419

89.35 million farm households, 43.42 million (48.6 per cent) were reported

to be indebted. That is, 51.4 per cent or about 46 million did not enjoy

any indebtedness (of the value above

`

300) to any of the credit agencies –

international or non-international.

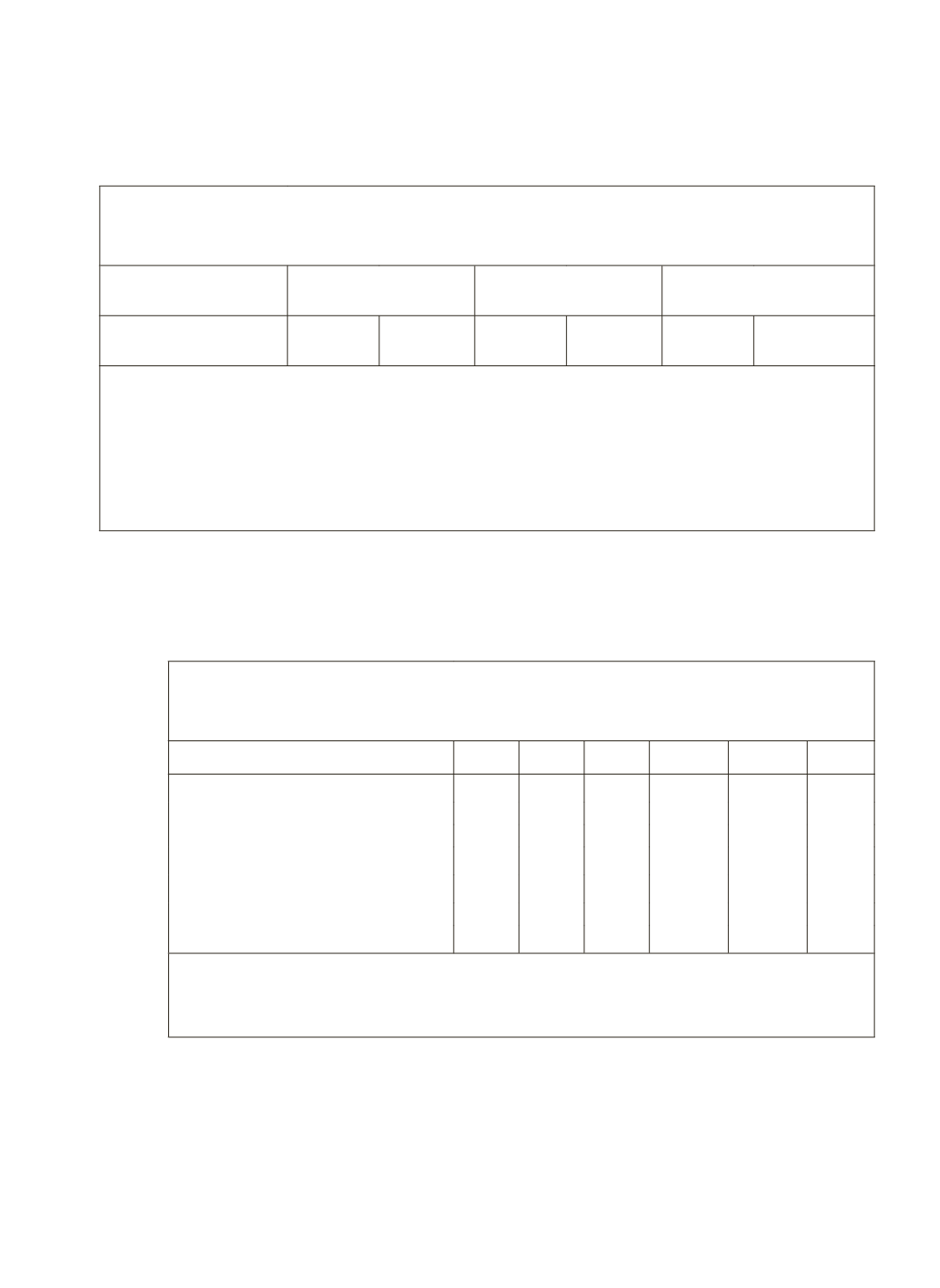

Table 1: Number of Rural, Farmer and Indebted and Non-Indebted Farmer

Households as per NSS 59th Round Survey (January-December 2003)

(Number in Million)

Rural

Households

Farmer

Households

Indebted Farmer

Households

Non-Indebted

Farmer Households

147.90

89.35

(60.4)

43.42

(29.4)

[48.6]

45.93

(31.1)

[51.4]

Note

(i) Figures in round brackets are percentages to total rural households

(ii) Figures in square brackets are percentages to total farmer households

(iii) Farmer household was defined as one in which at least one family member was farmer.

(iv) Farmer was defined as a person who possesses some land and was engaged in agricultural

activities on any part of the land during the 365 days preceding the date of survey.

(v) Indebtedness refers to liability in each or kind

`

300 or more as value of transaction

Source:

NSSO (2005), Indebtedness of Farmer Households, Situation Assessment Survey of Farmers,

NSS 59

th

Round (January-December 2003), Report No. 498(59/33/1)

Institutional Sources

(i)

For the indebted households, about 58 per cent of loans have been

provide by institutional agencies (Table 2).

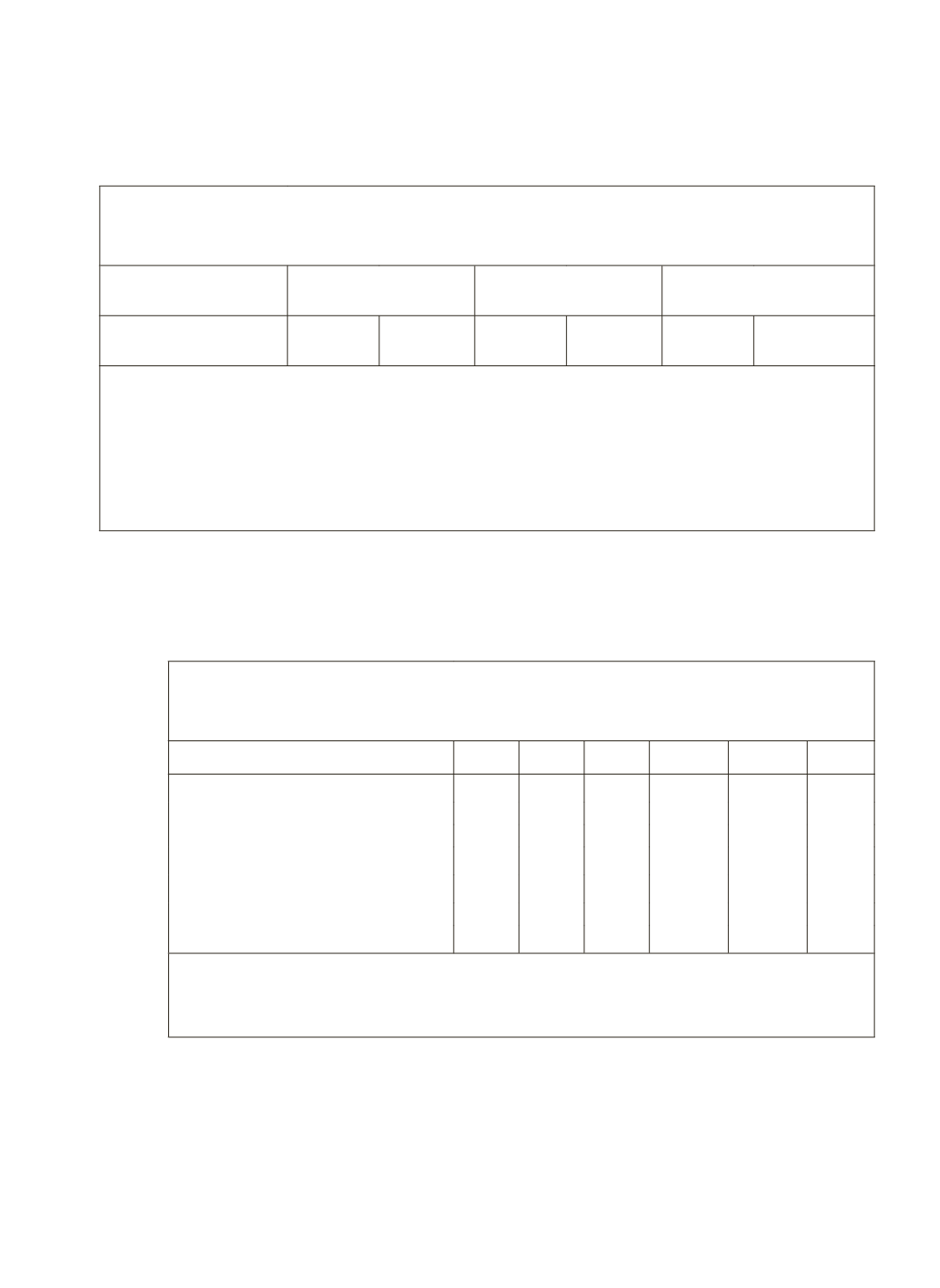

Table 2: Relative Share of Debt

#

of Cultivator Households

from Different Sources

(In per cent)

Sources of Credit

1951 1961 1971 1981 1991 2002

Institutional of which:

7.3 18.7 31.7 63.2 66.3 61.1

Co-op Soc/Banks, etc

3.3 2.6 22.0 29.8 30.0 30.2

Commercial Banks

0.9 0.6 2.4 28.8 35.2 26.3

Non-Institutional of which:

92.7 81.3 66.3 36.8 30.6 38.9

Moneylenders

69.7 49.2 36.1 16.1 17.5 26.8

Unspecified

-

-

-

-

3.1

-

Total

100.0 100.0 100.0 100.0 100.0 100.0

Note:

# : Debt refers to outstanding cash dues

Source:

Reserve Bank of India (RBI), All-India Rural Credit Survey, 1951-52; RBI, All India Rural

and Debt Investment Survey, 1961-62 and NSSO, All-India Debt and Investment Surveys, 1971-

72, 1981-82, 1991-92 and 2003.

(ii)

A comparison over recent quinquennial surveys shows a decline in the

share of institutional debt outstanding of cultivator households from

66.3 per cent in 1991 to 61.1 per cent in 2002 and a corresponding

increase in the dependence of cultivators on money lenders. But, the

decline from institutional sources has occurred under the category of