[ 35 ]

NABARD AS

MICROFINANCE FACILITATOR

6 .

NABARD

continued with its role as the main facilitator and mentor of microfinance

initiatives in the country, particularly the SHG Bank Linkage initiative. It continued to

provide support in the form of grant assistance for formation, nurturing and credit linking

of SHGs with the banks, capacity building of various stakeholders through training,

exposure visits, seminars, workshops etc. NABARD intensified its efforts to promote

sustainable livelihoods among SHG members by mainstreaming Livelihood and Enterprise

Development Programme (LEDP), pilots in micro insurance and pension, digitization of

SHGs, commissioning studies on topics related to micro credit/ SHG-BLP. A glimpse of

the facilitator role played by NABARD during 2016-17 is given in following paragraphs.

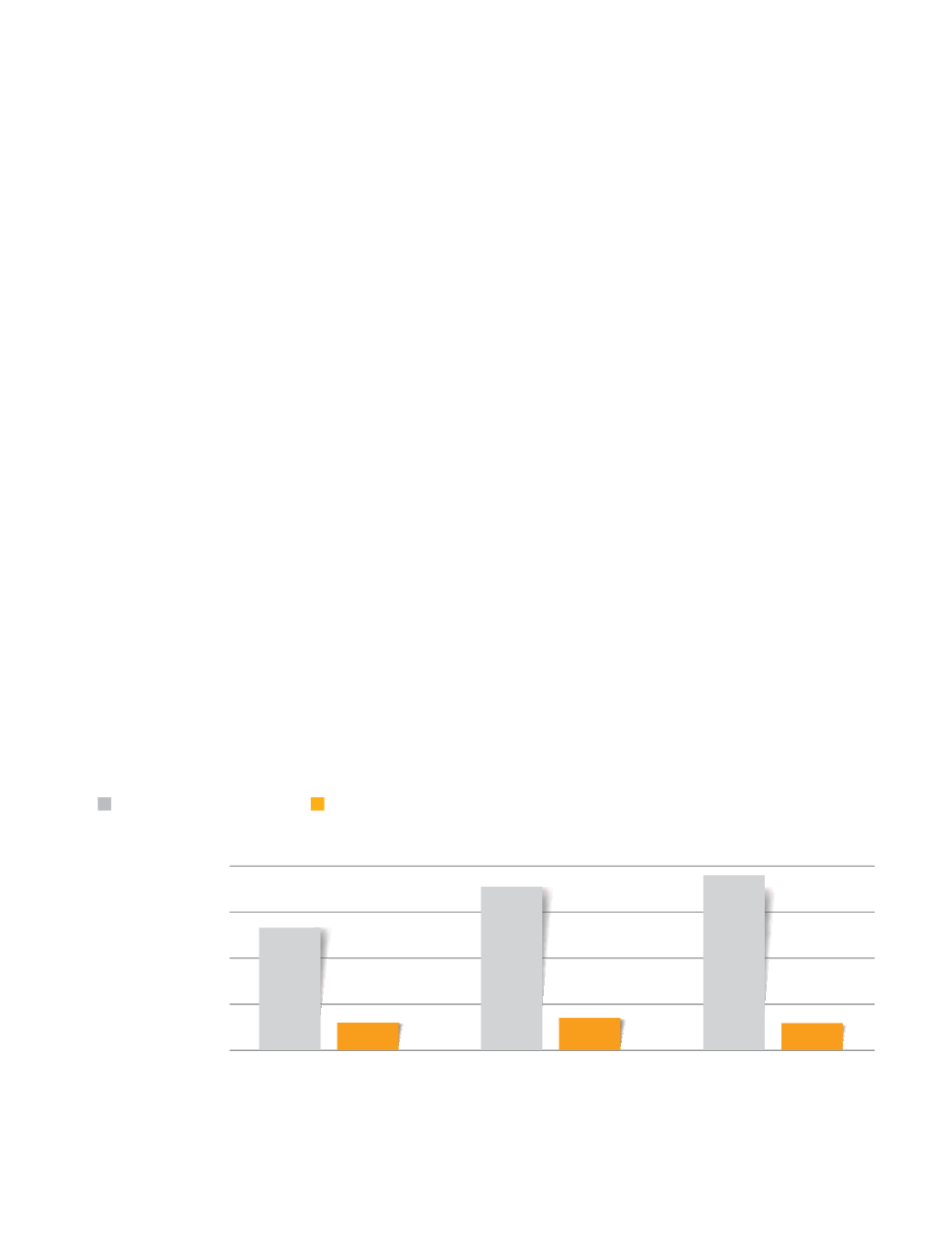

REFINANCE TO BANKS

NABARD has been extending 100% refinance to Banks

towards their lending to SHGs and MFIs to supplement their resources. Total loans issued

by Banks to SHGs and the refinance extended by NABARD for such loans is shown in

Figure 6.1. During 2016-17, NABARD extended refinance to the extent of

R

5659.51

crore against their SHG lending forming 10.58% of the total refinance provided to Banks

for investment credit, as against

R

6906.03 crore disbursed during the previous year.

Cumulative disbursement of refinance by NABARD for SHG lending now stands at

R

43293.60 crore

6.1

6.2

0

10000

20000

30000

40000

27582.31

2014-15

R

in Crore

2015-16

2016-17

4493.67

37286.90

6906.03

38781.16

5659.51

Figure 6.1

REFINANCE TO BANKS

Bank Loans to SHGs

NABARD Refinance to Banks