- 1. India and the World: The Economy in FY2024

- 2. Cooperatives: Tackling Challenges, Building Opportunities

- 3. Investing in a Sustainable Tomorrow

- 4. Towards Inclusive Development

- 5. Financing Rural Infrastructure for Sustainable Development

- 6. Credit Planning and Delivery for Financial Inclusion

- 7. Supervisory Role of NABARD

- 8. Empowering Rural Financial Institutions

- 9. People—Processes and Policies

- 10. Leveraging Finance for Growth

- Success Stories

- Board of Directors as on 31 March 2024 (PDF)

- Principal Officers (PDF)

- Corporate Governance (PDF)

- Annual Accounts 2023–24 (PDF)

- E-Mail Addresses of HODs and Subsidiaries at Mumbai (PDF)

- Regional Offices/Cells/Training Establishments/Subsidiaries (PDF)

- Annual Report 2023-24 (PDF)

- Home

- Board of Directors as on 31 March 2024 (PDF)

- Principal Officers (PDF)

- 1. India and the World: The Economy in FY2024

- 2. Cooperatives: Tackling Challenges, Building Opportunities

- 3. Investing in a Sustainable Tomorrow

- 4. Towards Inclusive Development

- 5. Financing Rural Infrastructure for Sustainable Development

- 6. Credit Planning and Delivery for Financial Inclusion

- 7. Supervisory Role of NABARD

- 8. Empowering Rural Financial Institutions

- 9. People—Processes and Policies

- 10. Leveraging Finance for Growth

- Success Stories

- Corporate Governance (PDF)

- Annual Accounts 2023–24 (PDF)

- E-Mail Addresses of HODs and Subsidiaries at Mumbai (PDF)

- Regional Offices/Cells/Training Establishments/Subsidiaries (PDF)

- Annual Report 2023-24 (PDF)

As an apex institution promoting rural development in India, one of NABARD’s primary responsibilities is to enable the flow of ground-level credit (GLC). Its objective is to ensure that the smallest and most marginalised economic actors at the grassroots gain access to institutional credit to invest into diversifying, expanding, and scientifically modernising their farm and off-farm activities. They can, thus, simultaneously ‘contribute to’ and ‘enjoy’ the fruits of inclusive and sustainable rural development in the long term.

On the one hand, NABARD fulfils its role in expanding credit availability and supply through credit planning and monitoring, and last-mile credit delivery through both refinance and direct finance products. And on the other, it also seeks to stimulate credit demand through greater financial inclusion.

6.1 CREDIT PLANNING

Credit planning is important for estimating credit demand (potential) in the rural economy and trying to meet it. NABARD has placed 479 district development managers pan India with the prime responsibility of credit planning, monitoring of credit flow, and coordination with channel partners.

Under credit planning, NABARD prepares potential-linked credit plans (PLPs) on an annual basis for all the districts of the country. These PLPs estimate credit potential under the priority sector at the district level and present holistic interventions required in infrastructure and other support services.

During FY2024, 729 PLPs for FY2025 have been prepared covering 758 districts which further guide the banks in preparation of annual credit plans, ensuring credit supply in the rural economy.

Assessment of credit potential in PLPs under the priority sector for all districts in a state leads to the compilation of state focus papers (SFPs), highlighting the credit potential, gaps, and strategies for sector and infrastructure development of the state. The SFP also outlines the support to be provided by government departments.

The SFPs are launched at state credit seminars (SCSs) wherein infrastructure gaps and major sectoral issues relating to credit flow are deliberated on with relevant stakeholders, namely, senior officials of state governments, banks, research institutions, etc. Suggestions emanating in the SCSs help state governments in framing suitable policies/schemes and making budgetary provisions, as required.

During FY2024, SFPs were launched in SCSs across 30 states. The SFP projection for FY2025, under the priority sector, is estimated at ₹61 lakh crore, of which the share of agriculture is ₹26.3 lakh crore i.e., 43%.

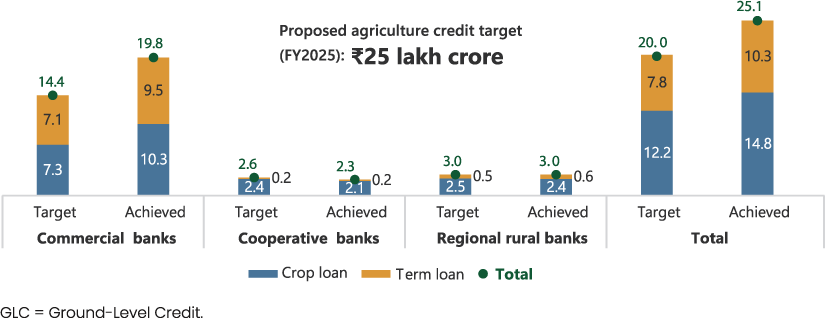

The government has been fixing annual targets for GLC for the agriculture sector by scheduled commercial banks (SCBs), regional rural banks (RRBs), and rural cooperative banks (RCBs). During FY2024, ₹25.1 lakh crore (provisional) has been disbursed, against the target of ₹20 lakh crore, thus overachieving the target by 25% (Figure 6.1). Significantly, much of the incremental agricultural GLC was extended by SCBs.

Figure 6.1: Agricultural GLC by agency during FY2024 (provisional data) (₹ lakh crore)

6.2 REFINANCE ACTIVITIES

Encompassing the diverse credit needs of rural clients, NABARD extends refinance to rural financial institutions (RFIs), SCBs, and non-banking financial companies (NBFCs) against their loan portfolio. Loans to governments and state-owned corporations for procurement (short-term or ST) and infrastructure projects (long-term or LT) are extended directly. RFIs and SCBs extend GLC to agriculture consisting of both ST working capital and LT funds for capital formation.

NABARD extends concessional refinance with support of the Government of India (GOI) and the Reserve Bank of India (RBI) under Short-Term Cooperative Rural Credit Fund (STCRCF), Short-Term Regional Rural Bank Fund, and Long-Term Rural Credit Fund, resulting in augmentation of credit, both for agriculture and allied activities, and affordable credit at ground level.

6.3 REFINANCE TRENDS

Total ST refinance disbursement of ₹1.8 lakh crore was 121% of the target for FY2024, a remarkable achievement (Figure 6.2). The disbursement under LT refinance has been moderate with 76% achievement of the target of ₹1.7 lakh crore in FY2024.

Figure 6.2: Long- and short-term refinance support (₹ crore)

Long-term refinance

Short-term refinance

aAs against Board approved target of ₹25,000 crore, RBI released ₹15,154.2 crore.

bAs against Board approved target of ₹75,000 crore, RBI released ₹65,675.7 crore.

LT = Long-Term, LTRCF = Long-Term Rural Credit Fund, RBI = Reserve Bank of India, ST = Short-Term, ST (SAO) = Short-Term Credit for Seasonal Agricultural Operations.

Note: Figures may not add up to total due to rounding off.

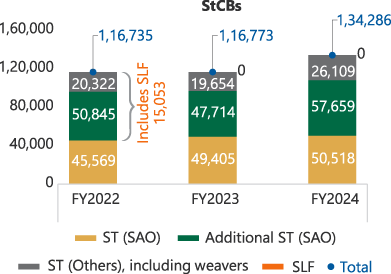

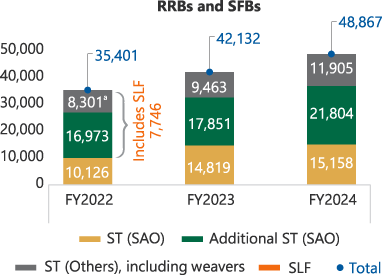

Figure 6.3: Disbursement of short-term refinance by agency (₹ crore)

a₹32.8 crore disbursed to SFBs.

RRB = Regional Rural Bank, SFB = Small Finance Bank, SLF = Special Liquidity Facility, ST = Short-Term, StCB = State Cooperative Bank, ST (SAO) = Short-Term Credit for Seasonal Agricultural Operations.

Note: SLF for the FY2022 already included in Additional ST (SAO) and ST (Others); no allocation under SLF by Reserve Bank of India during FY2024.

6.3.1 Performance of ST refinance

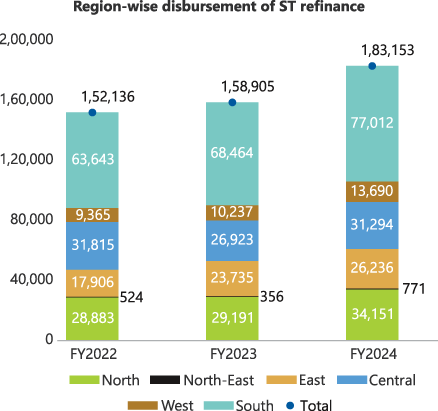

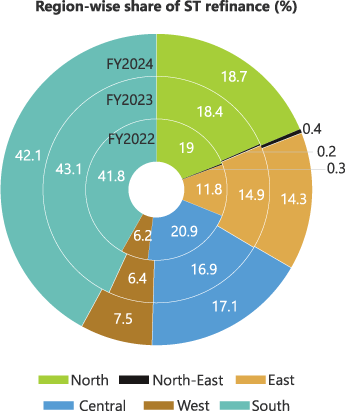

For production and working capital requirements of farmers, weavers, and artisans, refinance is provided under the ST facility. During FY2024, of the total ST refinance of ₹1.8 lakh crore, 73.3% was disbursed to state cooperative banks (StCBs) (Figure 6.3). Disbursements under ST credit support of NABARD increased by 15% over FY2023. Short-term facility to cooperatives increased by 15% whereas disbursement to RRBs and SFBs combined, increased by 16% during FY2024. In terms of region-wise trends, the southern region has received the largest proportion of ST refinance at 42.1%, followed by north (18.7%), central (17.1 %), and the east (14.3%). The western region has a very small share (7.5% ) in ST refinance disbursement (Figure 6.4). 1

Figure 6.4: Disbursement and share of short-term refinance by region (₹ crore)

ST = Short Term.

Notes:

- Figures may not add up to total due to rounding off.

- For the list of states and Union Territories by region, see Note 1 at the end of Chapter 6.

6.3.2 Performance of LT refinance

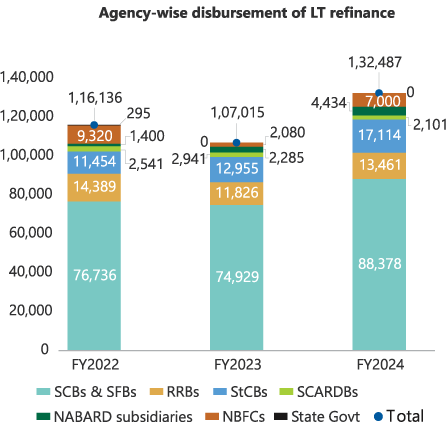

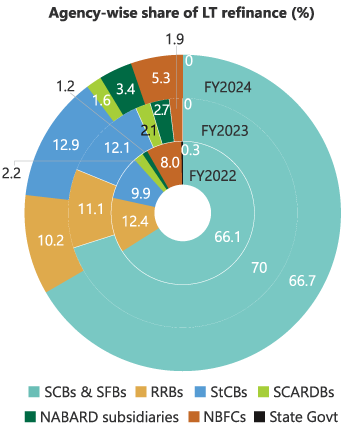

Disbursements under LT refinance touched ₹1.3 lakh crore during FY2024, registering an increase of 23.8% (Figure 6.5). A sizeable share (67%) of the disbursement went to SCBs including SFBs, followed by StCBs (13%) and RRBs (10%).

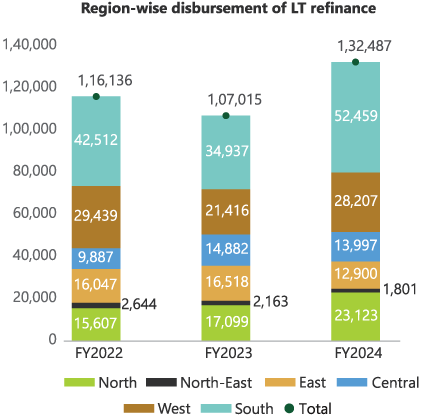

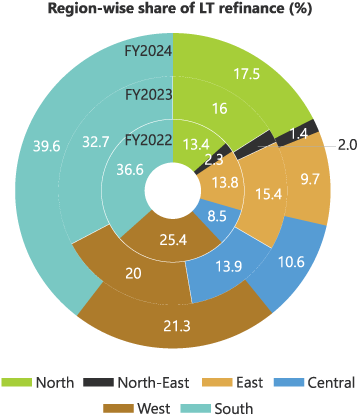

Regional disparity is visible even in LT refinance as the major share of refinance offtake was in the south (39.6%), followed by the west (21.3%), north (17.5%), central (10.6%), east (9.7%), and the north-east regions (1.4%) (Figure 6.6).

Figure 6.5: Disbursement of long-term refinance by agency (₹ crore)

LT = Long Term, NBFC = Non-Banking Financial Company, RRB = Regional Rural Bank, SCARDB = State Cooperative Agriculture and Rural Development Bank, SCB = Scheduled Commercial Bank, SFB = Small Finance Bank, StCB = State Cooperative Bank.

Note: Figures may not add up to total due to rounding off.

Figure 6.6: Disbursement and share of long-term refinance by region (₹ crore)

LT = Long Term.

Notes:

- Figures may not add up to total due to rounding off.

- For the list of states and Union Territories by region, see Note 1 at the end of Chapter 6.

6.4 OTHER CREDIT EXPANSION INSTRUMENTS

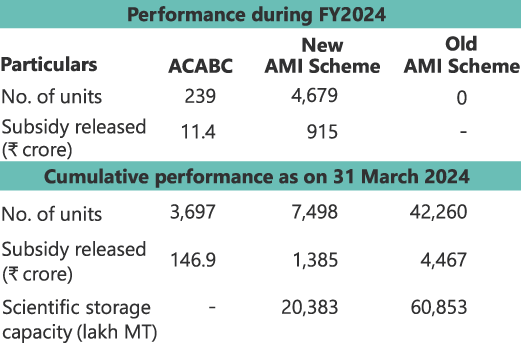

Apart from the short-term and long-term refinance support, NABARD also offers special refinance schemes which are summarised below (Figure 6.7).

Figure 6.7: Performance of special refinance schemes in FY2024

GOI = Government of India; MSC = Multi-Service Centre; PACS = Primary Agricultural Credit Society;

SFB = Small Finance Bank; SRS = Special Refinance Scheme; ST = Short Term; WASH = Water, Sanitation, and Hygiene; WLGSP = World’s Largest Grain Storage Plan in the Cooperative Sector.

Notes:

- The WLGSP entails setting up of grain storage infrastructure, including warehouse and silos, along with other agri-infrastructure, such as procurement centres, custom hiring centres, primary processing centres, grameen haats, etc., through the convergence of various government schemes at PACS level, such as Agriculture Infrastructure Fund, Agricultural Marketing Infrastructure, Sub-mission on Agriculture Mechanization, Mission for Integrated Development of Horticulture, Pradhan Mantri Formalisation of Micro-Food Processing Enterprises, and Pradhan Mantri Krishi Sinchayee Yojana. More details are available in Box A10.1.

- For details on each of these refinance products, please see NABARD (2023), Annual Report 2022–23, National Bank for Agriculture and Rural Development, Mumbai, p.75. https://www.nabard.org/pdf/2023/annualreport-2022-23-full-report.pdf.

Interest subvention, assistance to sugar mills for ethanol production, Kisan Credit Card (KCC) saturation, and credit-linked subsidies are some of the other products that NABARD has been effectively managing for the GOI (Figure 6.8, Box 6.1). NABARD also supports cooperatives through direct refinance to DCCBs and credit facility for federations (Figure 6.8).

Figure 6.8: Performance of other credit products in FY2024

Interest subvention schemes

- Crop loan IS scheme for RCBs and RRBs

- IS to loans to small and marginal farmers both for raising crops as well as against NWRs

- IS towards repayment incentive to farmers in animal husbandry and fisheries

- IS on ST loans (for crops, animal husbandry, or fisheries) to farmers who have KCCs.

- IS scheme under DAY–NRLM for RCBs and RRBs

Disbursement in FY2024

- ₹8,297.1 crore under IS scheme for ST crop loans

- ₹1,036.2 crore to WSHGs through RCBs and RRBs under DAY–NRLM

- Cumulative disbursement till 31 March 2024: ₹5,638.9 crore.

Financial assistance to sugar mills for

increasing ethanol production capacity

FY2024

- IS of ₹492.3 crore through RCBs, RRBs, and SCBs, etc.

- 917 quarterly claims settled

Cumulatively, till 31 March 2024

- IS of ₹930.9 crore

- 2,170 quarterly claims settled

Claims settled through the newly developed Sugar Ethanol Portal.

Implementation of CSSs of GOI

Channelling subsidy foragri culture projects and priority sector activities

KCC saturation drive

DRA to StCBs and DCCBs for ST multipurpose credit

DRA for credit to meet needs of working capital, repair and maintenance of farm equipment and other productive assets, storage/grading/packaging of produce, marketing activities, food credit consortium, non-farm activities, working capital loans against pledge limits sanctioned to cooperative and private sugar factories, etc.

In FY2024

- Sanction ₹26,816 crore; 25% higher than FY2023

- Disbursement ₹26,869 crore; 48% higher than FY2023

- The outstanding position as on 31 March 2024 ₹20,504 crore against ₹13,956 crore as on 31 March 2023.

- Credit availed by StCBs and DCCBs in Andhra Pradesh, Bihar, Chhattisgarh, Gujarat, Haryana, Himachal Pradesh, Jharkhand, Karnataka, Madhya Pradesh, Maharashtra, Odisha, Rajasthan, Tamil Nadu, Telangana, Uttar Pradesh, Uttarakhand, and West Bengal

- 'C' rated DCCBs also eligible for DRA

Credit Facility to Federations

ST credit to agricultural marketing federations, dairy cooperatives, milk unions and federations to support procurement of inputs, processing, and marketing operations.

In FY2024

- Sanction ₹38,700 crore (FY2024); ₹40,606 crore (FY2023)

- Disbursement ₹39,240 crore; 25% higher than FY2023

- The outstanding position as on 31 March 2024 ₹20,583 crore against ₹17,355 crore as on 31 March 2023.

- Credit availed by marketing federations and civil supplies corporations in Andhra Pradesh, Bihar, Chhattisgarh, Gujarat, Haryana, Madhya Pradesh, Odisha, Tamil Nadu, Telangana, and Uttarakhand

ACABC = Agri-Clinics and Agri-Business Centres, AMI = Agriculture Marketing Infrastructure, CSS = Capital Subsidy Scheme, DAY–NRLM = Deendayal Antyodaya Yojana–National Rural Livelihood Misison, DCCB = District Central Cooperative Bank, DRA = Direct Refinance Assistance, GOI = Government of India, IS = Interest Subvention, KCC = Kisan Credit Card, MT = metric tonne, NWR = Negotiable Warehouse Receipt, RCB = Rural Cooperative Bank, RRB = Regional Rural Bank, SCB = Scheduled Commercial Bank, ST = Short-Term, StCB = State Cooperative Bank, WSHG = Women Self-Help Group.

Notes:

- AMI scheme supports the development and upgrading of gramin haats to Gramin Agriculture Markets.

- ACABC scheme supplements the efforts of public extension by facilitating the setting up of agri-ventures by qualified agricultural professionals.

- For details on each of these credit products, please see NABARD (2023), Annual Report 2022–23, National Bank for Agriculture and Rural Development, Mumbai, p.76–77. https://www.nabard.org/pdf/2023/annual-report-2022-23-full-report.pdf.

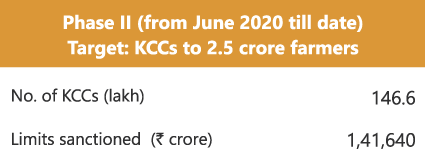

Box 6.1: Increasing KCC penetration

Ghar Ghar KCC Abhiyan

NABARD spearheaded the nationwide campaign targeting PM-KISAN beneficiaries not yet covered by KCC. The camps conducted under the campaign were monitored by an IT-based application especially developed by NABARD. Under GGKA, 6,361 camps were held across 490 districts, covering 1,998 blocks and 5,914 villages, with more than 2.7 lakh participants.

VBSY and PM-JANMAN

Launched by the GOI on 15 November 2023, VBSY and PM-JANMAN are nationwide initiatives across all gram panchayats, nagar panchayats, and urban local bodies that aimed at spreading awareness to achieve comprehensive coverage of schemes such as KCC to benefit vulnerable populations who are eligible for various schemes but have not yet availed the benefits.

AHDF–KCC campaign

Ministry of Fisheries, Animal Husbandry and Dairying resumed the Nationwide AHDF–KCC Campaign from 1 May 2023 to 31 March 2024, for providing KCC facility to all eligible farmers engaged in animal husbandry, dairying, and fisheries.

AHDF = Animal Husbandry, Dairying, and Fisheries; GGKA = Ghar Ghar KCC Abhiyaan; GOI = Government of India; IT = Information Technology; KCC = Kisan Credit Card; PM-JANMAN = Pradhan Mantri Janjati Adivasi Nyaya Maha Abhiyan; PM-KISAN = Pradhan Mantri Kisan Samman Nidhi; VBSY = Viksit Bharat Sankalp Yatra.

6.5 NEW INITIATIVES IN REFINANCE DURING FY2024

6.5.1 Policy initiatives

- Floating rate under Short-Term Credit for Additional Seasonal Agricultural Operations and ST (Others): Keeping in view the requirements of the RCBs and the RRBs, flexibility introduced under these facilities now allows client banks to avail of refinance at floating rates.

- Floating rate under LT refinance: A floating rate product was introduced under LT refinance for public and private sector commercial banks, small finance banks, NBFCs, and NBFC–microfinance institutions (NBFC–MFIs).

- Automatic Refinance Facility (ARF) under special refinance schemes (SRS): Since SRS-PACS as MSCs and SRS-AIF have been operational since 2020 and client banks have gained the experience and competency necessary for appraising the projects, ARF mode of refinance was introduced under these schemes in place of pre-sanction procedure.2

- Relaxing eligibility criteria to serve greater client base: Eligibility criteria were relaxed to allow RCBs whose internal risk rating category is NBD1 to NBD7 to participate in the pilot project of the World’s Largest Grain Storage Plan in the Cooperative Sector.

6.5.2 Operational initiatives

- Digitalisation of refinance operations for NBFCs, NBFC-MFIs, and commercial banks was introduced to ease the process of refinance.

- The documentation procedure for refinance in respect of NBFCs and NBFC-MFIs were revised.

- The operational guidelines for NBFCs and NBFC-MFIs were revised incorporating the latest industry trends and detailed internal guidelines were issued to the regional offices.

- The NABPARIKSHAN app was revamped for smooth verification of refinanced assets at ground level.

- Initiatives in assessing market requirements and designing refinance products accordingly have attracted new clients into NABARD’s refinance fold, like Indian Overseas Bank, Karnataka Bank, DBS Bank, Bank of India, etc.

6.6 IMPROVING EFFICIENCY IN THE CREDIT DELIVERY ECOSYSTEM

Steadfast in its commitment to fostering innovation and catalysing positive change within the rural credit delivery ecosystem, NABARD continues to embrace dynamic strategies and cuttingedge technologies to boost efficiency, ensure transparency in operations, and streamline decisionmaking. NABARD has been responsive to the emerging options and opportunities within a rapidly and profoundly transforming financial and economic landscape. It has not only taken forward existing initiatives in improving the credit ecosystem in the country but also introduced many new ones in the last year, some of which are listed below.

- Core Banking Solutions (CBS) in RCBs: NABARD has played a pivotal role in the onboarding of RCBs to CBS since 2012. As on date, as many as 214 banks have benefited from this initiative. NABARD has won the prestigious Association of DFIs in Asia and Pacific Sustainable Development Project Award 2024 in Financial Inclusion Category for this initiative.

- Centralised Account Aggregator (AA) Platform for RCBs and RRBs: NABARD took the initiative to successfully develop and pilot test a centralised AA platform which will reduce the capital costs for the RCBs and RRBs while onboarding onto the AA framework. This is expected to enhance seamless exchange of financial information between participating banks.

- Shared Aadhaar Data Vault (ADV) for RCBs: To improve Aadhaar data security, NABARD is facilitating discussions for a shared ADV environment, potentially reducing costs for participating RFIs.

- Development of digital technology for credit delivery, interest subvention, etc.

- eKCC Portal: NABARD has developed an online portal for KCC, which can be accessed by farmers at their doorstep to submit their loan applications to RCBs and RRBs. This portal envisages sanction of KCC loans as the first offering and shall be expanded in phases to cover other types of agri-loans like personal loans or MSME loans.3 The portal will have links to land record systems of state governments, satellite imagery, CIBIL, and Unique Identification Authority of India for Know-Your-Customer authentication to facilitate underwriting of loans by banks.4 From the banks’ perspective, the portal also provides all the functionalities of a loan origination system, enabling banks to scrutinise and convey inprinciple sanction of loans immediately.

- eNWR Pledge Loan Gateway: The Warehousing Development and Regulatory Authority,5 working closely with NABARD, has developed an eNWR Pledge Loan Gateway on the JanSamarth Portal of Department of Financial Services (DFS), GOI. The portal, ‘e-Kisan Upaj Nidhi’, was launched on 4 March 2024 and is expected to ease the flow of pledge loans to the farming community. NABARD will be disseminating information on the ‘Pledge Loan Scheme based on eNWRs’ through seminars and awareness camps organised at state and district level.

- AIF Interest Subvention Portal: NABARD is developing a portal for automating the processing of interest subvention claims as also credit guarantee fee claims submitted by banks under the AIF scheme, enabling quick and accurate claim settlement. This will also motivate the banks to finance more infrastructure projects under AIF by encouraging beneficiaries to set up new units and avail the benefit of interest subvention. The portal is currently undergoing user acceptance testing.

- NRLM Interest Subvention Portal: NABARD has developed a web portal for NRLM interest subvention claims by RRBs and RCBs in respect of WSHGs financed by them under DAY–NRLM.6 The portal was launched on 11 January 2024. As on 31 March 2024, the portal has successfully processed interest subvention claims totalling ₹142 crore for FY2024.

- Ghar Ghar KCC Abhiyan campaign monitoring: NABARD developed an IT-based application for monitoring the camps conducted under the campaign (for details see Box 6.1).

- Digitalising Agri-Value Chain Finance (AVCF): This initiative of NABARD would streamline the financing and digitising of input purchase, crop production, and output procurement, thereby linking institutions more systematically with agri-value chains. Working in close collaboration with two start-ups, NABARD launched the AVCF pilot in three states covering 10 farmer producers’ organisations (FPOs) and 16 crops, involving credit support from two banks. Further, NABARD is actively seeking solutions to field-level challenges encountered in these pilots by exploring purpose-bound loans using Central Bank Digital Currency alongside implementation of the FPO accelerator model.7

- Technology Facilitation Fund (TFF): NABARD has set up a dedicated fund from its profit with a corpus of ₹50 crore to support the development of digital technology with the help of tech start-ups. During the year, two proposals were sanctioned amounting to ₹73.17 lakh under TFF.

- Shielding RCBs from cyber threats: NABARD, as an ecosystem developer, facilitated collective cyber risk insurance for 75 RCBs by floating a common request for proposal (RFP) on the central public procurement portal, achieving significantly lower premium and higher comprehensive coverage compared to individual policies independently procured by RCBs. The premium at 0.62% of ‘limit of liability‘ for the maximum liability coverage (against market rates of 0.75%–1.25%) would never have been possible without NABARD’s collective cyber risk insurance initiative. Not only does the 12-month policy (effective 1 April 2024) offer more comprehensive coverage on friendlier terms but also relieves the RCBs of the burden of floating individual RFPs. It is, therefore, expected that in the current fiscal, more RCBs will participate in the common RFP process of NABARD to buy into the collective cyber risk insurance for FY2026.

6.7 STRENGTHENING FINANCIAL INCLUSION

Initiated in FY2019, NABARD’s differentiated approach to financial inclusion focuses on addressing regional disparities and ensuring equitable access to financial services across the country. Attention is paid to special focus districts, including aspirational districts, left-wing extremism-affected districts, credit-deficient districts as well as districts in hilly states, the North East Region (NER), and the Andaman and Nicobar Islands.

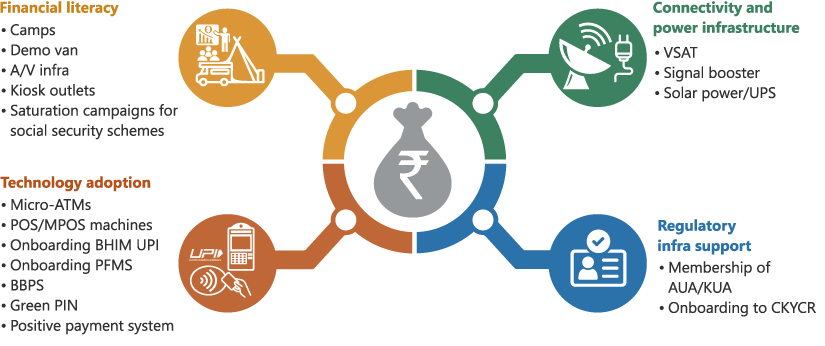

Grant support assistance through NABARD’s Financial Inclusion Fund (FIF) has improved lastmile financing in India by enabling access to formal credit sources, enhancing financial literacy and awareness, supporting technology adoption and innovation, creating infrastructure and connectivity, and facilitating policy advocacy for the unserved and underserved segments of the rural population (Figure 6.9).

Figure 6.9: Activities supported by FIF

ATM = Automatic Teller Machines, AUA = Aadhaar User Agency, A/V = Audio Visual, BBPS = Bharat Bill Payment System, BHIM UPI = Bharat Interface for Money Unified Payments Interface, CKYCR = Central ‘Know Your Customer’ Record Registry, FIF = Financial Inclusion Fund, KUA = KYC User Agency, MPOS = Mobile Point of Sale, PFMS = Public Financial Management System, POS = Point of Sale, UPS = Uninterruptible Power Supply, VSAT = Very Small Aperture Terminal.

6.7.1 Financial literacy and capacity building

Financial literacy with awareness and understanding of financial products, particularly digital services, has been a primary focus area for NABARD. Initiatives supported by NABARD include financial and digital literacy camps, reimbursement of examination fees for banking correspondents, and the deployment of demonstration vans and kiosks in unbanked villages. Extensive outreach efforts have included over 8.1 lakh awareness programmes reaching 35 crore households, significantly contributing to the adoption of technology and promoting financial inclusion among rural populations.

6.7.2 Technology adoption and infrastructure support

NABARD plays a crucial role in advancing financial inclusion through technology, particularly for RRBs and RCBs. This includes facilitating the adoption of CBS, enabling services like Any Branch Banking, NEFT, RTGS, and ATM access across rural areas.8 NABARD supports initiatives such as revised KCC through cooperatives to ensure timely credit for farmers, and promotes digital infrastructure like PFMS, BHIM UPI, and AUA/KUA, thereby expanding banking touch points such as CSPs and kiosks in remote areas.9 Addressing challenges such as erratic power supply and connectivity issues, NABARD provides funding support for VSAT,10 mobile boosters, and solar units. The deployment of 77,219 micro-ATMs, 72,552 POS/MPOS machines,11 and nearly 14 lakh BHIM Aadhaar Pay devices, along with mobile vans conducting hands-on training for over 5 lakh households, has significantly increased access to digital financial services in the underserved areas.

6.7.3 New activities supported under FIF during FY2024

- Support for the deployment of micro-ATMs: Grant assistance to district central cooperative banks (DCCBs) under a pilot project of the Ministry of Cooperation, GOI (Showcase 6.1).

Showcase 6.1: Promoting ‘Cooperation among Cooperatives’

Project: Pilot project under the Sahakar se Samriddhi Scheme to promote ‘Cooperation among Cooperatives’

Purpose:

- To promote financial transactions of primary dairy cooperative societies with cooperative banks

- To strengthen cooperative sector and increase its self reliance

- To ensure easy access of rural customers to banking services

Location: Five districts of Gujarat

Implemented by: Banaskantha DCCB and Panchmahal DCCB

Grant support: ₹367 lakh

Challenges faced: Poor access to banking services with distant bank branches

Interventions

- Primary dairy cooperative societies were made business correspondents/bank mitras of DCCBs

- Micro-ATMs were given to the bank mitra dairy cooperative societies with support from NABARD to ensure ease of doing business through digital financial transactions and to promote financial inclusion by offering doorstep financial services to dairy farmers even at remote locations.

- Financial and digital literacy campaigns were organised to create awareness among the members of dairy cooperative societies on the capabilities of micro-ATMs and the services offered under the campaign.

- Opening of bank accounts of dairy societies and their members with DCCBs was promoted.

- KCCs were promoted and distributed by DCCBs to members of dairy cooperative societies.

Output>>Outcomes>>Impact

- Geographical coverage

- Micro-ATMs deployed in PACS: 465 (440 with NABARD support)

- Micro-ATMs deployed in cooperative milk societies: 1,271 (1,191 with NABARD support)

- Financial inclusion and new accounts

- New savings accounts opened: 3.9 lakh

- Financial transactions increased 50 times compared to 6 months prior

- Agricultural financing facilitation: 77,995 RuPay KCCs issued/reissued.

- Special efforts by the banks: Panchmahal DCCB and Banaskantha DCCB deployed additional micro-ATMs using internal resources, showcasing commitment to long-term financial inclusion initiatives.

- Benefits for DCCBs:

- Micro-ATMs at dairy societies helped banks improve their customer engagement by providing financial services to those living far away from bank branches, saving travel costs and time.

- The DCCBs witnessed increase in deposits as well as expansion of the loan portfolio.

- Many cooperative milk societies shifted their accounts from other banks to these DCCBs

- Benefits for cooperative societies:

- Dairy farmer members of primary dairy cooperative societies were able to get affordable and timely credit through Rupay KCC from DCCBs.

- Digital transactions through micro-ATMs improved transparency in operations of dairy societies.

- Their miscellaneous income improved through commission/fee income as bank mitras.

- In view of the success of the pilot project, the campaign on ‘Cooperation amongst Cooperatives’ was launched in all districts of Gujarat by the Chief Minister of Gujarat on 15 January 2024.

Conclusion: The project is a beacon of the transformative potential of digital banking. By fostering financial inclusion and cooperation among cooperatives, it has breathed new life into rural economy, paving way for sustainable growth and prosperity.

ATM = Automated Teller Machine, DCCB = District Central Cooperative Bank, KCC = Kisan Credit Card, PACS = Primary Agricultural Credit Societies.

- Incentive scheme for CSPs/business correspondents (BCs) of banks operating in NER states: A scheme has been launched to provide incentive from FIF to CSPs and BCs of banks operating in the hilly and NER states. This assistance aims to offset high transportation costs in these areas and increase the net income of service providers. The incentive, set at ₹1,000 per month per BC, is in addition to the fixed and variable commissions already paid by the banks. To qualify, BCs must achieve a monthly average of 50 transactions. This initiative aims to motivate and empower BCs to actively contribute to financial inclusion efforts. The incentive is to be paid directly to the BC agents or CSP operators.

- Scheme to develop Learning Management System for Rural Self Employment Training Institutes (RSETIs): The project, being implemented in collaboration with the National Academy of RUDSETI and IIT Madras,12 aims to improve skills training towards greater financial inclusion, by building an e-learning platform for RSETIs. This platform will offer 64 courses in 11 languages, providing 4,400 hours of video content for skill development. It aims to enhance the capabilities of approximately 6 lakh rural trainees annually, fostering entrepreneurship and contributing to economic prosperity.

- Partnership with Women’s World Banking (WWB): NABARD and WWB have formalised a partnership which aims to replicate the successful JanDhan Plus programme in the context of RRBs in India. The JanDhan Plus programme has already made a significant impact by increasing the adoption of basic financial services among 80 million JanDhan account holders.

- Capital expenditure support to RSETIs/RUDSETIs: A one-time grant support up to a maximum of ₹4.5 lakh per RSETI/RUDSETI is provided for the purchase of training equipment and maintenance. Support can also be provided to banks for running business and skill development centres, including RSETIs/RUDSETIs.

- Special Campaign 3.0: As directed by DFS, GOI, NABARD coordinated with all RRBs for the successful implementation of the programme. RRBs conducted special financial literacy camps during October 2023, resulting in the opening of new Pradhan Mantri Jan Dhan Yojana (PMJDY) accounts and fresh enrolments under Pradhan Mantri Suraksha Bima Yojana (PMSBY), Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), and Atal Pension Yojana (APY) (Showcase 6.2). Through collective efforts of all RRBs, 640 financial literacy awareness camps were organised across the country, contributing to the opening of 1.1 lakh new PMJDY accounts and fresh enrolments of 1.8 lakh under PMSBY, 94,209 under PMJJBY, and 34,279 under APY.

- Promotion of digital payments in Agricultural Produce & Livestock Market Committees/mandis: GOI has assigned NABARD the task of promoting digital payments across 30 agricultural markets (mandis). In pursuit of this objective, NABARD implemented a range of initiatives. These included organising about 400 financial literacy camps, digital literacy camps, and street plays in market areas and neighbouring villages. Simultaneously, POS machines are being deployed to streamline the digital payments. Collaborations with payment aggregators have also been established to facilitate QR code-based payments. Additionally, strategic placement of banners and hoardings has been undertaken to underscore the benefits of digital transactions. These concerted efforts aim to encourage a shift in behaviour among farmers and stakeholders, thereby enhancing transparency in financial transactions within agricultural markets.

Showcase 6.2: Paradigm shift through financial literacy, Bihar

Project: Running a Special Financial Literacy Programme and enabling access to banking services for rural communities

Location: Bihar

Implemented by: Dakshin Bihar Gramin Bank

Grant assistance: ₹140.1 lakh

Challenges faced: The communities faced lack of awareness about banking services and had limited access to livelihood opportunities.

Intervention: Implementation of extensive awareness generation programmes

Output>> Outcomes>>Impact

- Geographical coverage: 46,366 participating beneficiaries from 1,046 villages across 20 districts

- Accounts opened:

- PMJDY new accounts opened: 13,039

- PMJJBY enrolments: 17,267

- Savings bank accounts opened: 11,480

- Credit cards issued/reactivated: 977

- PMSBY enrolments: 23,255

- APY enrolments: 7,700

- Debit cards issued: 1,403

- Credit cards issued/reactivated: 977

Spotlight on Aropur

Aropur village is located in Bihar’s agricultural heartland. Previously lacking in financial literacy, now nearly half the villagers have opted for banking services, resulting in over 1,920 new accounts being opened. As a result:

- The utilisation of crucial government initiatives (PMSBY, PMJJBY, and APY) has improved significantly.

- Over 150 small farmers are receiving support from programmes such as KCC and PM-KISAN.

- The establishment of 50 self-help groups has fostered financial independence of women and their sense of empowerment and community cohesion.

- Entrepreneurs have leveraged PM Mudra Yojana loans to grow their businesses, generating incomes and employment locally through the establishment of new production units.

- Additionally, under PMAY–G, four villagers are now proud owners of permanent homes.

Conclusion: Through collaborative efforts and targeted interventions, Dakshin Bihar Gramin Bank, with NABARD’s support, has significantly improved financial literacy, access to banking services, and digital awareness among rural communities, paving the way for inclusive growth and development in rural Bihar.

APY = Atal Pension Yojana, KCC = Kisan Credit Card, PMAY–G = Pradhan Mantri Awaas Yojana–Gramin, PM-KISAN = Pradhan Mantri Kisan Samman Nidhi, PMJDY = Pradhan Mantri Jan Dhan Yojana, PMJJBY = Pradhan Mantri Jeevan Jyoti Bima Yojana, PMSBY = Pradhan Mantri Suraksha Bima Yojana.

6.8 WAY FORWARD

institution, however, it has also influenced and laid out policies to effectively address demand side challenges. NABARD monitors refinance to mitigate credit risk and improve access in credit-starved regions through its many products and campaigns. Since its inception, NABARD has focused on augmenting the supply of refinance. As a development

In recent years, NABARD’s initiatives have become more technology-led. NABARD is continuously investing in technology and digitalisation to deploy innovative delivery models to bridge the existing inequities in credit access. In the near future, NABARD will also leverage the advantages offered by big data, artificial intelligence, and quantum computing in achieving cent per cent penetration, saturation, and financial inclusion. And yet, NABARD will never lose sight of the many human catalysts that keep the credit machinery running in rural areas.

NABARD’s upcoming initiatives include:

A. Connectivity through HTS/SD-WAN

- A new connectivity technology (providing spot-beam connectivity through satellite) HTS VSAT and Dual LTE, along with SD-WAN, is being provided to banks along with the current wide-beam VSAT for better connectivity.13 HTS VSAT is more reliable and reduces network congestion, making it a valuable upgrade for banks’ communication systems and useful to enhance banking connectivity and services.

- HTS systems and SD-WAN are significant in the context of regional connectivity disparitydue to their potential to enhance connectivity and financial services delivery, especially inunderserved areas.

B. Scheme for compensating BCs/CSPs operating in the hilly states

- The scheme for compensating BCs operating in NER was launched in 2023 providing incentives to BCs on achieving a target number of monthly transactions. The scheme is being extended to compensate BCs operating in other hilly areas—Himachal Pradesh, Jammu & Kashmir, Ladakh, and Uttarakhand.

C. Automation of Jansuraksha Portal for RRBs

- As a part of the Jan Suraksha schemes—PMJJBY, PMSBY, and APY—the automation of the Jansuraksha Portal facilitates the issuing of policy and remittance of claims online, creating a repository of data to avoid duplicate policies. It is crucial for providing social security coverage and financial protection against unforeseen risks and uncertainties, especially for the unorganised sector.

- NABARD’s role in extending Jansuraksha access to all 43 RRBs underscores its commitment to financial accessibility and efficiency across rural communities. This initiative will bring the RRBs at par with the commercial banks in digital enrolment and claim settlement for Jan Suraksha schemes by aligning with the government’s vision of Digital India.

D. Financial Inclusion 2.0

- NABARD will collaborate with RBI under the National Strategy for Financial Inclusion 2.0 to prepare a comprehensive strategy to be implemented by leading financial institutions in the next 5 years.

NOTES

- States and Union Territories by region

- South: Andhra Pradesh, Telangana, Karnataka, Kerala, Tamil Nadu, Puducherry, and Lakshadweep

- West: Gujarat, Goa, Maharashtra, Dadra & Nagar Haveli, and Daman & Diu

- North: Haryana, Himachal Pradesh, Punjab, Rajasthan, Jammu & Kashmir, Delhi, and Chandigarh

- Central: Madhya Pradesh, Chhattisgarh, Uttar Pradesh, and Uttarakhand

- East: Bihar, Jharkhand, Odisha, West Bengal, and Andaman & Nicobar Islands

- North East: Assam, Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Tripura, Nagaland, and Sikkim

- AIF = Agriculture Infrastructure Fund, MSC = Multi-Service Centre, PACS = Primary Agricultural Credit Society.

- MSME = Micro-, Small-, and Medium-Sized Enterprises.

- TransUnion CIBIL Limited is a credit information company operating in India.

- The mission of the Warehousing Development and Regulatory Authority is to establish a negotiable warehouse receipt (NWR) system in the country.

- DAY–NRLM = Deendayal Antyodaya Yojana–National Rural Livelihood Mission, WSHG = Women Self- Help Group.

- https://www.nabard.org/auth/writereaddata/WhatsNew/2205244306chairman-launches-first-of-itskind- accelerator-project.pdf.

- ATM = Automated Teller Machine, NEFT = National Electronic Funds Transfer, RTGS = Real Time Gross Settlement.

- AUA = Aadhaar User Agency, CSP = Customer Service Point, BHIM = Bharat Interface for Money, KUA = KYC User Agency (KYC = know your customer), PFMS = Public Financial Management System, UPI = Unified Payments Interface.

- VSAT = Very Small Aperture Terminal.

- POS/MPOS = point of sale/mobile point of sale.

- IIT = Indian Institute of Technology, RUDSETI = Rural Development & Self Employment Training Institute.

- HTS = High Throughput Satellites, LTE = Long-Term Evolution, SD-WAN = Software-Defined Wide Area Network.

© 2024 NABARD All Rights Reserved

Designed & Developed by RDX Digital