i nc lu s i ve f i nanc e

9

be tracked to understand the continued state of exclusion

as also the credit-GDP ratio at the district or state level,

as a measure of financial deepening.

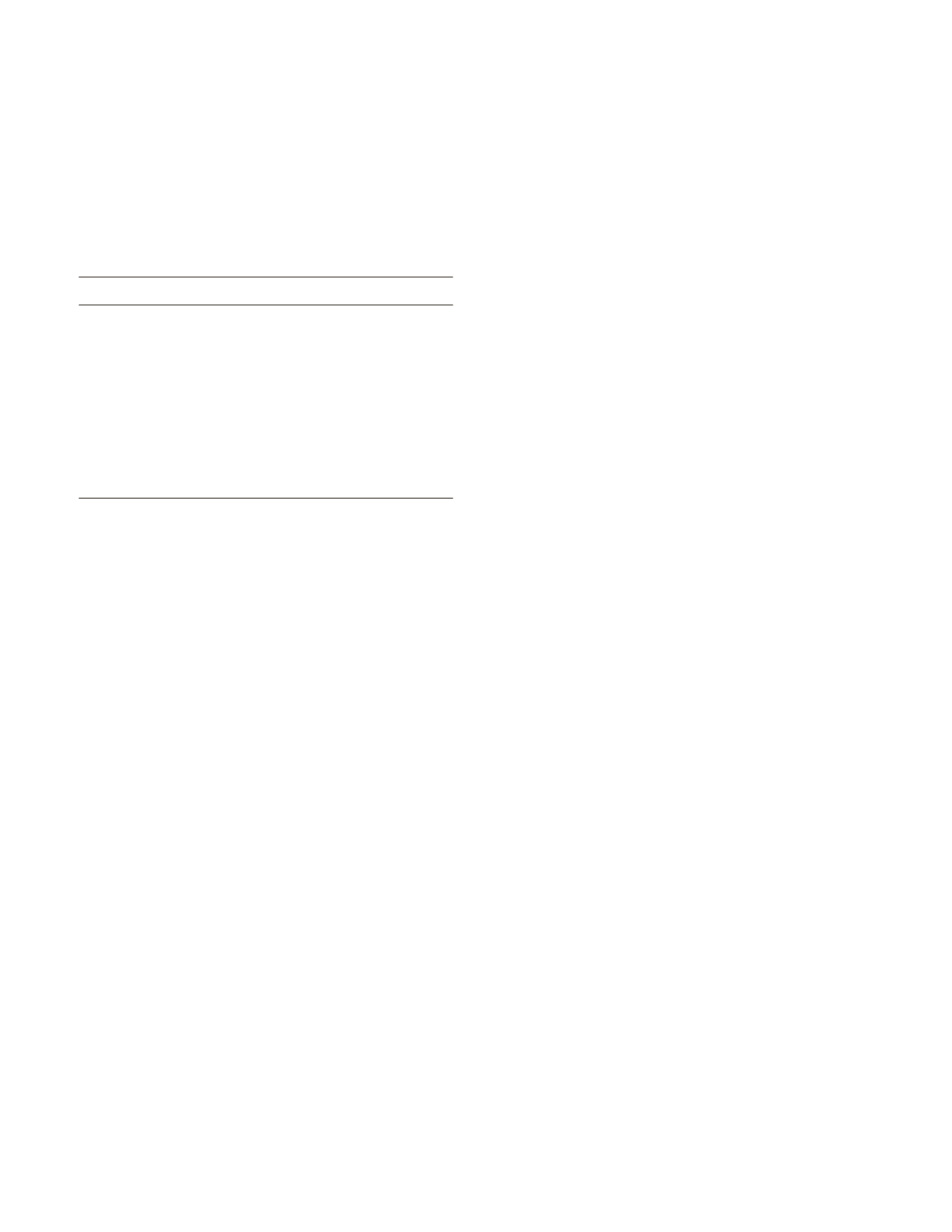

T

ABLE

1.3

Crisil Inclusix: Top States/Union Territories

and Districts

States/Union territories

Districts

Top 5

Puducherry

Pathanamthitta

Chandigarh

Karaikal

Kerala

Thrissur

Delhi

Ernakulam

Goa

Thiruvananthapuram

Bottom 5

Manipur

Kurung Kumey

Bihar

Mon

Nagaland

South Garo Hills

Arunachal Pradesh

Imphal East

Chattisgarh

Ukhrul

Source

: CRISIL (2013).

1.4.2 Financial Inclusion Insights Tracker Survey

and Digitized Government Payments Study

20

Financial Inclusion Insights, an international research

program on digitized financial services supported by

the Bill and Melinda Gates Foundation, conducted the

Tracker Survey and the Digitized Government Payments

Qualitative Study in India from October 2013–January

2014 which studied the financial behavior of Indian

adults. In particular, the focus of the study was on the

access and use of banking services and mobile money ser-

vices as well as triggers and barriers for potential uptake.

The Tracker Survey

covered a nationally representative

sample of 45,024 Indian adults, ages 15 and older on

access and use of financial services

21

as well as barriers

and potential for future use and was conducted from

October 2013 to January 2014.

The Digitized Government Payments Study across

four districts in the state of Maharashtra was conducted

during December 2013, and focussed on the potential

for digital government payments to expand financial in-

clusion. The study covered beneficiaries of social security

pensions, post-matric scholarships and National Rural

Employment Guarantee Scheme (NREGS) as those who

receive payments through Direct Benefit Transfer (DBT)

and those who receive payments in non-DBT form (e.g.,

cash, cheques, etc.)

The key findings of the survey and study were:

General Financial Behaviour

•

70 per cent of those who saved money did so in a bank

and 35 per cent saved at home. Nationally, 3 per cent

saved through village-level savings groups. Village-level

savings groups were relatively more popular in states

such as Andhra Pradesh (23 per cent), Chhattisgarh

(18 per cent) and Maharashtra (14 per cent).

•

For loans, most borrowers relied on those within their

personal networks, including relatives, neighbours

and friends (67 per cent).

Eleven per cent of borrowers

borrowed from a bank

, 12 per cent borrowed from a

private money lender and 4 per cent borrowed within

their savings group. Based on the state-wise analysis,

Tamil Nadu topped the chart with 52 per cent of the

respondents depending on money lenders for a loan

and Bihar occupying the second place with 46 per cent

of the borrowers opting for loans from money lenders.

Madhya Pradesh (39 per cent), Assam (37 per cent)

and Jharkhand (30 per cent) were the other states that

also had a high number of borrowers dependent on

money lenders.

•

As far as

digital financial services

22

were concerned,

according to the Tracker survey,

48 per cent of respon-

dents had accessed a bank account,

23

47 per cent of the

respondents held a bank account, and 25 per cent of

respondents actively used

24

a bank account

. Only 0.3

per cent of respondents, however, had accessed Mobile

Money, 0.2 per cent of respondents wereMobileMoney

account holders and only 0.1 per cent had actively

used their Mobile Money accounts. 0.07 per cent of

the respondents held both active bank accounts and

an active mobile money account, whereas rest of the

respondents (nearly 75 per cent) neither held active

bank nor mobile money accounts.

•

Although 47 per cent have their own bank account,

only 54 per cent of these bank account holders

have used their bank accounts actively (in the past

90 days).

•

77 per cent of active bank account holders (base =

10,570) said that their bank branch was within 5 km

(base = 10,570) and 84 per cent of active bank account

holders said that their ATM was within 5 km (base =

3,323).