425

27 states, 12 states have more than 24 per cent of formal sector loans from

cooperatives. Cooperatives dominate in two states: Gujarat (60.1 per cent),

Maharashtra (57.9 per cent); Tamil Nadu (43.6 per cent). Punjab (36.7 per

cent), Kerala (34.4 per cent) and Haryana (35.4 per cent) and West Bengal

(33.1 per cent) come close to them. The second revelation is that cooperatives

generally serve the sub-marginal (0.01 hectare) and marginal farmers (0.01 to

0.40 hectare) better than commercial banks. In Maharashtra, 71.5 to 64.3 per

cent of the debt are from cooperatives and in Gujarat from 23.1 per cent to

67.1 per cent in respect of sub-marginal and marginal farmers. In other states,

the situation is not uniformly so. Overall, there is unmistakable evidence that

commercial banks serve large-size farmers better.

The Incidence of Interest Burden

About 82 per cent of the rural debt against institutional agencies as of

June 2002 were in the interest range of 12 to 20 per cent while prime lending

rates (PLRs) of banks were in the range of 11 to 12 per cent. The onerous

nature of debt from non-institutional agencies is brought out by the fact that 73

per cent of their debt has been at rates of interest above 20 per cent (Table 9).

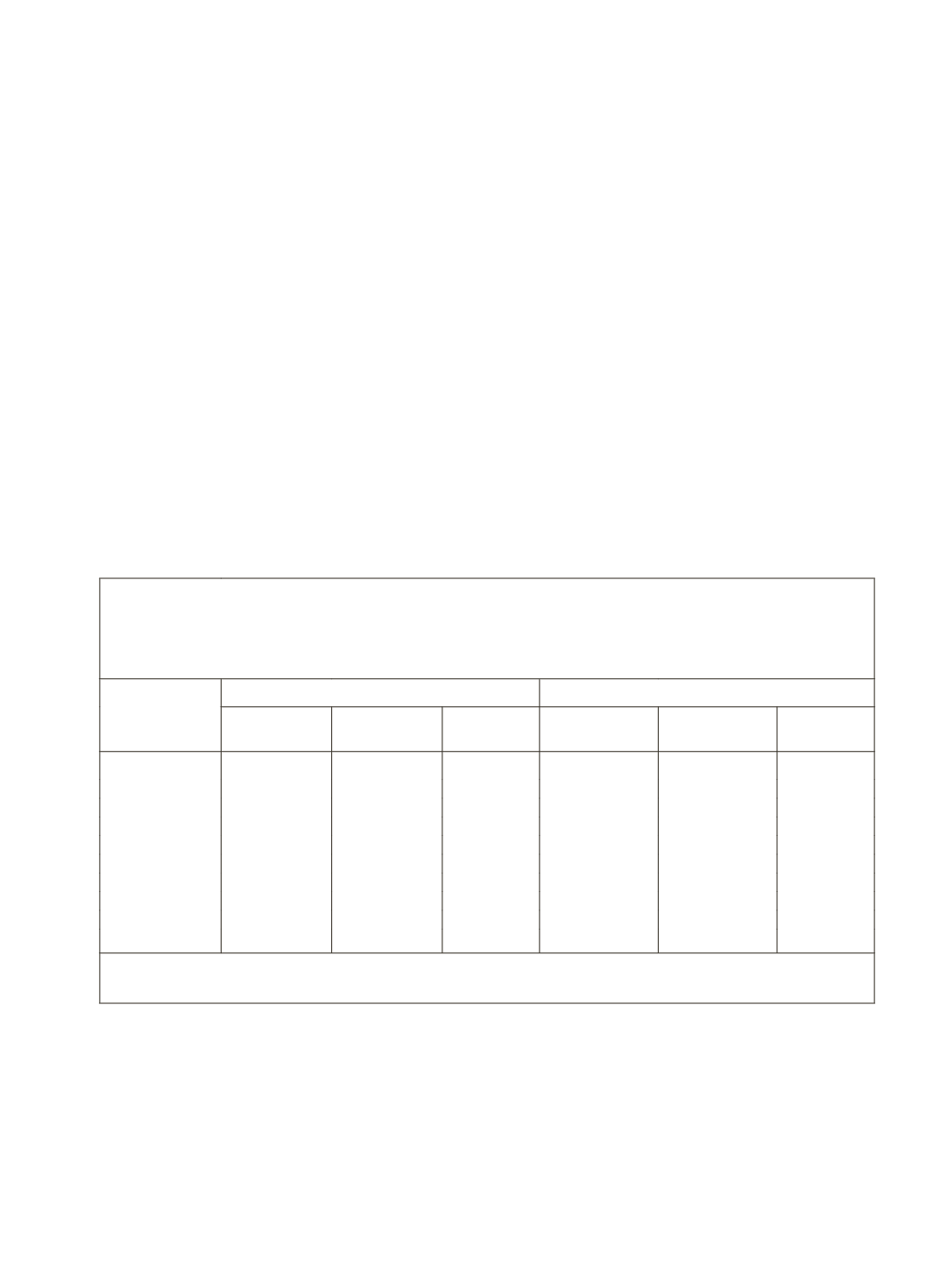

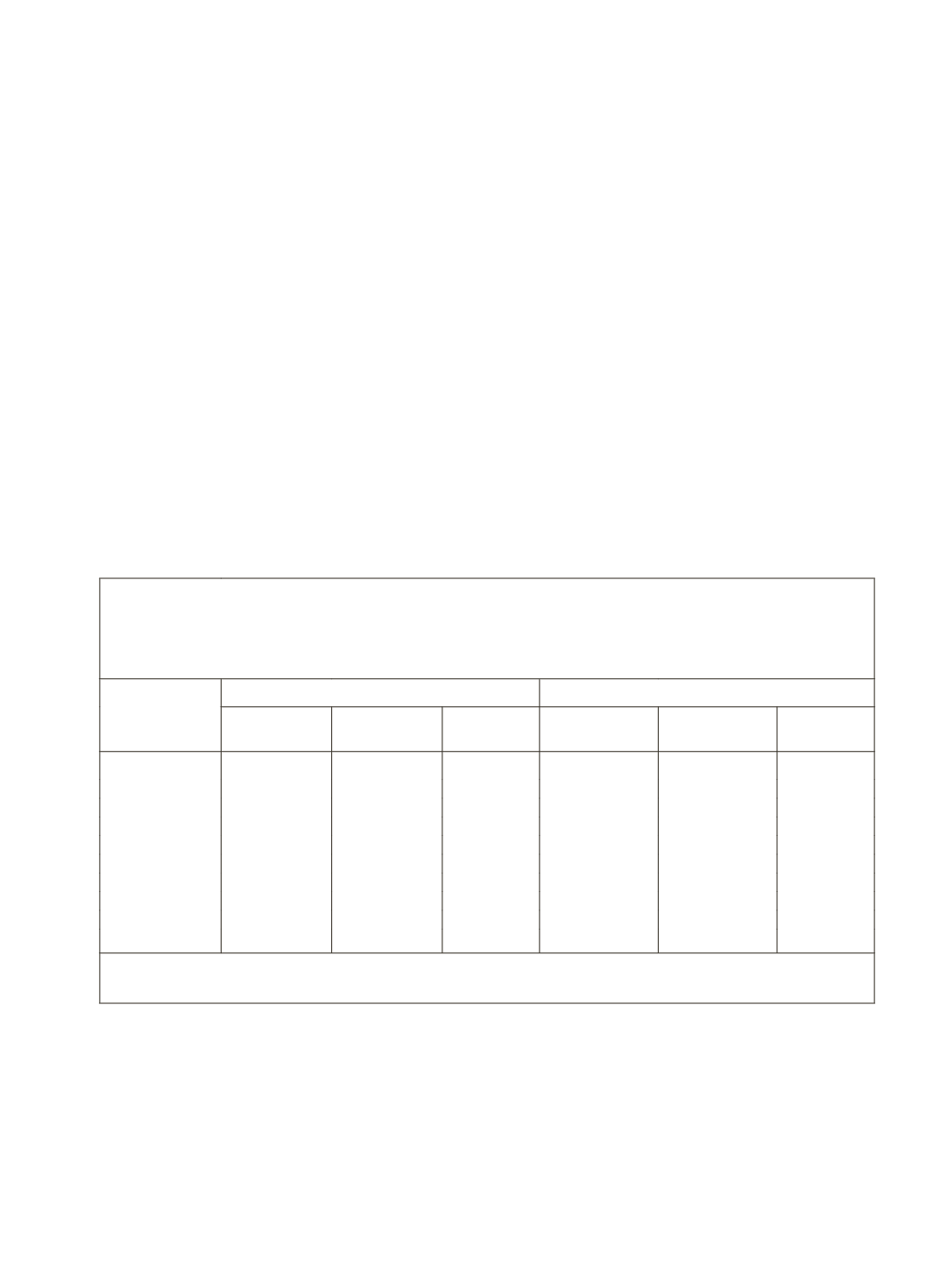

Table 9: Percentage Distribution of Amount of Cash Debt Outstanding by

Rate of Interest Separately for Institutional and Non-institutional

Agency as on June 30, 2002

All-India

Rate of

Interest

Class (%)

Rural

Urban

Institutional

Non-

Institutional

All

Agencies

Institutional

Non-

Institutional

All

Agencies

nil

1

18

8

3

33

10

less than 6

2

2

2

4

1

3

6-10

4

1

3

12

1

9

10-12

9

1

5

25

1

19

12-15

48

1

28

32

4

25

15-20

34

3

21

22

9

19

20-25

1

33

15

1

18

5

25-30

0

0

0

0

1

0

30 & Above

0

40

17

1

32

8

Total

100

100

100

100

100

100

Source:

NSSO:

Household Indebtedness in India

, All India Debt and Investment Survey, (January-

December 2003), NSS 59

th

Round, Report No. 501

Looking at it in a more aggregated way, the cultivator households have

borne 15 to 20 per cent rates of interest on 35 per cent of their outstanding

debt and 12 to 15 per cent on 50 per cent of such debt, together 12 to 20 per

cent for 85 per cent of debt. On the other hand, 36 per cent of cultivators’ debt

with non-institutional agencies were at the interest range of 20 to 25 per cent

and another 38 per cent of debt at 30 per cent and above (Table 10).