158

direct agriculture in the form of minor irrigation, land development and farm

mechanisation. In absolute amount, these three investment items together

have absorbed

`

20,778 crore (15.7%), while the above defined allied activities

have absorbed nearly

`

112,000 crore (84.3%) during 2010-11. There is thus

a decisive shift in bank lendings, particularly commercial bank lendings, in

favour of allied activities. These of course have included RIDF deposits of

individual years which have grown from

`

2,158 crore in 2003-04 to

`

6,092

crore in 2005-06, to

`

6,956 crore in 2006-07, to

`

13,056 crore in 2010-11 and

to

`

15,241 crore in 2011-12 (see earlier Table 4.29).

Credit Flow and Agricultural GDP

On an earlier occasion, we have established some significant positive

association ship between farm credit and agricultural GDP. Statistically,

we have done this at three levels. First, we have worked out the trends in

credit intensity, that is, the ratio of agricultural credit to agricultural GDP in

percentages. Second, we have measured correlation coefficients indicating the

extent to which the two variables, credit and agricultural GDP, are correlated.

Finally, taking into account the high level of correlation between the two, we

went a step further and measured the output elasticity of bank credit for

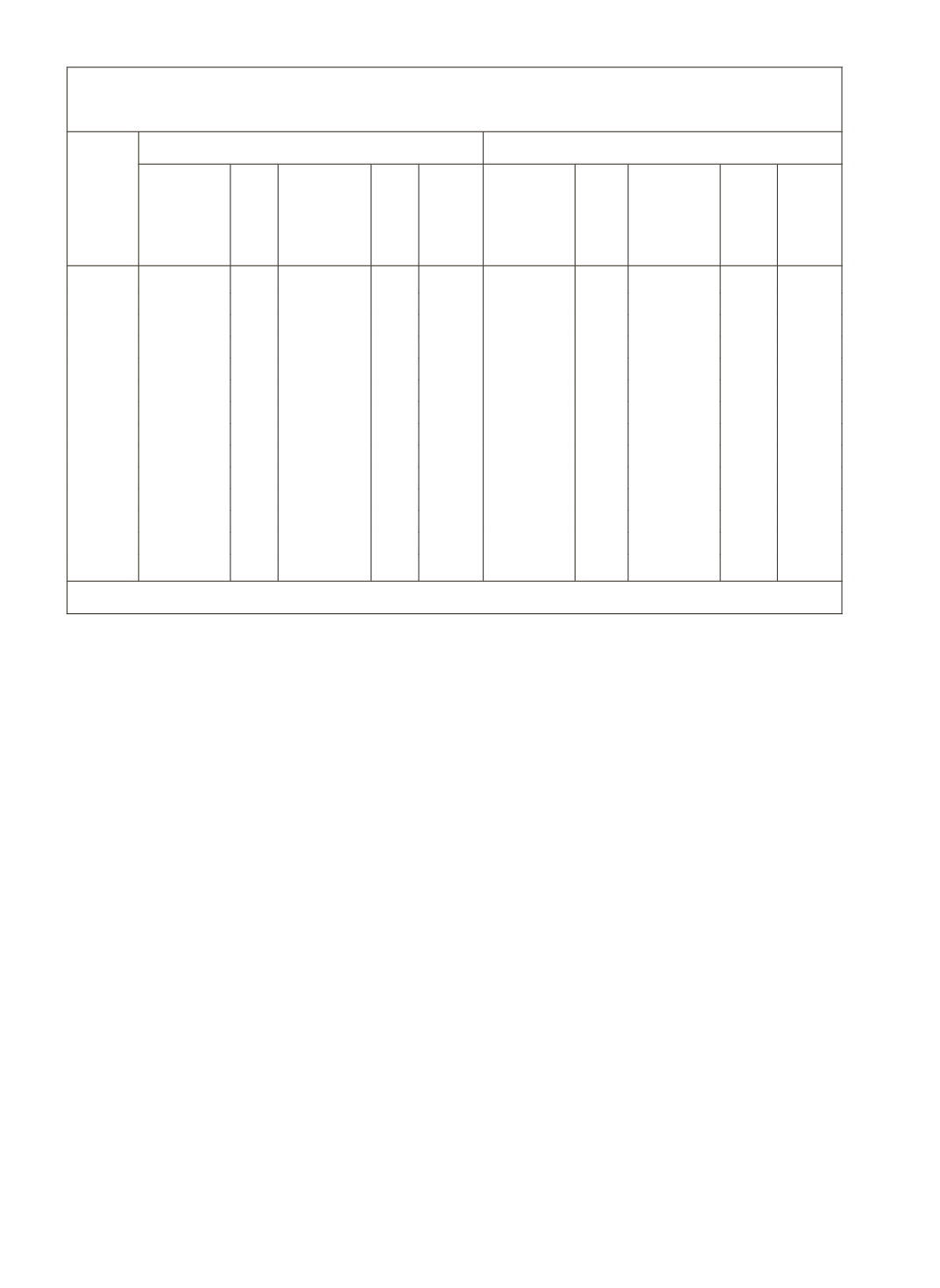

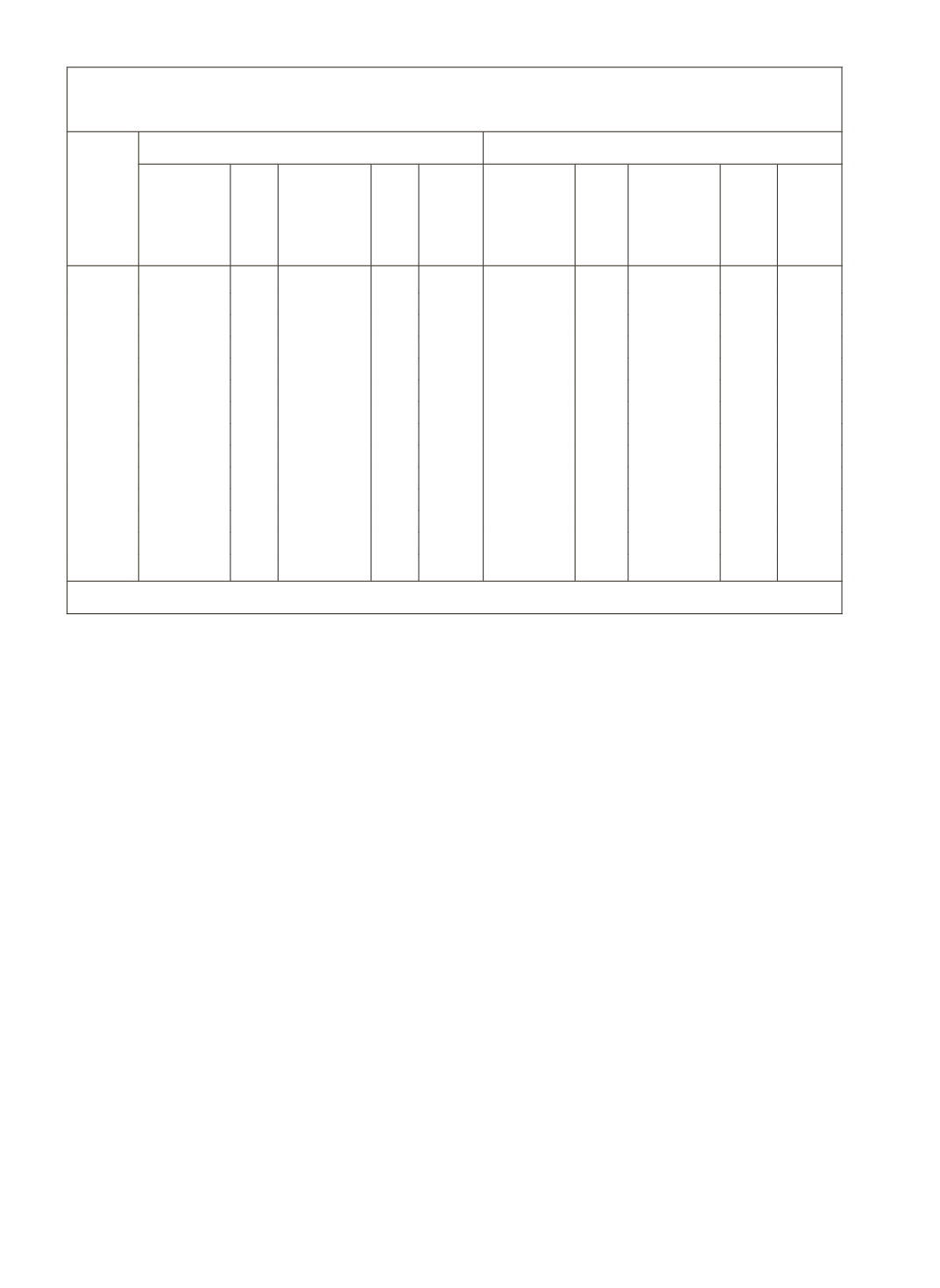

Table 5.12: Ground Level Credit Flow for Agriculture & Allied Activities

(

`

Crore)

Year

Including Allied Activities

Excluding Allied Activities

Short-

Term

(ST -

Production

Credit)

% to

Total

Term-

Loans

( MT & LT

Investment

Credit)

% to

Total

Total

Short-

Term

(ST -

Production

Credit)

% to

Total

Term-

Loans

( MT & LT

Investment

Credit)

% to

Total

Total

1997-98

20,640 64.6

11,316 35.4 31,956 20,640 79.5

5,323 20.5 25,963

1998-99

23,903 64.8

12,957 35.2 36,860 23,903 80.1

5,943 19.9 29,846

1999-00

28,965 62.6

17,303 37.4 46,268 28,965 81.5

6,554 18.5 35,519

2000-01

33,314 63.1

19,513 36.9 52,827 33,314 84.2

6,235 15.8 39,549

2001-02

40,509 65.3

21,536 34.7 62,045 40,509 87.1

5,999 12.9 46,508

2002-03

45,586 65.5

23,974 34.5 69,560 45,586 88.4

5,969 11.6 51,555

2003-04

54,977 63.2

32,004 36.8 86,981 54,977 88.3

7,295 11.7 62,272

2004-05

76,062 60.7

49,247 39.3 125,309

76,062 88.8

9,581 11.2 85,643

2005-06 105,350 58.4

75,136 41.6 180,486 105,350 84.0

20,107 16.0 125,457

2006-07 138,455 60.4

90,945 39.6 229,400 138,455 86.8

20,964 13.2 159,419

2007-08 181,393 71.2

73,265 28.8 254,658 181,393 93.0

13,696 7.0 195,089

2008-09 210,461 69.7

91,447 30.3 301,908 210,461 93.6

14,401 6.4 224,862

2009-10 276,656 71.9 107,858 28.1 384,514 276,656 93.5

19,077 6.5 295,733

2010-11 335,550 71.7 132,741 28.3 468,291 335,550 94.2

20,778 5.8 356,328

Source:

NABARD Annual Report, 2011-12 and earlier issues.