47

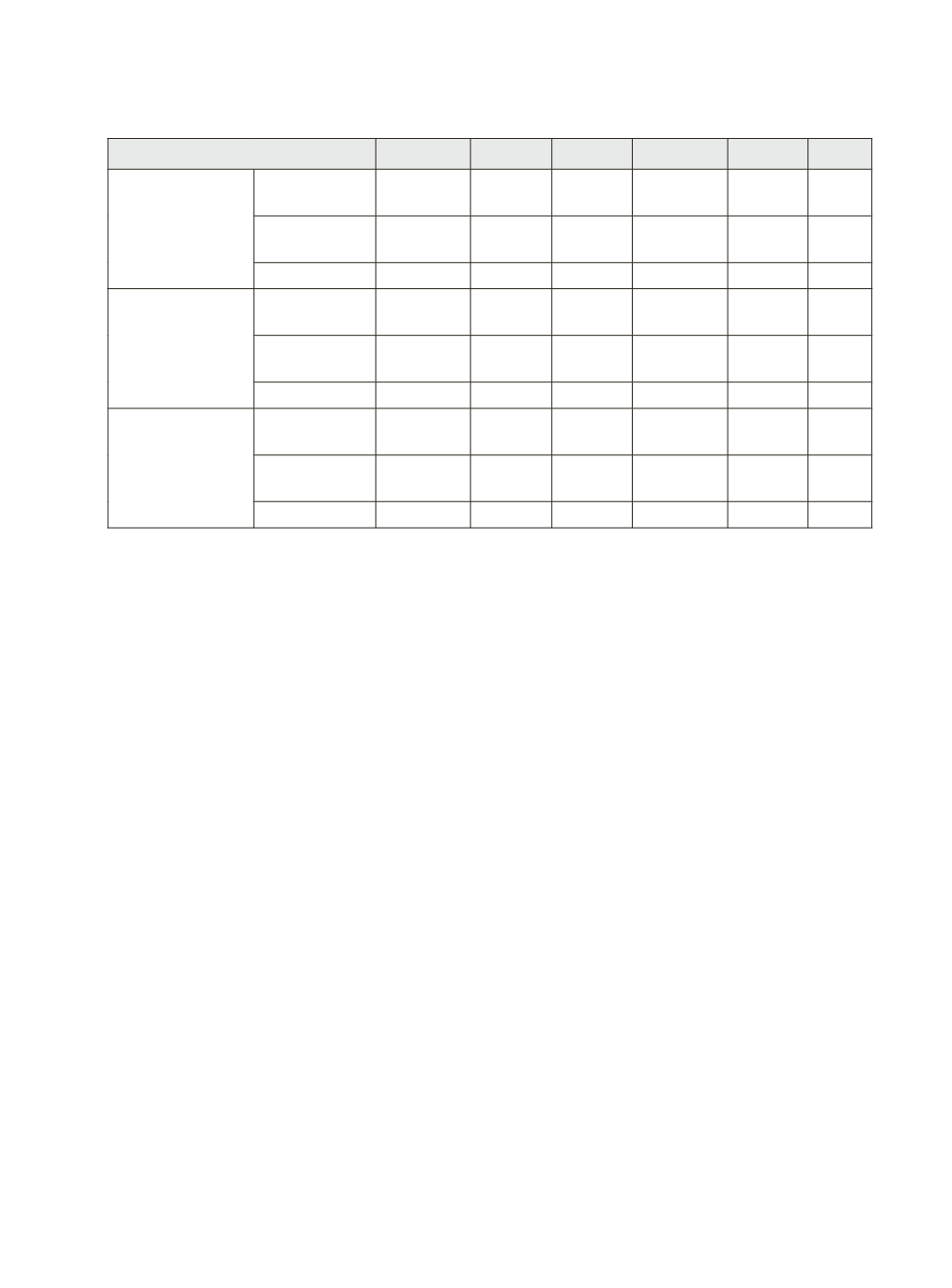

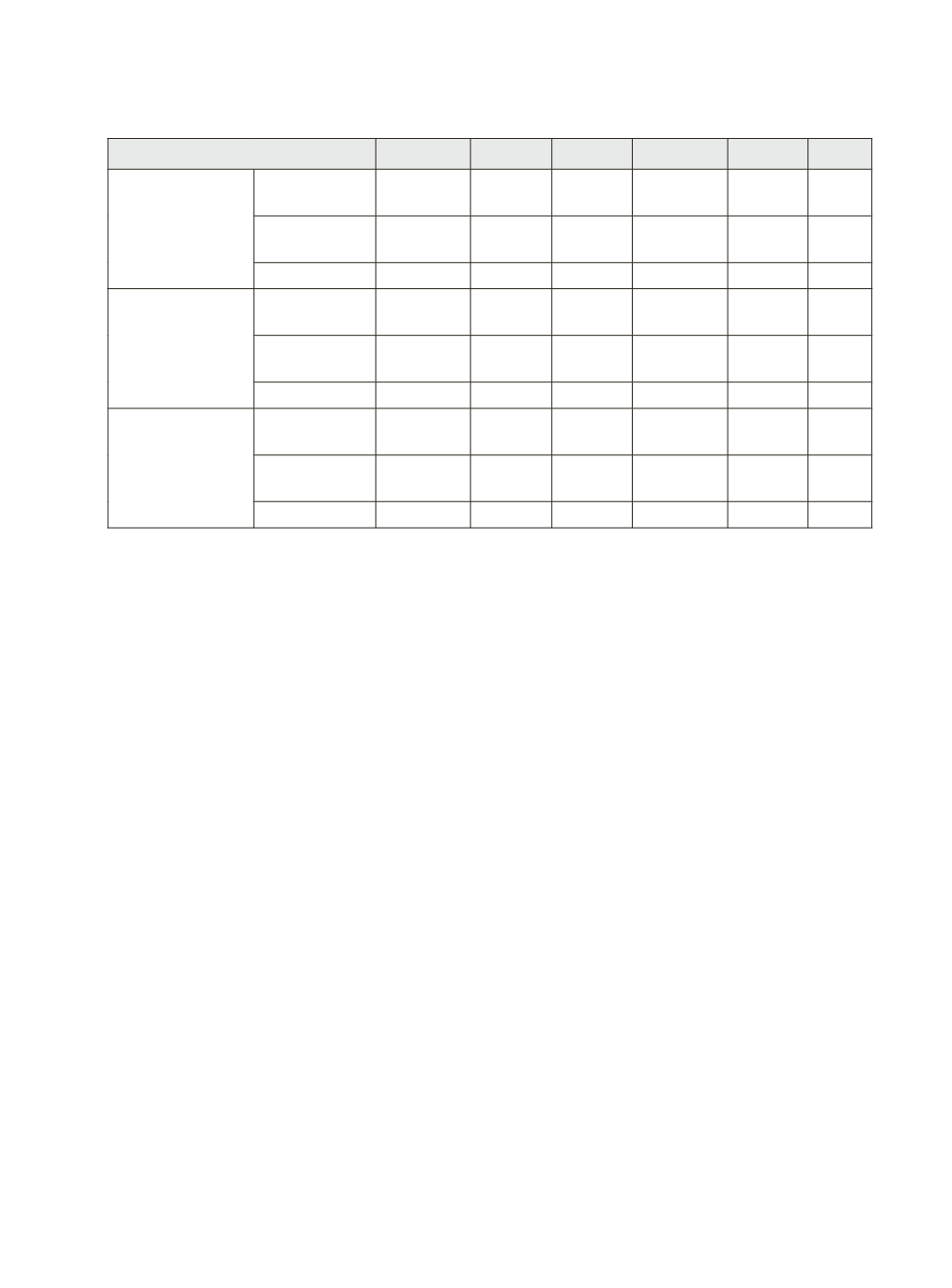

Table- 3.10: The rate of Interest on KCC loans above Rs. 3.0 lakh

and agricultural term loan

Particulars/ Parameter

Assam Bihar

UP Punjab Maha Kar

Int rate (%) on

KCC loan above

Rs 3.0 lakh

Commercial

Banks

7

11.6 9.0

11.15-

12.1

12 10.7

RRBs

7

11.0-

13.0

13.5 12.5-13.5 12.0-

13.5

12.5

Coop Banks

7

NA 10.7

10.5

9.5 12.0

Agricultural

Term Loan (%)

up to Rs.3.0

lakh

Commercial

Banks

11.0-13.0

11.0

12.1 10.7

11.15-

12.1

12 10.7

RRBs

9.65-9.9 11.2-

13.0

12.5

-13.0

12.75-

13.5

13.0-

14.0 12.5

Coop Banks 12.5

NA 10.7 11.5-13.5 13-13.5 NA

Agricultural

Term Loan (%)

above Rs.3.0

lakh

Commercial

Banks

11.4-13.1

10.45-

12.4

11.15-

12.1

12 10.7

RRBs

11.0 12.5-

13.0 13.0 12.75-

13.5

13.0-

14.0 12.5

Coop Banks 12.5

NA 10.7 11.5-13.5 13-13.5 NA

Number of Kisan Credit Cards with a Farmer

3.44 During the field visit, it was gathered that some of the farmers had taken KCC

from more than one banks, normally one from cooperative banks and the other

from either a commercial bank or a regional rural bank. As such there is nothing

wrong in it since these farmers have offered a portion of their total land to one

bank and the other portion to the other bank. Such farmers, despite average loan

sanctioned by cooperative banks being quite less, still preferred to have KCC

from cooperative Bank just to get good quality fertilizer and seed, etc. However,

the farmers were reluctant in revealing their availment of KCC loan from multiple

sources. For example, 4 farmers having KCC with Sherghati branch of Magadha

DCCB, Bihar indicated that they had KCC from some other banks too -Mr. Manoj

Kumar (A/C 00515008000599) with MBGM, Karanauli branch; Mr. Shailesh

Kr Sinha (A/c 000515008000997) with Bank of Baroda; Mr. Dilip Kumar (A/c

000515008100277) with Bank of Baroda; Mr. Khairat Ahmad also with Bank of

Baroda.

3.45 Some farmers in Moradabad and Bijnore districts of UP who had large farm

holdings, were also having more than one KCC. For example, Ashok Kumar,

(DCCB, Surjannagar) who had 9 acres was eligible for loan of Rs. 4.5 lakh, but

since there was no interest subvention beyond Rs. 3 lakh, he had availed two

KCCs, one from HDFC Bank, Kashipur branch and another KCC from DCCB

Moradabad. In fact, the farmer indicated that the private bank disbursed the

loan in less than a fortnight whereas the DCCB took about six months, and

imposed additional conditionality of cash and kind component, and fixed the

repayment date as 30 June. Similarly, Naubhar Singh also had two KCCs, for

his 9 acre landholding, Rs. 3.00 lakh from Prathama Bank & Rs. 0.50 lakh from

DCCB Moradabad.