421

(ii)

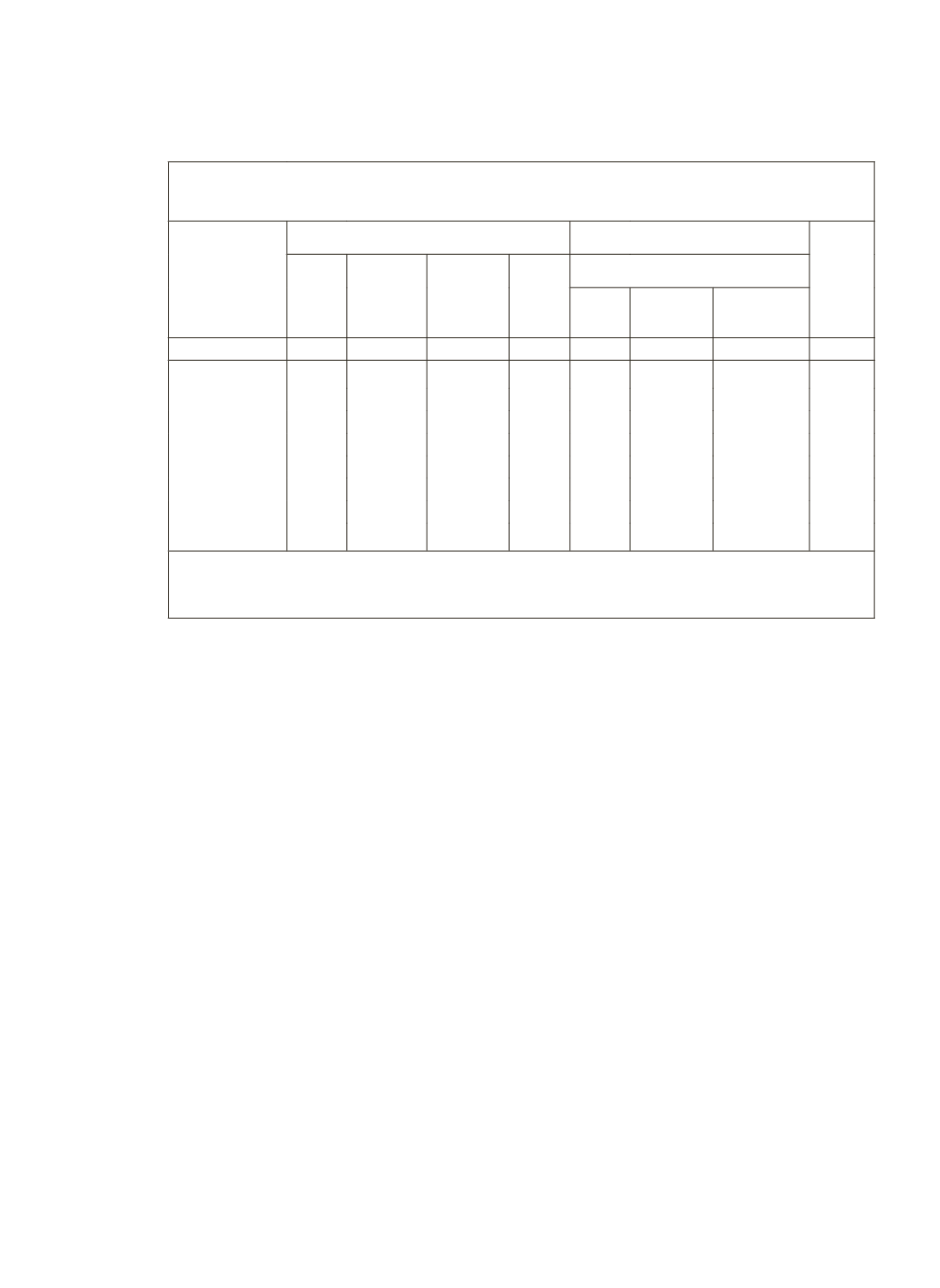

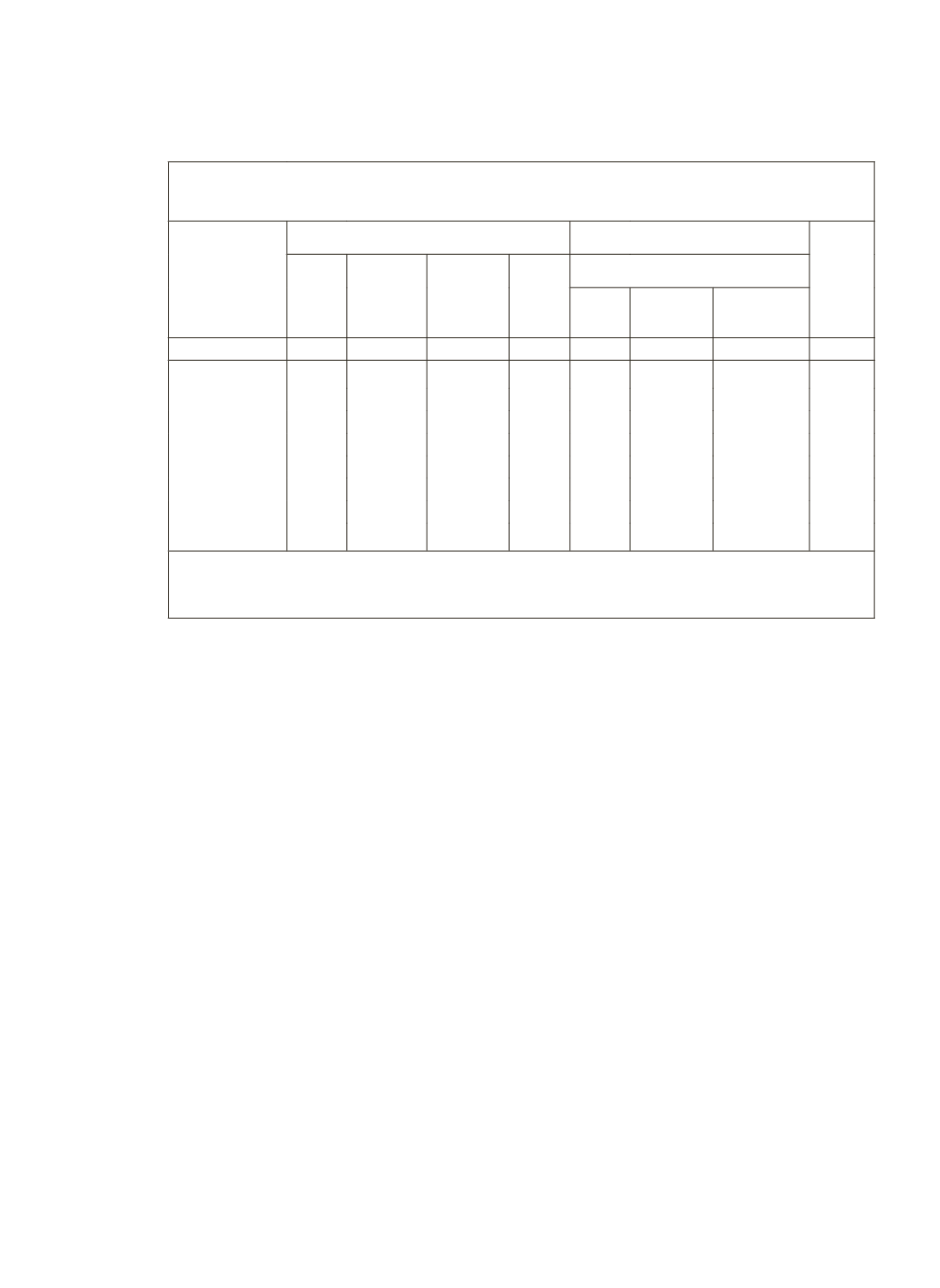

Interestingly, the cooperative sector loans are relatively more evenly

distributed amongst the medium and large-size holdings than in the

case of banks (Table 4).

Table 4: Per cent distribution of outstanding loans (in

`

) by source of

loans for each size class of land possessed by farmer households

Size class

of land

possessed

(in hectare)

Institutional Agencies

Non-Institutional Agencies All

Total Govern-

ment

Co-op

Society

Bank

Total of which:

Money

Lender*

Relatives

& friends

1

2

3

4

5

6

7

8

9

< 0.01

22.6

1.9

5.3 15.4 77.4

47.3

23.1 100.0

0.01-0.40

43.3

4.0

14.5 24.8 56.7

31.8

14.9 100.0

0.40-1.00

52.8

3.8

17.0 32.0 47.2

30.8

9.1 100.0

1.01-2.00

57.6

1.7

20.5 35.4 42.4

25.9

8.8 100.0

2.01-4.00

65.1

1.5

22.6 41.0 34.9

23.4

5.1 100.0

4.01-10.00

68.8

1.3

23.0 44.5 31.2

16.7

5.6 100.0

10.00+

67.6

1.7

23.2 42.7 32.4

17.2

4 100.0

All Sizes

57.7

2.5

19.6 35.6 42.3

25.7

8.5 100.0

‘ * ‘ Includes both professional and agriculturist money lenders

Source:

NSSO(2005), Indebtedness of Farmer Households, NSS 59

th

Round (Jan-Dec 2003),

Report No. 498(59/33/1)

But, marginal farmers have received lower share even from cooperatives.

Probably because of directed credit arrangements, the commercial banks have

provided a relatively higher share for the marginal farmers; there have been

directions from the government to provide a higher share of credit for small

and marginal farmers.

State-Wise

There are significant inter-state and inter-regional disparities in the

incidence of indebtedness. The southern region enjoys the highest incidence

(31 to 42 per cent) and the eastern region generally the lowest (26 to 8 per

cent). The shares of institutional agencies are generally high in the south

except Andhra Pradesh which, amongst all states, faces the highest incidence

of incidence to the non-institutional agencies (33 per cent against Kerala’s 12

per cent). Even Maharashtra enjoys a better institutional share, 23 per cent as

against 7 per cent from non-institutional agencies.

By Asset Classes

(i)

The inequality in the distribution of institutional loans appears much

more severe when size-wise distribution of asset holdings are attempted.