426

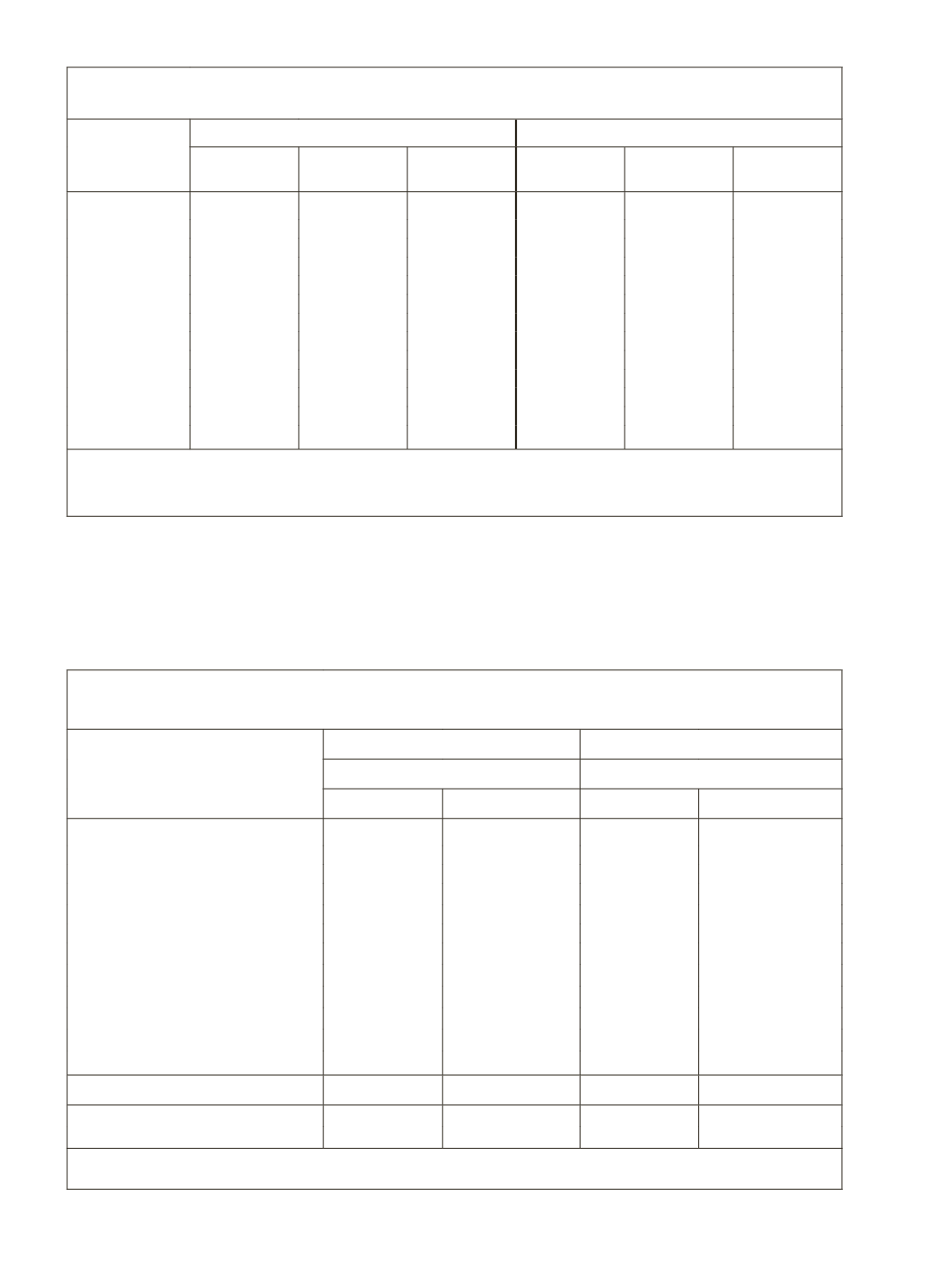

Table 10: Percentage Distribution of Cash debt by Occupational Category

and Credit Agencies as on 30-6-2002

Rate of

Interest Class

(%)

Institutional Agencies Rural Areas

Non-Institutional Agencies

Cultivator

Non-

Cultivator

All Rural

Household

Cultivator

Non-

Cultivator

All Rural

Household

nil

0.5

2.3

0.9

17.4

20.4

18.4

less than 6

1.8

2.7

2

2.3

2.5

2.4

6-10

3

6.9

3.8

0.3

1.5

0.7

0-10

4.8

9.6

5.8

2.6

4

3.1

10-12

7.4

14

8.8

0.6

0.2

0.5

12-15

50

39.8

47.8

1.6

0.8

1.3

15-20

34.8

32.5

34.3

2.7

3

2.8

10-20

92.2

86.3

90.9

4.9

4

4.6

20-25

1.4

1.2

1.4

36.2

27.5

33.3

25-30

0

0

0

0.3

0.1

0.3

30 % above

0.3

0.3

0.3

38.2

43.9

40.1

20 % above

1.7

1.5

1.7

74.7

71.5

73.9

All

100

100

100

100

100

100

Note :

All included not reported

Source :

Source: NSSO (2005), Household Indebtedness in India as on 30.6.2002 59th Survey, Report

No. 501(59/18.2/2)

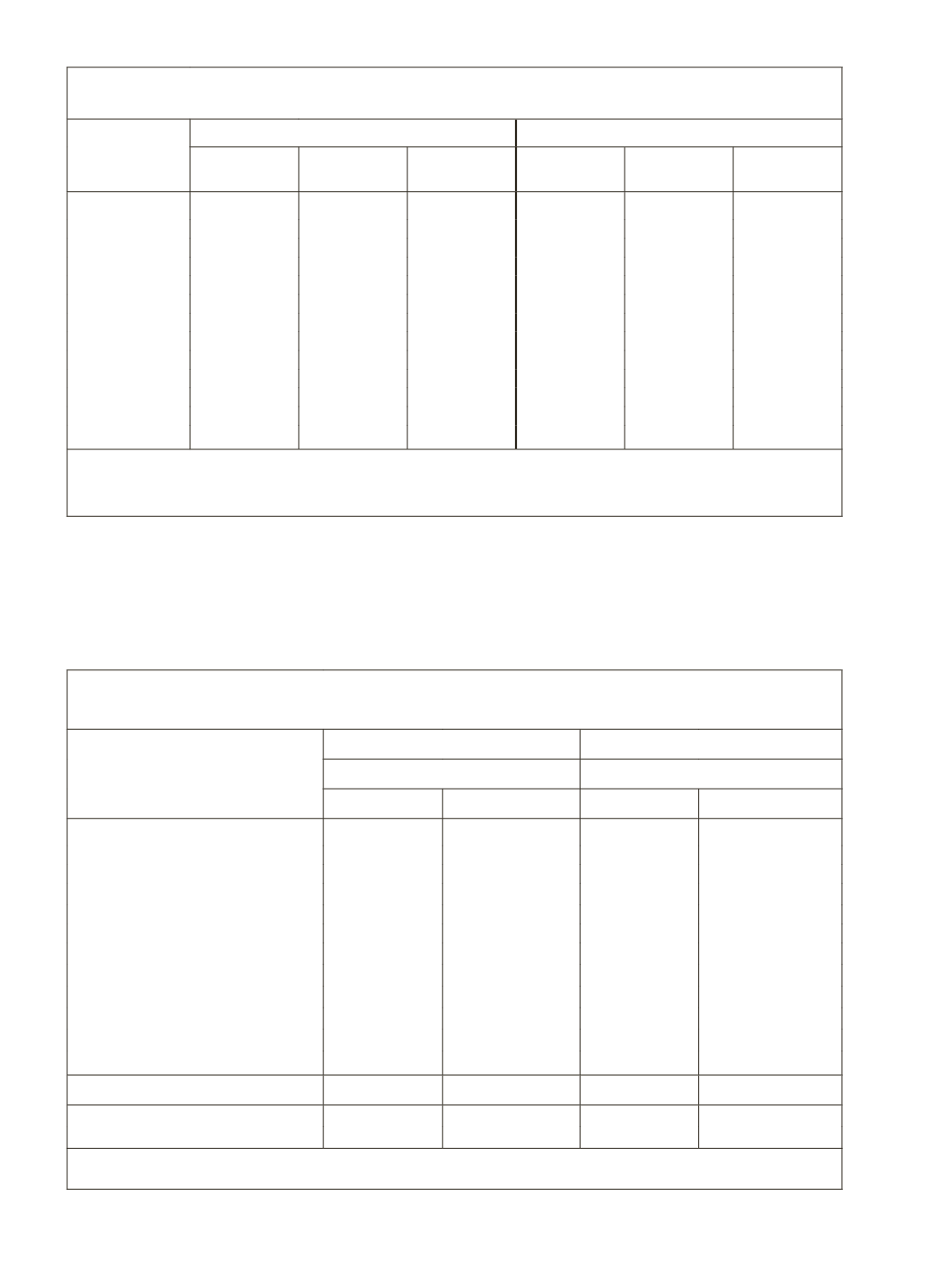

Debt by Purpose

Table 11 portrays the purpose-wise distribution of indebtedness

amongst rural households by occupational categories, i.e., by cultivator and

non-cultivator categories.

Table 11: Percentage of Indebted Households (P) and Percentage of Dues

Outstanding as on 30-6-2002 by Purpose of Loans Among Rural Households

Purpose of Loans

Cultivator

Non-Cultivator

Percentage of

Percentage of

Households

Cash dues

Households

Cash dues

Farm-Business

15.4

52.5

2.5

9.3

Capital Expenditure

8.2

34.3

1.6

6.3

Current Expenditure

7.9

18.2

1.0

3.0

Non-Farm Business

2.4

9.4

3.6

19.0

Capital Expenditure

1.8

7.4

2.5

14.2

Current Expenditure

0.6

2.0

1.2

4.8

Household Expenditure

12.1

27.7

14.2

55.0

Repayment of Debt

0.4

1.5

0.4

1.3

Expenditure on Litigation

0.1

0.3

0.1

0.2

Financial Investment

0.1

0.6

0.1

1.0

Other Purposes

2.3

8.0

2.3

13.9

All (non-business)

14.6

38.1

16.8

71.4

Expenditure in Household

not reported

0.0

0.0

0.0

0.3

All

29.7

100.0

21.8

100.0

Source:

NSSO(2005) Household Indebtedness in India as on 30.6.2002, 59th Round, Report No.501

(59/18.2/2).