i nc lu s i ve f i nanc e

7

Overall 45 per cent of the urban residents and 32

per cent of the rural residents were estimated to

be having bank accounts. There is also significant

variation from district to district.

18

(viii) A more widely followed analysis of the extent of

financial inclusion is available from the CRISIL

Inclusix which was first released in 2013 and in

2014 has released the second round of findings

pertaining to 2012. Besides there was a new study by

Financial Inclusion Insights, which undertook the

most comprehensive survey of financial behaviour

in India during 2013–14. The results and findings

of these studies are reported and discussed in greater

detail as follows.

1.4.1 CRISIL Inclusix

CRISIL launched the Inclusix tool, developed with sup-

port from Ministry of Finance, Government of India and

Reserve Bank of India in the year 2013. In January 2014,

CRISIL brought out the latest computation of Inclusix

based on the data made available by Reserve Bank of

India till March 2012 and covered all the 638

19

districts

of the country.

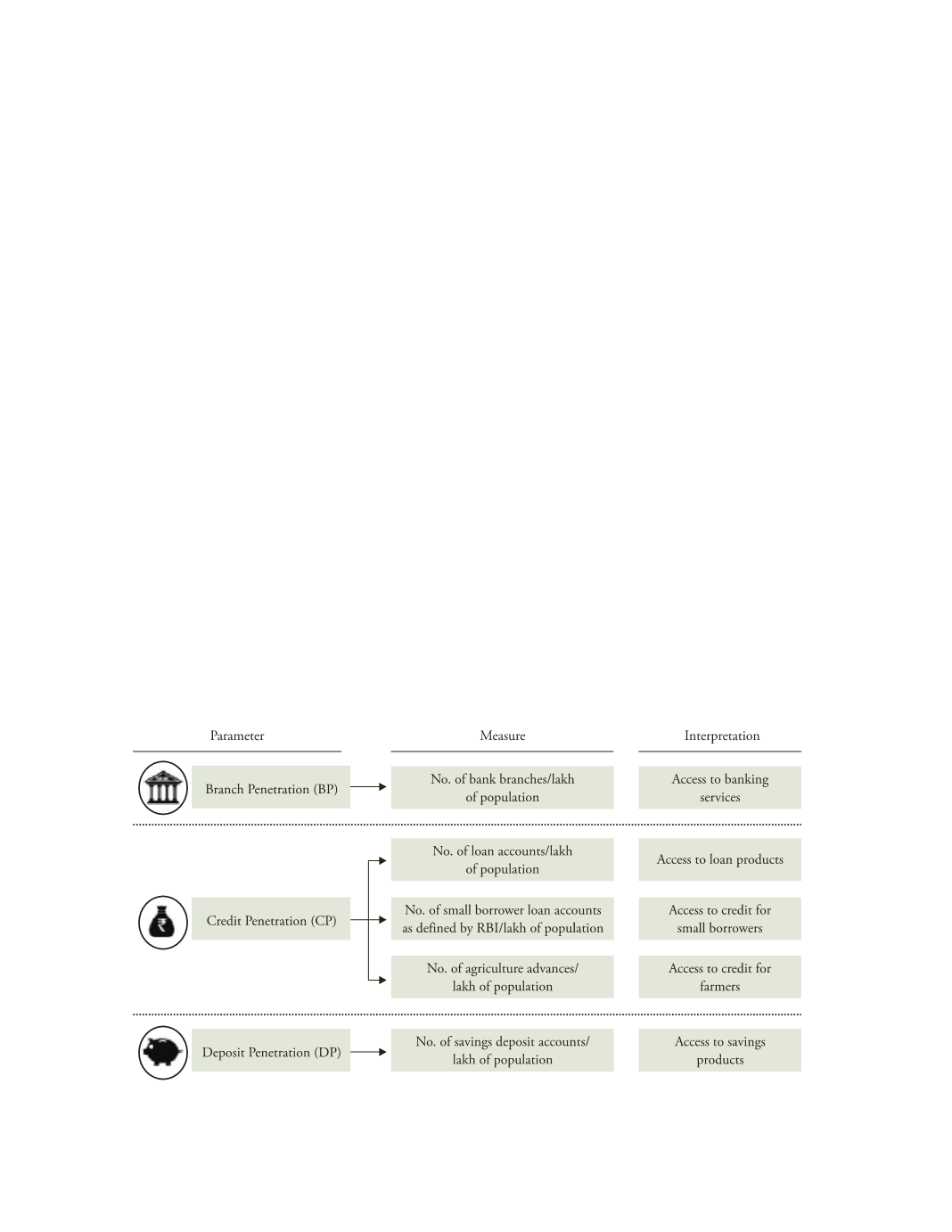

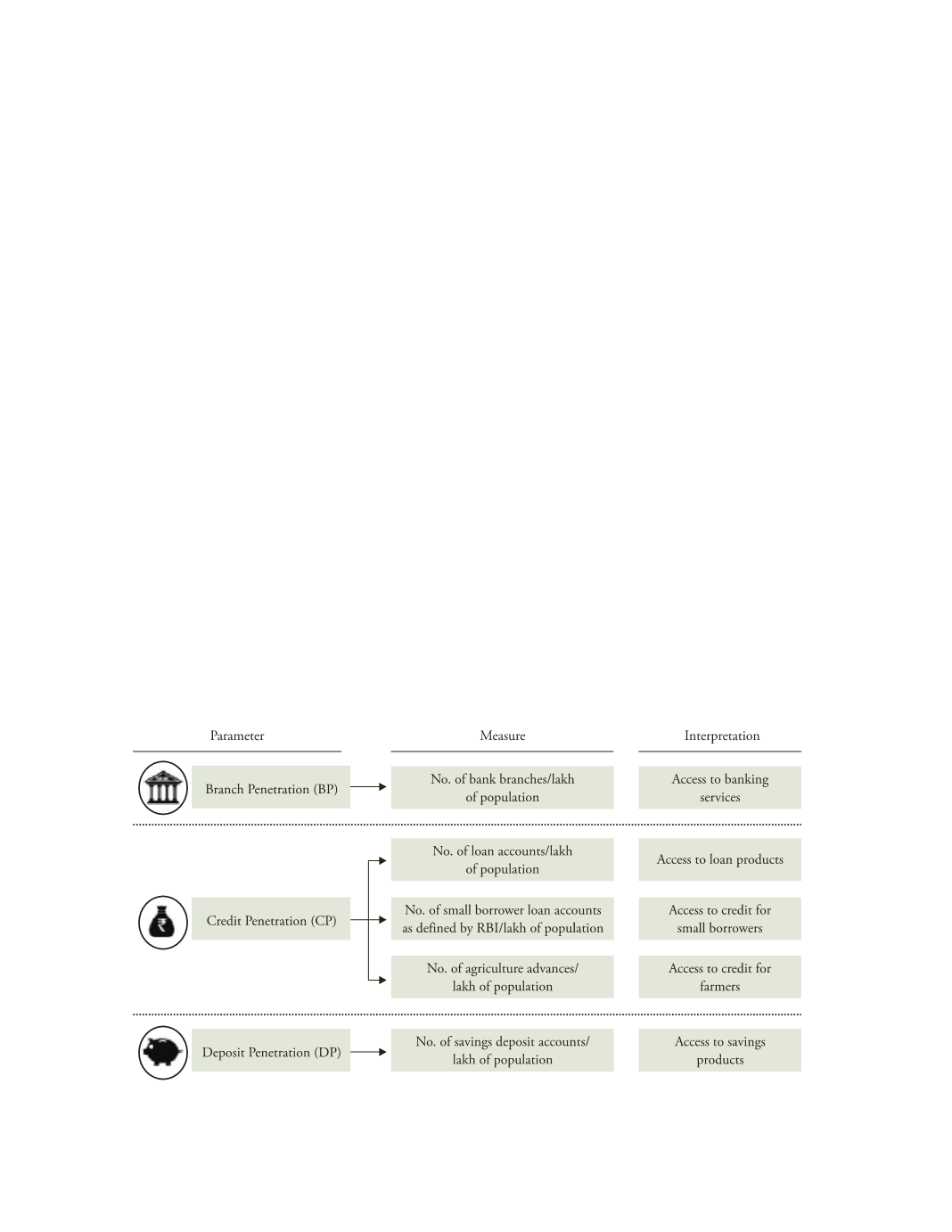

CRISIL uses a statistically robust and transparent

methodology. It is a relative index on a scale of 0 to 100,

and combines three critical parameters of basic banking

services—branch penetration, deposit penetration, and

credit penetration—into one metric. Besides measur-

ing inclusion at the district, state and national levels,

the index can be used to compute progress on financial

inclusion by each bank. CRISIL Inclusix also enables

inter-temporal comparison for financial inclusion. The

latest Inclusix assesses trends in financial inclusion in

India in fiscal 2012 compared with 2011, 2010 and 2009.

Based on CRISIL Inclusix scores, CRISIL has come up

with four categories—low (<25), below average (25.0 to

40.1), above average (40.1 to 55) and high (>55) levels of

financial inclusion.

As evident from Figure 1.2 whilst calculating financial

inclusion CRISIL Inclusix uses non-monetary aggregates

like ‘number of people’ whose lives have been touched

by various financial services, rather than the ‘amounts’

deposited or loaned—which negates the disproportionate

impact of a few high-value figures on the overall picture.

Currently the index has been calculated based on

the data related to the banking system (scheduled com-

mercial banks and RRBs) provided by the RBI (Figure

1.3). Data from a large network of cooperative banks and

F

IGURE

1.2

CRISIL Inclusix