422

In fact, the relationship is inverse as between the asset sizes, on the

one hand, and institutional and non-institutional sources, on the other

(Table 5)

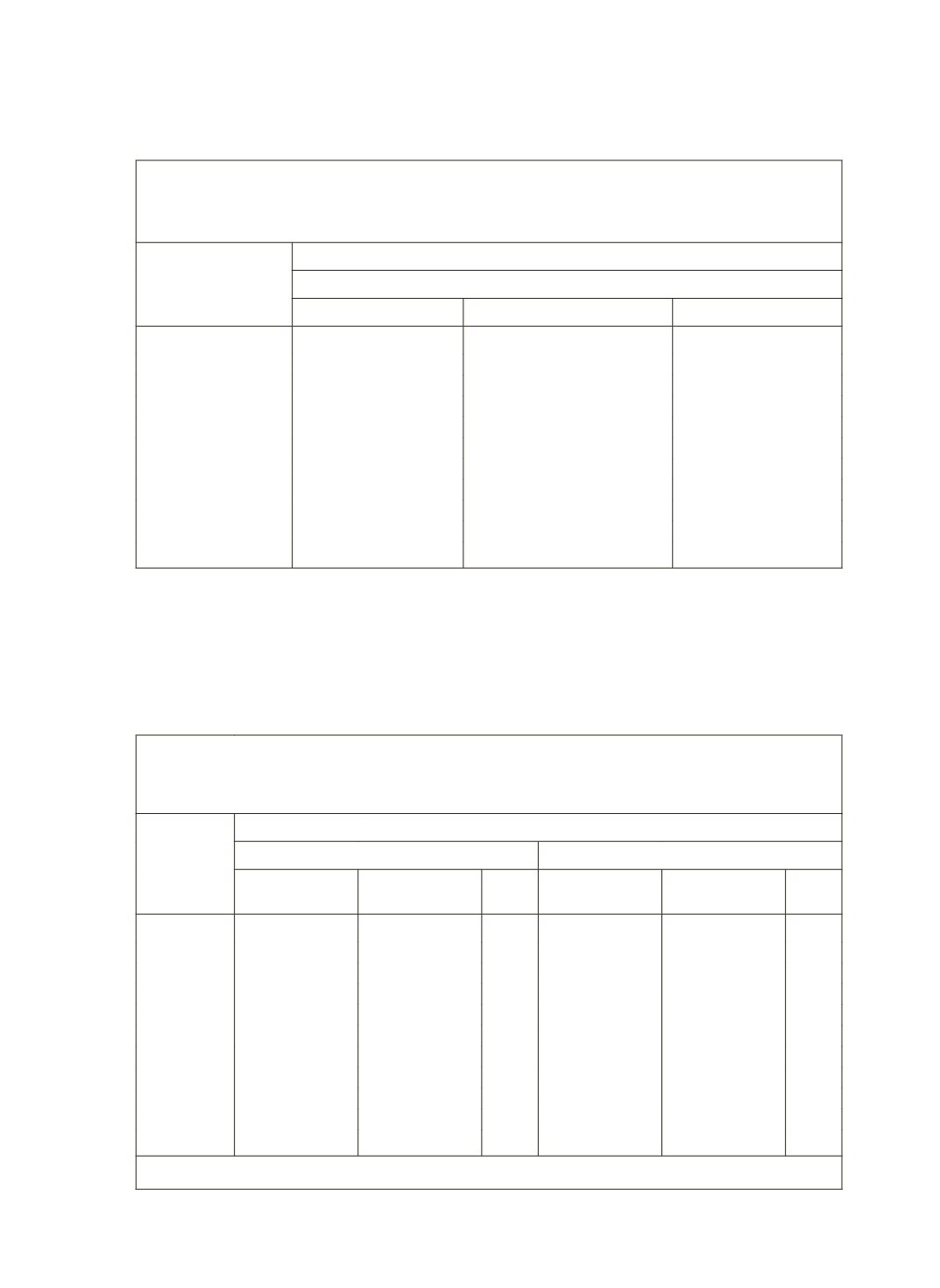

Table 5: Percentage Share of Institutional Agencies to the Total

Cash Debt of the Households as on 30-6-2002 by Household

Assets Holding Class (AHC)

AHC

(

`

000)

Percentage Share

Rural

Institutional

Non-Institutional

All

< 15

21.0

79.0

100.0

15-30

29.0

71.0

100.0

30-60

31.0

69.0

100.0

60-100

31.0

70.0

100.0

100-150

39.0

61.0

100.0

150-200

42.0

58.0

100.0

200-300

48.0

52.0

100.0

300-450

59.0

42.0

100.0

450-800

67.0

33.0

100.0

800 +

80.0

21.0

100.0

All

57.0

43.0

100.0

(ii)

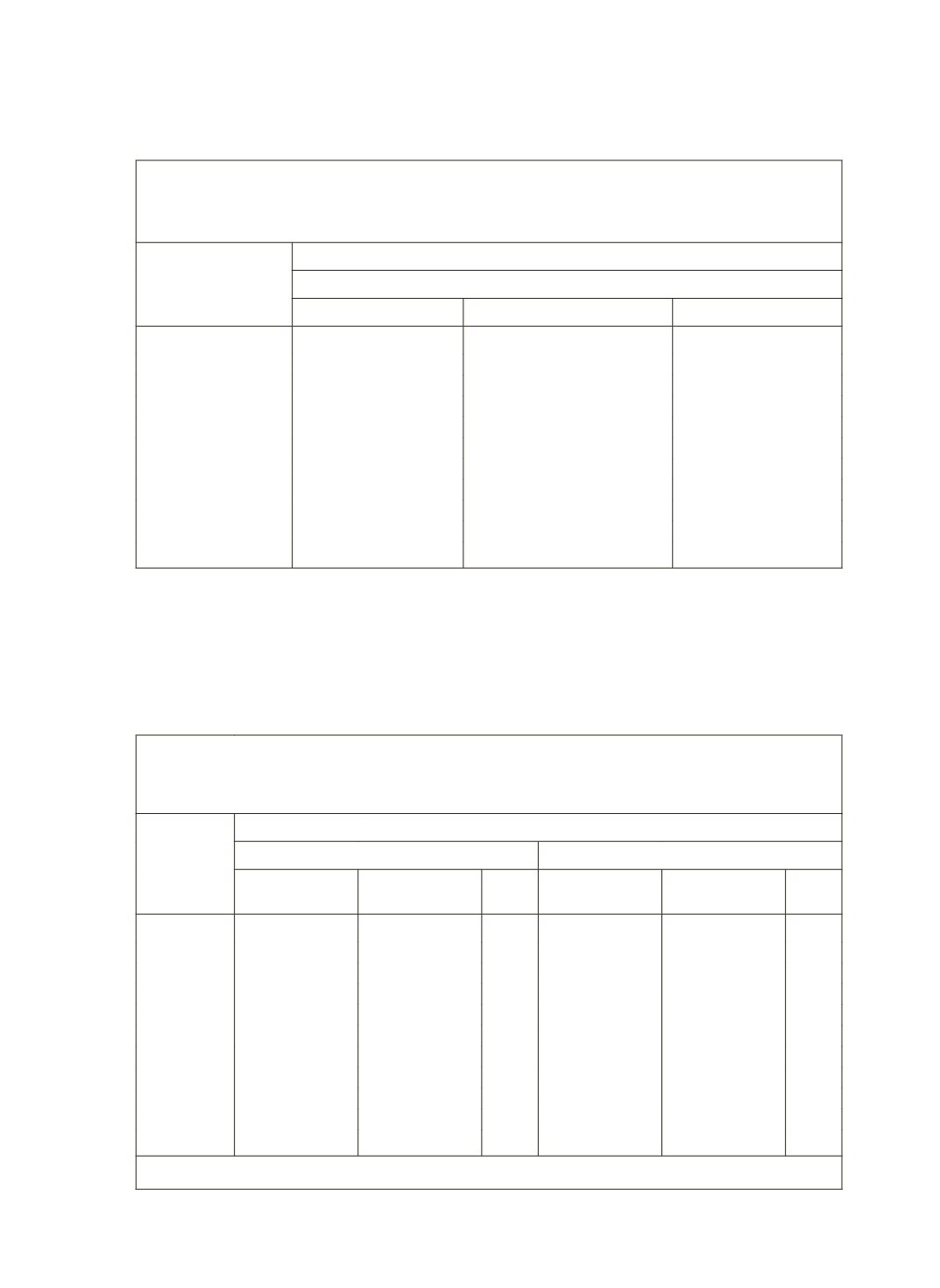

Looking at it differently, the incidence of indebtedness (in terms of the

percentage of indebted rural households) to institutional agencies is

just one-fourth to one-half of that to non-institutional agencies amongst

the low asset classes (Table 6). Contrariwise, the high asset groups have

low incidence to non-institutional agencies.

Table 6: Incidence of Indebtedness (IOI) of Households as on

30-06-2002 to Institutional and Non-Iinstitutional Credit

Agencies by Household Assets Holding Class(AHC)

AHC

(

`

000)

IOI (%) to

Rural

Urban

Institutional

Non-

Institutional

All

Institutional

Non-

Institutional

All

< 15

03.6

12.0 15.0

1.4

9.5 10.7

15-30

6.2

13.9 19.0

2.4

12.8 14.8

30-60

8.7

17.7 25.2

4.5

11.0 14.8

60-100

10.9

17.7 26.5

7.2

11.9 18.3

100-150

13.6

17.9 28.9

8.3

12.2 19.7

150-200

14.6

17.1 28.7

8.9

12.0 20.0

200-300

16.2

15.7 28.7

11.1

10.1 19.9

300-450

18.7

13.2 28.7

12.1

8.2 18.7

450-800

22.0

13.0 31.0

16.9

7.2 22.5

800 +

26.7

10.3 32.9

18.5

4.2 21.4

All

13.4

15.5 26.5

9.3

9.4 17.8

Source:

NSSO(2005), Household Indebtedness in India as on 30-06-2002, Report No.501(59/18.2/2)