420

cooperative societies and banks and not under commercial banks. It

reflects the inefficiencies that have set in the functioning of cooperatives.

By Land Size

(i)

In the distribution of farmer households by land possessed, the

prevalence of indebtedness increases with the size of landholdings.

About 84 per cent of farmer households or 80 per cent of indebted

households belong to up to 2 hectares of land possessed. But, what

is significant is that there is increase in indebtedness with the size of

holdings; more significantly, the share of institutional agencies in total

loans tends to rise much more progressively. In the lowest size groups up

to 0.40 hectare (marginal farmers), the shares of institutional agencies

have ranged from 23 to 43 per cent, whereas in the large size groups

of above 2 hectares, the corresponding shares have been 65 to 69 per

cent. Contrariwise, in the case of marginal farmers, the shares of non-

institutional agencies have been 57 to 77 per cent, whereas the shares

of large-size groups in indebtedness to these agencies have been 31 to

35 per cent (Table 3).

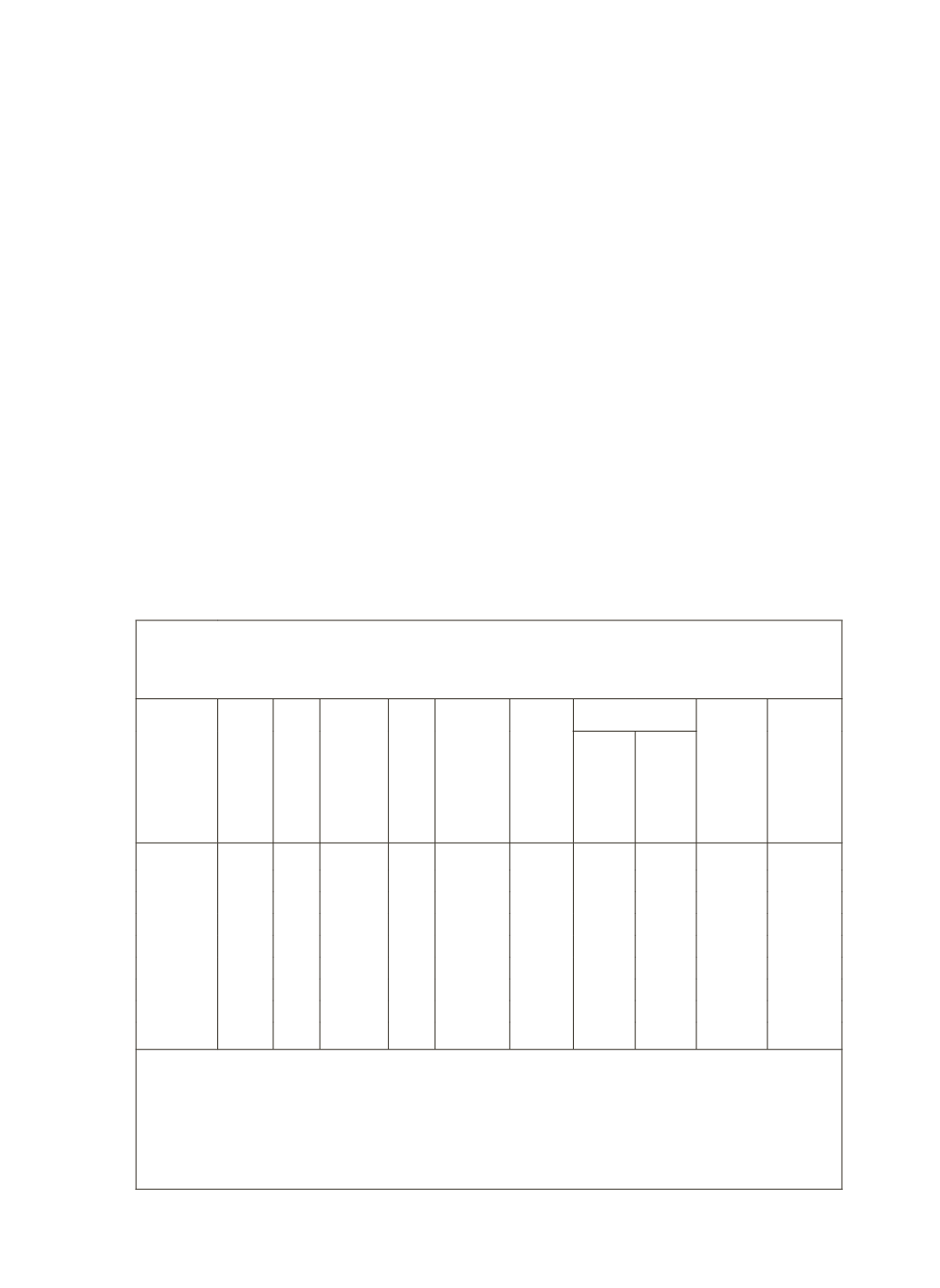

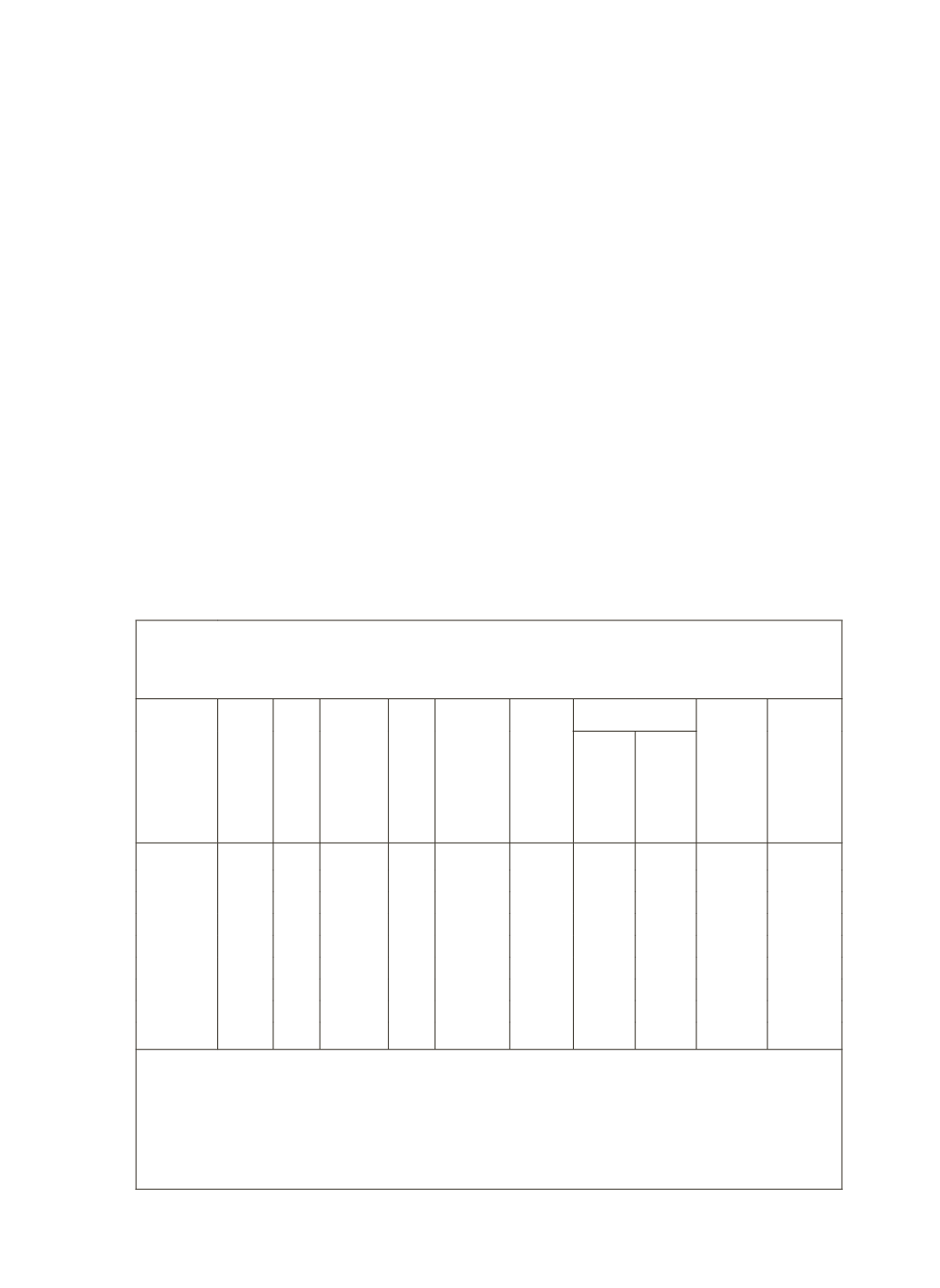

Table 3: Estimated Number of Total and Indebted Farmer Households

in Each Size Class of Land Possessed and Estimates of Debt

Outstanding for 2003

Size Class

of Land

Possessed

in ha.

Number

of

Farmer

House-

holds

In

million

Per

cent

to

Total

Number of

Indebted

Farmer

House-

holds in

million

Per

cent

to

Total

Prevalence

Rate of

Indebted-

ness

(percent-

age)

Amount

Outstand-

ing

(in

`

) per

Farmer

House-

holds

Loan from

Amount

Out-

standing

(

`

crore)

of which:

Insti-

tutional

Agencies

(

`

crore)

Institu-

tional

Agencies

(per

cent)

Non

Institu-

tional

Agencies

(per

cent)

< 0.01

1.26 1.4

0.57 1.3

45.3

6121

22.6

77.4 770.88

174.22

0.01 – 0.40 29.29 32.8

13.01 30

44.4

6545

43.3

56.7 19168.15 8299.81

0.41 – 1.00 28.36 31.7

12.92 29.8

45.6

8623

52.8

47.2 24455.69 12912.60

1.01 – 2.00 16.06 18

8.19 18.9

51 13762

57.6

42.3 22101.77 12730.62

up to 2.00 74.97 83.90 34.70 79.90

46.30 8870.00 51.30 49.70 66496.49 34117.25*

2.01 – 4.00

9.35 10.5

5.44 12.5

58.2 23456

65.1

35.0 21932.30 14277.93

4.01 – 10.00 4.26 4.8

2.77 6.4

65.1 42532

68.8

31.1 18110.55 12460.06

10.00 +

0.77 0.9

0.51 1.2

66.4 76232

67.6

32.4 5906.46 3992.76

All Sizes

89.35 100

43.42 100

48.6 12585

57.7

42.4 112447.48 64882.20

Notes:

(i) Amount of outstanding loan: For each loan, the amount outstanding on the date of survey was the sum of

principal outstanding and the interest payable as on the date of survey. In case of kind loans, the amount of the

liability was evaluated at the current market prices prevailing in the locality.

‘*’ Roughly increasing it by 20 per cent per annum for the next three years, the outstanding works out to about

`

60,00

crores in 2006.

Source:

NSSO(2005), Indebtedness of Farmer Households, Situation Assessment Survey of Farmers, NSS 59

th

Round

(January-December 2003), Report No. 498(59/33/1)