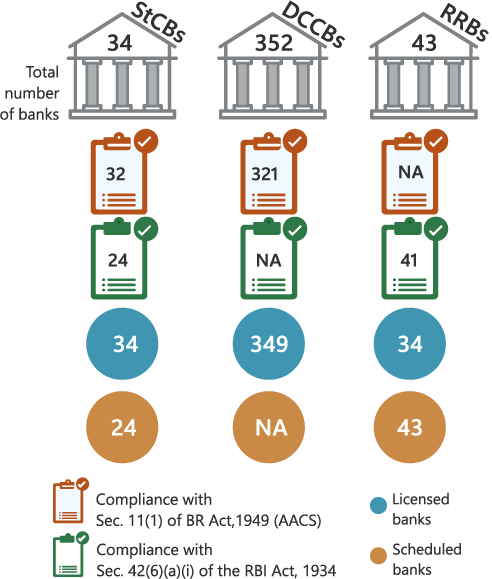

Figure A7.1: Compliance status of supervised entities as on 31 March 2023

AACS = As Applicable to Cooperative Societies, BR Act = Banking Regulation Act, DCCB = District Central Cooperative Bank, NA = not applicable, RBI = Reserve Bank of India, RRB = Regional Rural Bank, StCB = State Cooperative Bank.

Notes:

- DCCBs include Tamil Nadu Industrial Cooperative Bank Ltd.

- Three unlicensed DCCBs are Baramulla, Anantnag, and Jammu DCCBs.

- DCCBs include Malappuram DCCB that has been merged with Kerala StCB but the matter is subjudice.

- Compliance status as on 31 March 2023 (inspected figures).

Source: Data from ENSURE portal, NABARD.

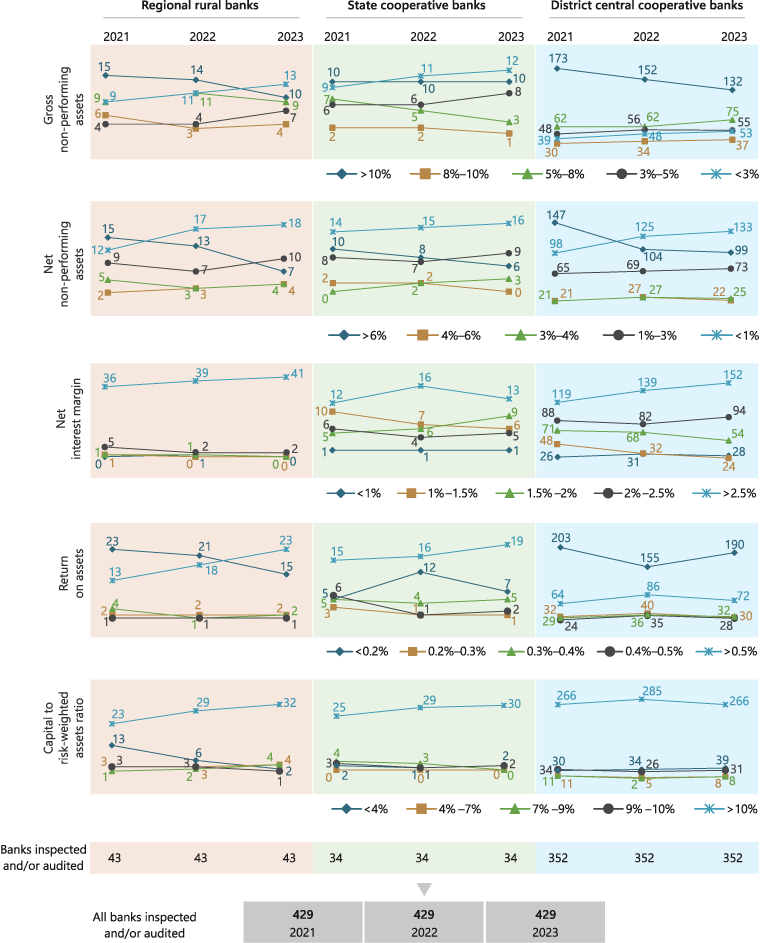

Figure A7.2: Number of banks by performance indicator as on 31 March (of the relevant year)

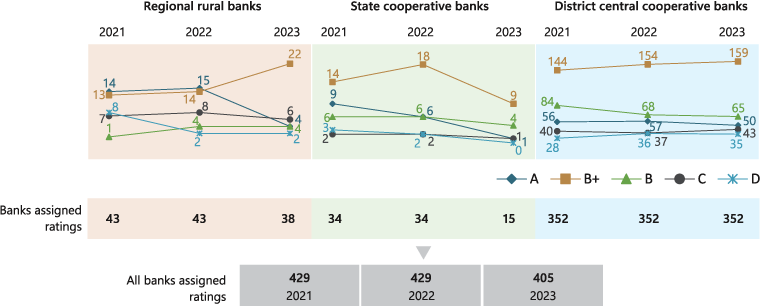

Figure A7.3: Number of banks by ratings as on 31 March (of the relevant year)

Notes to Figures A7.2 and A7.3:

- Percentage ranges in the legend in each figure pertain to the specific performance indicator of that figure. For example, in the figure for gross non-performing assets, the percentage ranges relate to gross non-performing assets.

- Data furnished for regional rural banks and state cooperative banks is as per inspections (latest available figures).

- Data for district central cooperative banks (DCCBs) is as per inspections or audit as available.

- Wherever DCCBs were not inspected, previous ratings have been repeated.

Source: Data from ENSURE portal, NABARD.

© 2024 NABARD All Rights Reserved

Designed & Developed by RDX Digital