152

data between direct and indirect lendings. As stated above, the data for

commercial banks in the above Table 5.6 include indirect lendings but the

same does not appear to be true of cooperative banks. This observation is

based on the fact that for many years the

SACP

series for cooperatives are

lower than the

Handbook

series. RIDF deposits are covered in commercial

banks’ lendings and cannot be so in cooperatives data. Also, if the RBI’s

Handbook

series are to be believed, indirect lendings by cooperative banks

have constituted much larger sums than those by commercial banks (see, for

details, an earlier paragraph and Annexure N). As a result, the decline in the

proportion of agricultural credit attributable to cooperative banks cannot be as

sharp as the NABARD data indicate; NABARD data obviously exclude indirect

credit data in respect of cooperatives. As for commercial banks, our conviction

of the proposition of mix-up is based on the following factual position.

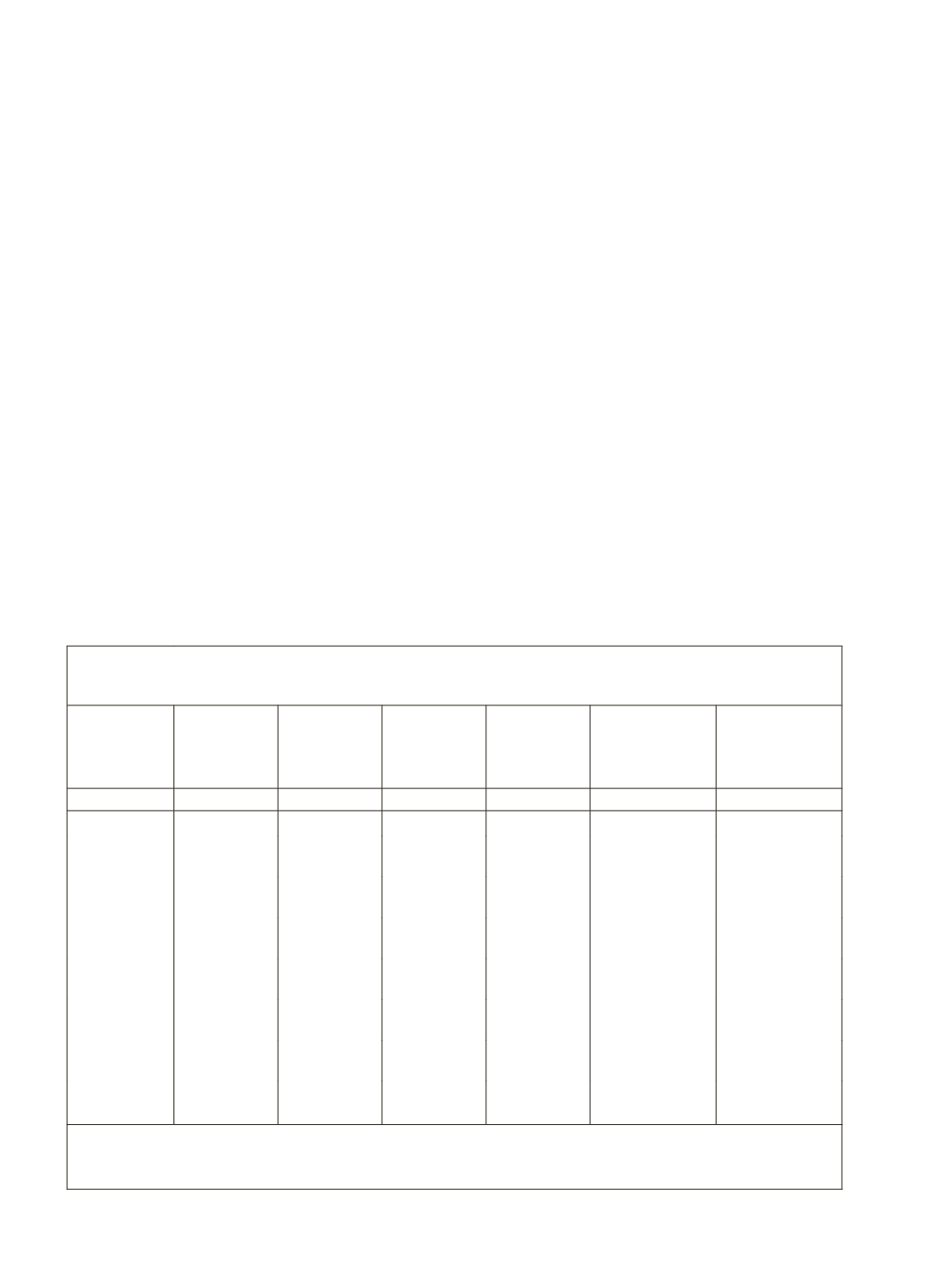

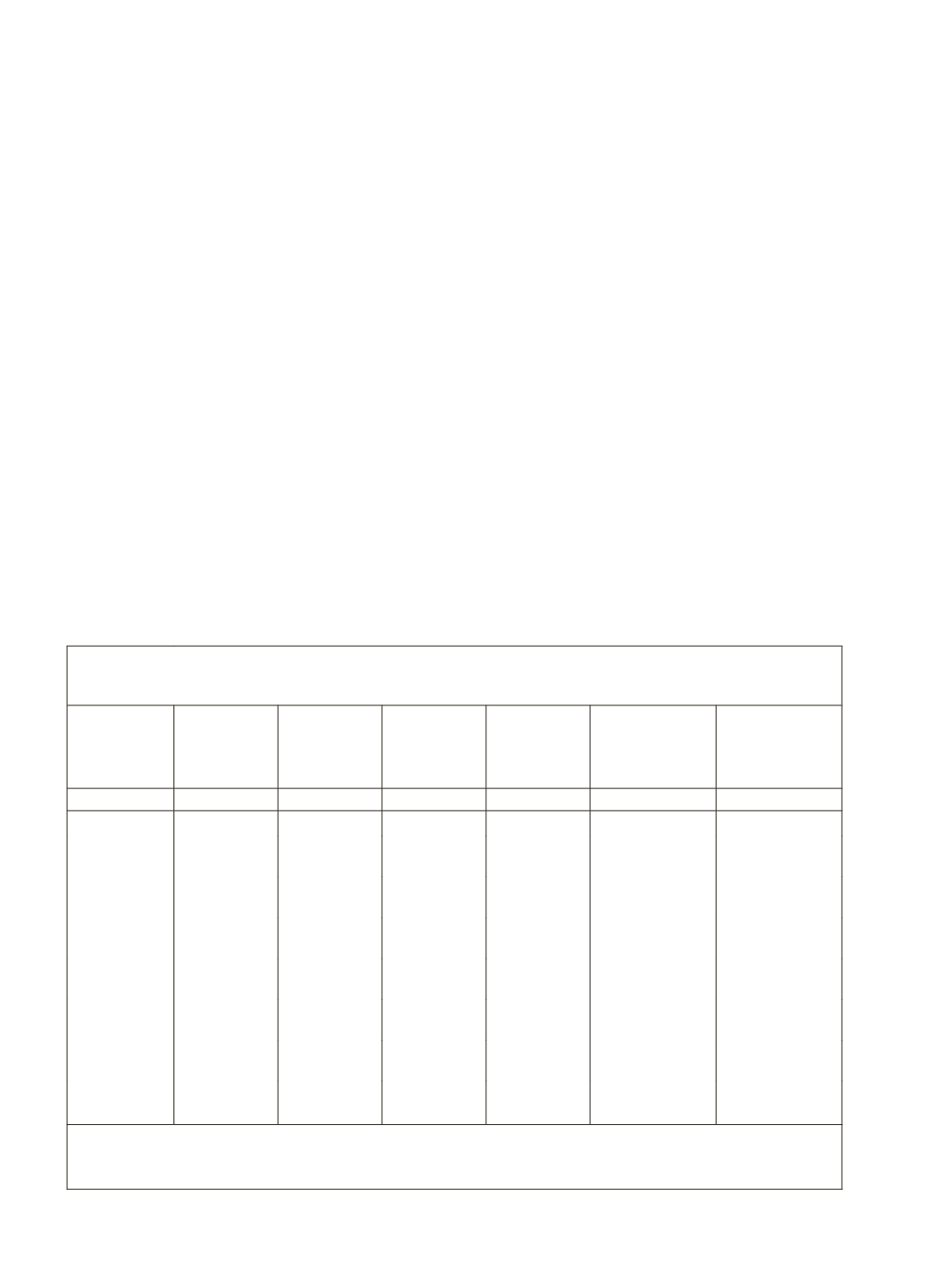

The Advisory Committee on Flow of Credit To Agriculture and Related

Activities From the Banking System

(Chairman: V.S. Vyas; June 2004) had

obtained the relevant data from the Rural Planning and Credit Department of

the RBI as reproduced in Table 5.8. As shown in the caption of the table (page

13 of V.S. Vyas 2004), these data are in respect of public sector banks. To prove

that these represent the same RBI data on commercial banks’ disbursements

Table 5.8: Disbursement of Credit to Agriculture under SACP

(by Public Sector Banks)

Year

Production

Credit

Investment

Credit

Total Direct

Lending

Indirect

Lending

Total

Disbursement

Total

Disbursements

by Public

Sector Banks*

(1)

(2)

(3)

(4)

(5)

(6)

(7)

1995-96

4,951

4,040

8,991

1,182

10,172

-

1996-97

6164

(24.5)

4,896

(21.2)

11,061

(23.0)

1,721

(45.7)

12,782

(25.6)

-

1997-98

7,299

(18.4)

5,373

(9.7)

12,672

(14.6)

2,136

(24.1)

14,808

(15.8)

14,808

1998-99

8,204

(12.4)

6,063

(12.9)

14,267

(12.6)

3,521

(64.8)

17,787

(20.1)

17,788

1999-2000 9,903

(20.7)

6,120

(1.0)

16,023

(12.1)

5,890

(67.3)

21,913

(23.2)

21,913

2000-01

11,615

(17.3)

6,818

(1.1)

18,433

(15.0)

6,221

(5.6)

24,654

(12.5)

24,654

2001-02

15,385

(32.5)

7,288

(6.9)

22,673

(23.0)

6,659

(7.0)

29,332

(18.0)

29,332

2002-03

18,319

(19.1)

7,831

(7.5)

26,150

(15.3)

7,771

(16.7)

33,921

(15.6)

33,921

* Including RIDF. Figures in brackets indicate year-on-year growth rates.

Source:

(i) RBCD, RBI as Reproduced from V.S. Vyas Advisory Committee Report, June 2004, p.13

(ii) Special tabulations supplied to EPWRF for the project by the RBI [column (7)]