424

(ii)

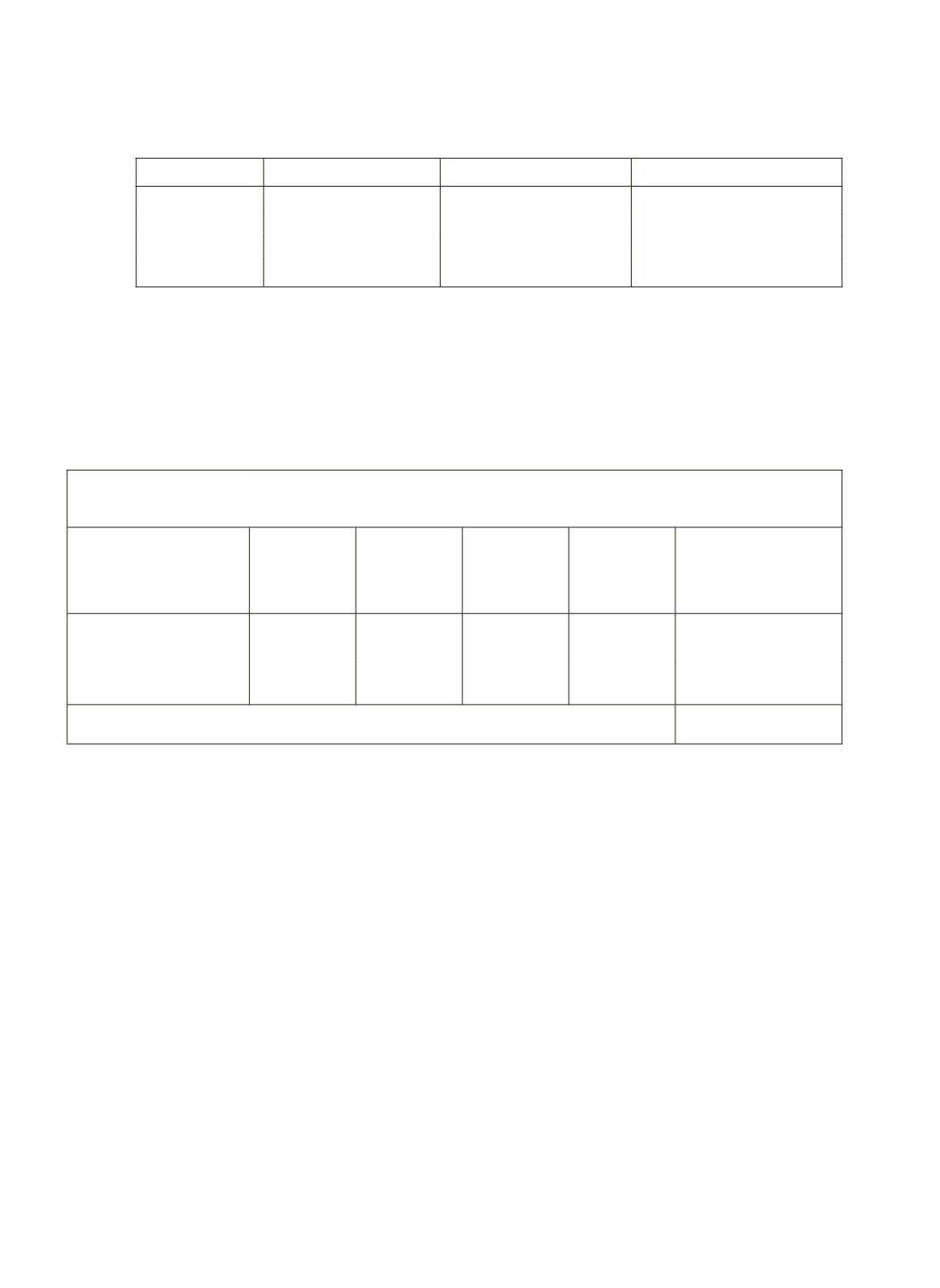

Again, the role of institutional agencies in farmer indebtedness differs

from state to state. A few case studies are interesting; these states have

vastly divergent pictures:

State

Indebtedness

Institutional Agencies Non-InstitutionalAgencies

Andhra Pradesh 82 per cent (high)

27 per cent (low)

73 per cent (high)

Bihar

33 per cent (low)

37 per cent (low)

63 per cent (high

Maharashtra 55 per cent (moderate)

85 per cent (high)

15 per cent (low)

West Bengal

50 per cent (moderate)

68 per cent (high)

32 per cent (low)

The cases of Maharashtra and West Bengal are showing high formal

credit because of the role of cooperatives.

Disparities Amongst Social Groups

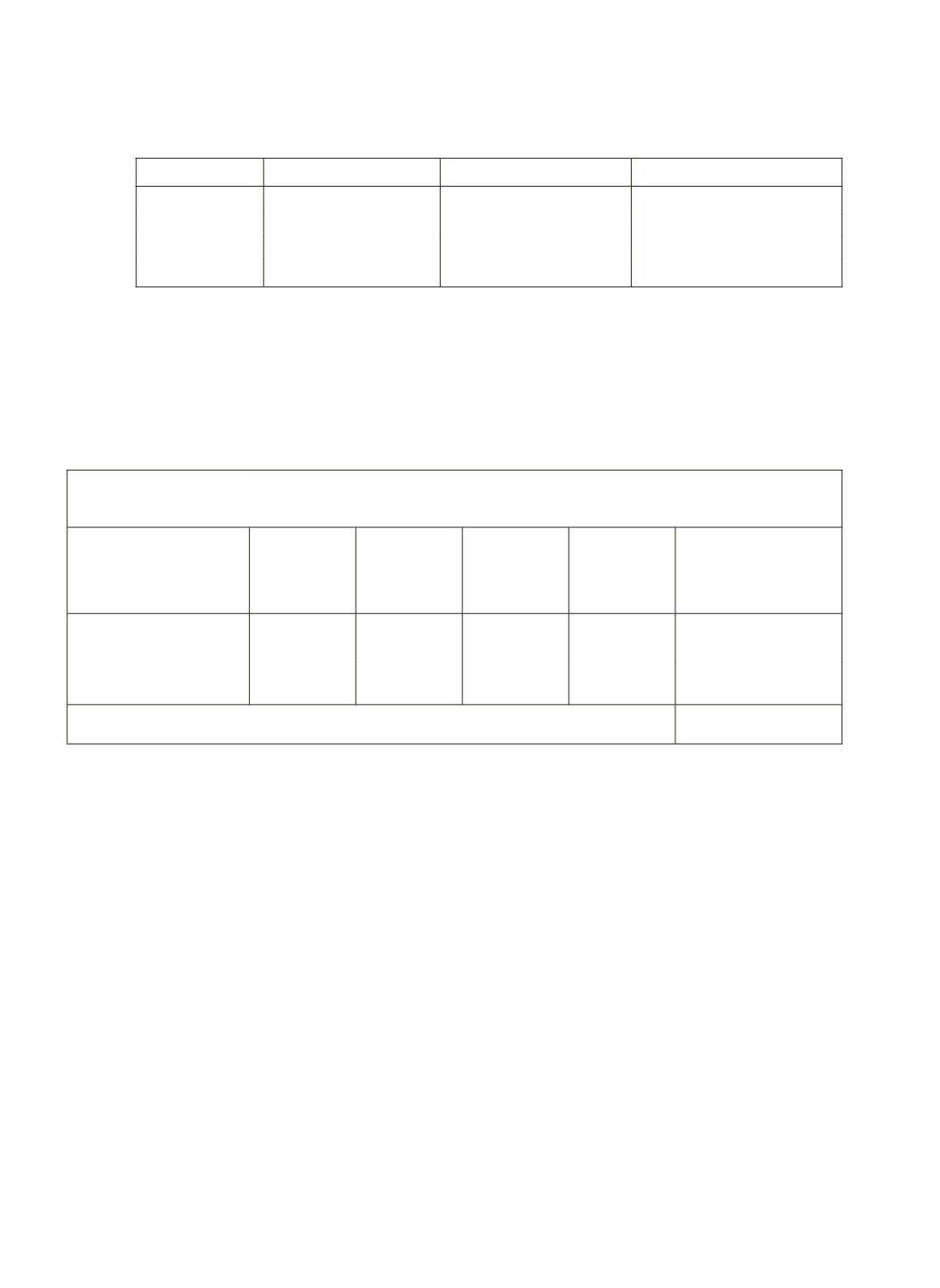

The proportions of households indebtedness are generally low

amongst schedule castes and scheduled tribes (Table 8).

Table 8: Percentage Distribution of All Farmer Households by Social Group in

Different States as per NSS 59th Round Survey (Jan-Dec 2003)

States

Scheduled

Tribe

Scheduled

Caste

Other

Backward

Class

Others

Estimated

Number of

Farmer House-

Holds in Million

All-India

13.3

(10.0)

17.5

(18.0)

41.5

(43.9)

27.6

(28.1)

89.35

(43.42)

Estimated no.of hhs

(mn)

11.92

(4.33)

15.59

(7.83)

37.04

(19.05)

24.69

(12.20)

89.35

(43.42)

Note:

Data in brackets pertains to that of indebted farmer households.

Declining share of institutional sources

As per the AIDIS, almost all states have experienced reductions in

the share of debt from institutional agencies in respect of their

cultivator

households from 1991 to 2002. There is a singular exception in Maharashtra

which has enjoyed a rise in the share from 81.8 per cent in 1991 to 85.2 per

cent in 2002. Interestingly, this has happened because of a sharp rise in the

share of cooperative credit, whereas the share of commercial banks has steeply

fallen during the period. Even at the all-India level, the share of cooperatives

has risen, while that of commercial banks eroded rather sharply.

Relative Roles of Cooperatives and Commercial Banks

The relevant data bring out the relative roles of commercial banks as

distinguished from cooperatives within the formal sources of farmers’ debt. The

first revelation in these data is that commercial banks dominate in providing

debt to farmers: 61.7 per cent against 34 per cent of cooperatives. Amongst