151

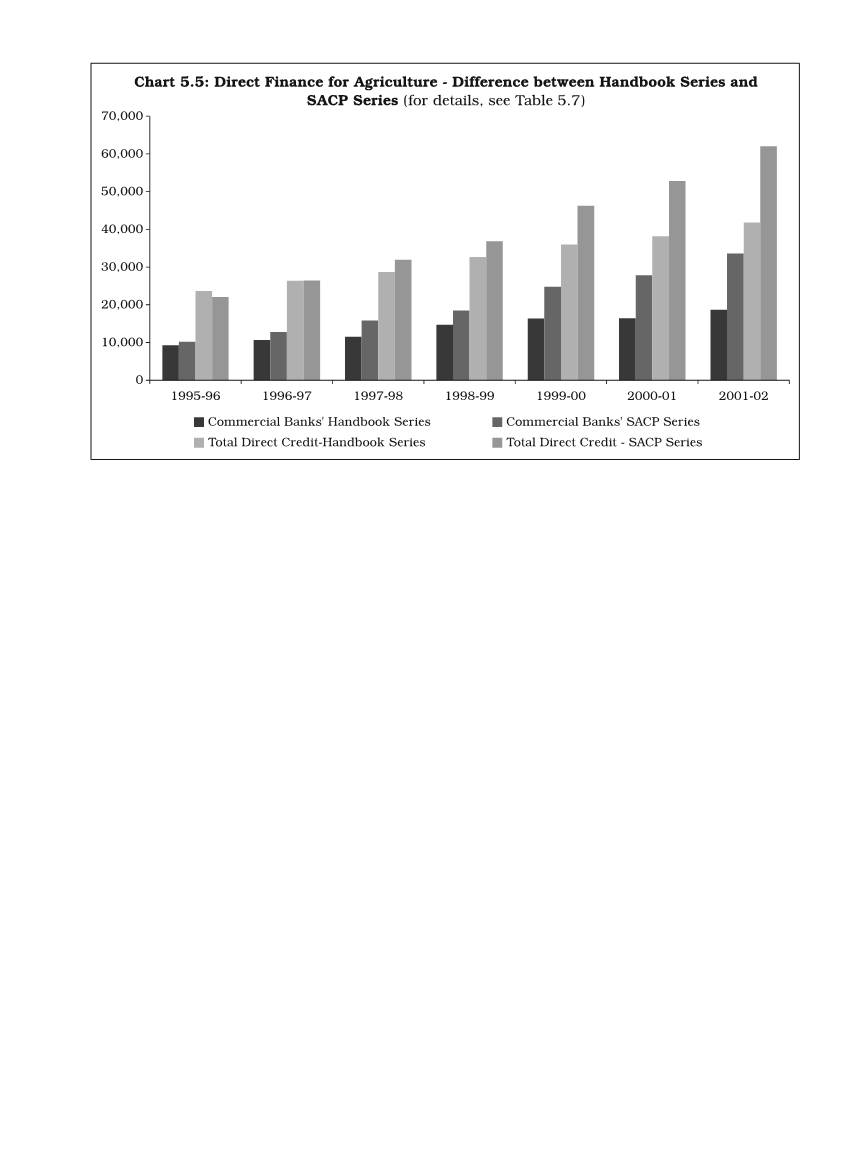

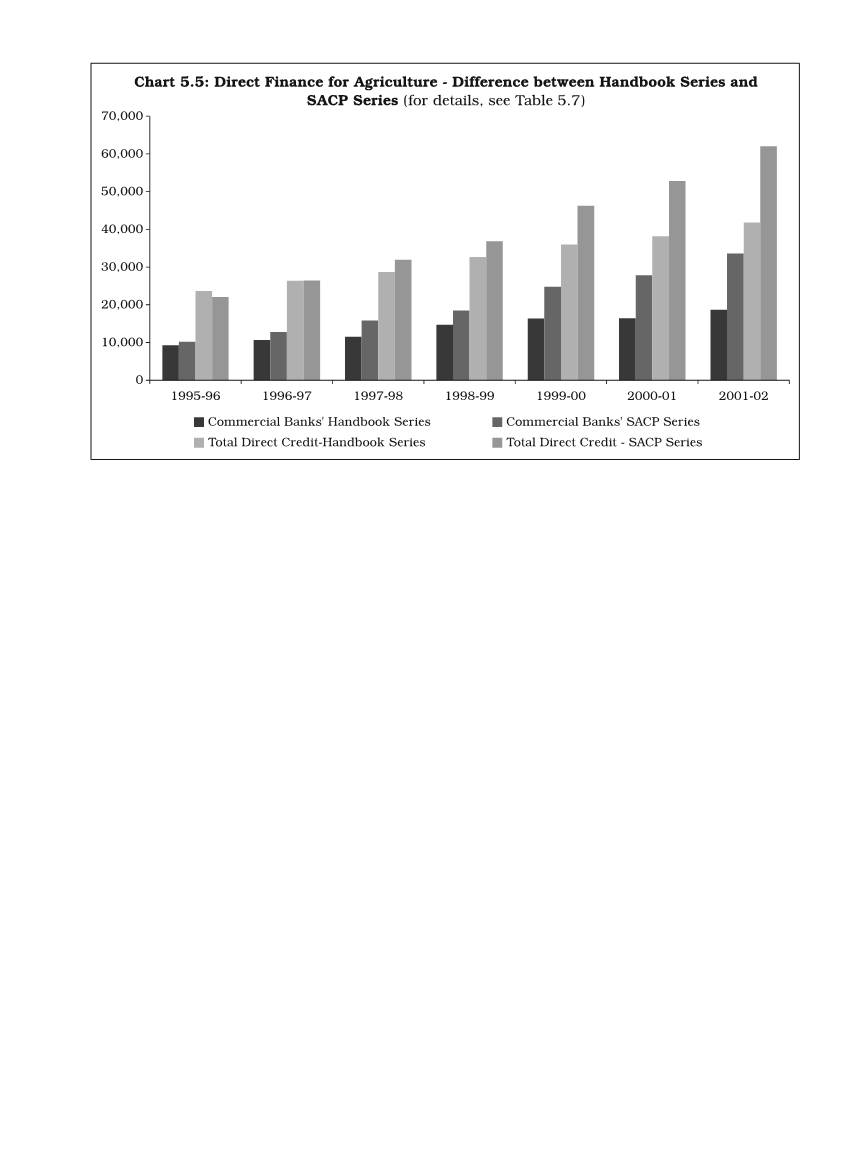

agricultural credit disbursements on direct basis at

`

33,587 crore for 2001-

02 or

`

39,774 crore for 2002-03 as against the figure of direct disbursements

at

`

18,638 crore and

`

25,256 crore, respectively, as reported earlier from the

RBI’s

Handbook.

This reveals that the official data overestimate the ground-level direct

disbursements of commercial banks by over 80% for 2001-02 or by 58% for

2002-03. In the aggregate including the differences so reported for cooperatives

and RRBs, the ground-level credit flows is placed at

`

62,045 crore for 2001-

02, that is, over 48% higher than that reported earlier (

`

41,828 crore) (see

Chart 14).

There is thus considerable mix-up in the official data on agricultural

lendings as between direct lendings and indirect credit disbursals and

outstandings, as also between crop loans and investment credit. The data

vastly differ as between sources giving rise to considerable misgivings regarding

their quality. Unless these data sets are cleaned up, it is extremely difficult to

provide any accurate assessment of the trends in growth and composition of

agricultural credit-flows and outstandings, those that are directly rendered in

favour of farmers and those rendered indirectly through supply chain agencies.

An Obvious Mix-Up in the SACPs Data

To collaborate the issue raised above, we have attempted a closer

examination of the above data to convince ourselves of the mix-up in SACPs